Be outstanding

at Cash and Treasury Management

Our mission is to provide treasury and finance teams with the clarity, knowledge, and trusted support they need to positively impact their organizations every day.

%20(1).png?width=700&height=702&name=Group%20427319697%20(2)%20(1).png)

Our story

Improve today. Exceed Tomorrow.

Nomentia not only improves how treasury and financial teams meet the high expectations for their daily work, but we’re also entirely dedicated to helping these teams exceed those expectations.

We understand that your work is getting more complex, and although treasury management systems have tried to keep pace, the main problem still exists: you need to get through your myriad of daily tasks to make a greater impact on your organization.

Think of the possibilities if you had room in your day to really make your mark! What treasury and finance teams need is solid ground. A foundational partner that unburdens you from daily tasks and earns you the capacity to exceed expectations and influence your organization.

So on our road to becoming Europe's #1 treasury system, we have composed an inspired and devoted team that provides treasury and finance teams with the trusted support, knowledge, and clarity needed to aim higher.

We are here to become your solid ground.

We are not only improving treasury and finance workflows... We are creating treasury and finance team potential.

Our mission

Empowering treasury and finance teams

Our mission is to provide treasury and finance teams with the clarity, knowledge, and trusted support needed to positively impact your organizations everyday.

.png?width=500&height=684&name=Group%20427319696%20(1).png)

Our values

Our company's core values serve as the foundation for every-day well-being and are guiding our actions

We win together

We differentiate by offering partnership-style support that makes us more than vendors to our customers. The same goes for our employees, as we create a mutual relationship with our teams that is supportive and built for the long term.

We build success

on health & happiness

Our customer's work requires a steady sense for the future of the organization's prosperity. Internally, we are always focused on initiatives that will allow us to become stronger, healthier, and happier as a team.

We deliver

what we promise

Our business is built on trust-intensive, long-term relationships made possible by our devotion to our customers. Beyond clients, we are also devoted to taking care of each other.

We take pride and delight

in what we do

Our work leaves an impact on the work of our clients. Our enthusiasm is the cornerstone of delivering high-quality implementations, support, and more.

We make treasury and finance work more actionable, knowledge-based, and valuable.

On top of a foundational treasury management system, you'll work with our enthusiastic teams to get all the tools and support you need to aim higher.

1400+

Happy customers

200+

Employees

8

Offices

1

System

Office locations

Finland

Linnoitustie 6

Espoo

02600

Åkerlundinkatu 11

Tampere

33100

Sweden

Västra Järnvägsgatan 3

Stockholm

11164

Austria

Am Belvedere 8

Vienna

1100

Germany

Friedrich-Ebert-Anlage 49

60308 Frankfurt

United Kingdom

162a London Rd

Newcastle Under Lyme, ST5 7JB

The Netherlands

Kraanspoor 50

Amsterdam

1033 SE

Poland

Tadeusza Kosciuszki 71/ 303

Torun

87-100

Awards & mentions

Treasury Excellence

The Association for Financial Professionals has rewarded Dräger with the Pinnacle Grand Prize for excellence in treasury and finance for its FX management project with Nomentia.

Best Intercompany Solution

TMI awarded CompuGroup Medical SE & Co. KGaA with the award for innovation and excellence for their project with Nomentia that improved the company's entire cash- and treasury management processes.

Technology implementation highly recommended

SKF Group implemented a global payments factory, transitioning from a 100% manual payment process to a fully automated, digitised process for purchase to pay.

Alexander von Schirmeister

CEO

A global technology executive with deep expertise in Financial Services software and a track record of driving growth through customer focus and operational excellence. Alex serves as the CEO of Nomentia. Previously, he held global Managing Director roles across payments (SumUp), accounting, compliance, and payroll (Xero) businesses, with additional experience in digital transformation, distribution and marketplaces. Alex is a pragmatic, decisive operator focused on building high-performing teams and delivering measurable impact for customers. He believes in fostering a culture that celebrates each team's strengths and diversity, where everyone can be the best version of themselves.

Huub Wevers

Chief Revenue Officer

A SaaS Sales leader bringing value to finance teams every day. Huub serves as the Chief Revenue Officer of Nomentia and works with the Marketing, Sales, Partner and Customer Success teams. Prior to his current role, Huub has been active as sales leader in several FinTech's and before that as Senior manager in Banking. Huub enjoys connecting business needs with transformative SaaS solutions. He has a lot of experience in leading teams towards their objectives whilst growing the business, client base and having fun doing so.

