Solutions

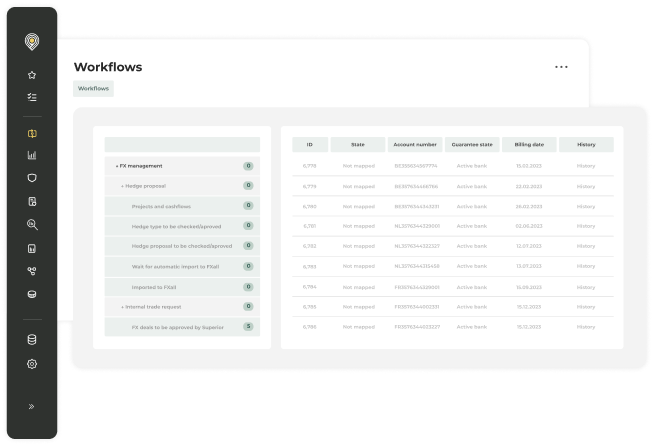

Treasury workflows

Automate and centralize end-to-end treasury processes with workflows. Define workflows to streamline different treasury processes and centralize the work of various organizational units and multiple systems with Nomentia Workflows.

.png?width=600&height=478&name=hero%20(3).png)

Build optimal treasury processes

Use customized treasury workflows to optimize your treasury and finance processes.

Automate processes with workflows

Automate processes for, for example, guarantees, payments, intercompany loans, master data, derivatives, bank fees, and bank accounts.

Central workflow monitoring

Centralize the work of various organization units and users and monitor all ongoing processes to remain up to date about global workflow status.

Automate task allocation and reminders

Automate task allocation according to set process rules. Set up automatic role-specific reminders for tasks in processes to eliminate the need for queries.

Enhance process security

Use workflows to set safety stops in critical parts of treasury processes.

Start automating any treasury process using workflows

Centrally create optimal treasury workflows

to enhance processes

Work smarter with smart treasury workflows.

- Centralize end-to-end processes for guarantees, intercompany loans, master data, derivatives, bank fees, and bank accounts

- Consolidate the work of various organizational units and multiple systems

- Monitor all ongoing processes and remain up to date about global statuses