Marc Vietor

Chief Product Officer

Marc is recognized for deep expertise in product strategy and artificial intelligence, combined with a relentless focus on customer and partner success. He excels at building high-performing, cross-functional teams and fostering a culture of innovation, collaboration, and measurable impact.

Martin Fikar

Chief Services Officer

With over 15 years of dedicated experience in the world of treasury, Martin Fikar brings a rare blend of strategic insight and hands-on expertise. His journey in the world of Treasury began at Schwabe, Ley & Greiner, where he contributed to a wide range of Treasury projects and built a strong foundation in financial operations. He later led a corporate treasury and export department, developing clear guidelines and optimizing financial processes with a focus on efficiency and reliability.

For the past eight years, Martin has played a key role in shaping Nomentia’s treasury consulting practice and currently serves as Chief Service Officer. Under the guidance of him and his team, client projects are delivered with consistency and care, turning all kind of implementations into smooth, successful outcomes. Martin’s focus on innovation and his dedication to improving treasury operations make him a valued partner to our customers.

Leena Paajanen

Chief People & Culture Officer

Tami Halttunen

CFO

A hands-on CFO with 20 years of experience in creating shareholder value through corporate rearrangements, acquisitions, and international growth. Tami serves as the CFO of Nomentia. Before joining Nomentia, he held CFO and senior finance leadership roles at OpusCapita, Itella, and Bang & Bonsomer. Tami sees finance as the engine of progress — clarity in the numbers is the prerequisite for meaningful change.

Ari Valtaoja

CTO

Driven by a passion for building impactful software and empowering teams, Ari Valtaoja serves as CTO at Nomentia. With over 11 years at the company, he leads both R&D and SaaS operations and has played a key role in shaping Nomentia’s current software offering. Ari holds an M.Sc. in Computer Science and previously held technology leadership roles at Sandvik Mining and Construction, Accenture, and Nokia. He values teamwork, trusts people to deliver without micromanagement, and believes in momentum over endless planning.

.png?width=333&height=228&name=Stenb%C3%A4ck-Paul%20(1).png)

Paul Stenbäck

Chief Strategy Officer

Rick Medlock

Chairman of the Board

Alexander von Schirmeister

CEO, Nomentia

A global technology executive with deep expertise in Financial Services software and a track record of driving growth through customer focus and operational excellence. Alex serves as the CEO of Nomentia. Previously, he held global Managing Director roles across payments (SumUp), accounting, compliance, and payroll (Xero) businesses, with additional experience in digital transformation, distribution and marketplaces. Alex is a pragmatic, decisive operator focused on building high-performing teams and delivering measurable impact for customers. He believes in fostering a culture that celebrates each team's strengths and diversity, where everyone can be the best version of themselves.

Héloïse Marleau

Principal, Verdane

Henrik Nordman

Partner, Head of Nordics, Inflexion

Henrik Nordman is the Partner at Inflexion responsible for investments in the Nordic region. Prior to joining Inflexion in 2022, Henrik spent more than a decade at Bridgepoint. He started his career in the investment banking division of Morgan Stanley.

David Leigh

Managing Director, PSG Equity

Kristina Miettinen

Investment Director, Inflexion

Tami Halttunen

CFO, Nomentia

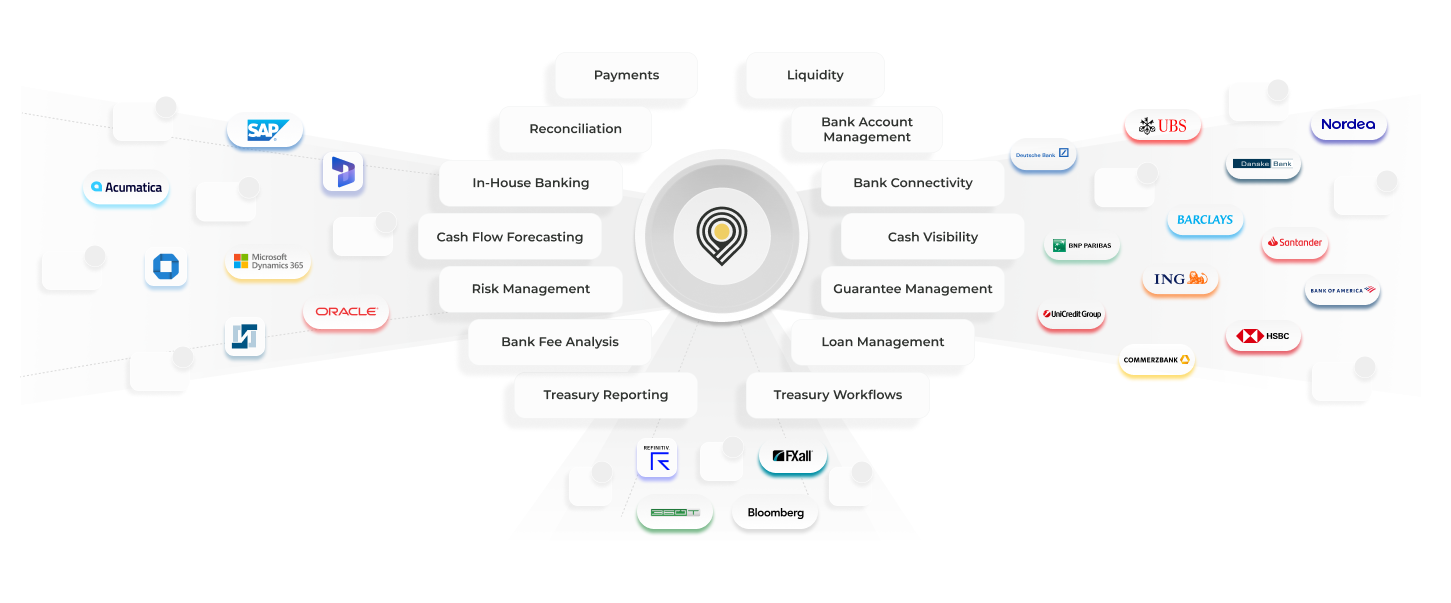

Cash & Treasury Management Solutions for SMEs & Enterprises

Payment hub

A complete payment hub for automating, managing, and centralizing local, cross-border, and global payments. Connect ERPs, financial systems, and banks to process all payments.

Reconciliation

Automatically match bank statements with transaction data or post transactions to the general ledger.

Bank connectivity as a service

Connect to over 10 000 banks globally. Fully managed connections and file format conversions between your banks, ERP, and financial systems.

In-house bank

Improve the group’s cash and treasury management processes by centralizing payment processes, liquidity and risk management, and taking control over intercompany financing.

Cash visibility

Monitor a complete and up-to-date cash position in centralized cash visibility solution. Automatically retrieve data from all internal and external systems and banks.

Liquidity management

Maximize visibility into your organization’s liquidity position, cash flows, and FX positions to optimize external & internal funding.

(e)BAM

A centralized multibank solution to manage all your bank accounts. Retrieve, view, analyze and monitor cash flows, account statements, and payments centrally.

Risk management

Implement a structured and systematic approach to risk management and hedging. Identify key risk drivers and optimally manage FX and interest rate risk during your day-to-day trading activities.

Cash flow forecasting

Automatically develop cash flow forecasts based on consolidated global cash flow data from all your systems and banks.

Guarantee management

Gain instant visibility into group-wide guarantees & LC status. Manage all processes related to internal and external guarantees in one platform.

Treasury reporting

Treasury reporting based on group-wide data from any system or bank. Easily export reports to BI tools or in other various formats if necessary.

Treasury workflows

Define workflows to streamline treasury processes. Centralize the work of various organizational units and multiple systems with Nomentia workflows.

Bank fee analysis

Automatically control and benchmark bank fees to avoid overcharges and ensure you don't pay the higher end of the market rates.

Loan management

Optimize the management of external bank loans and intercompany loans, integrate them into treasury processes, and measure their impact on cash flows and risk.

Risk Management

Implement a structured and systematic approach to risk management and hedging. Identify key risk drivers and optimally manage FX and interest rate risk during your day-to-day trading activities.

Sanctions screening

Automatically catch payments to sanctioned beneficiaries before they are processed. Screen your outgoing payments against any type of sanction list.

Payment process controls

Built-in payment process controls for fraud prevention, treasury finance policies, and data validation. Automatically catch irregular payments before they are processed.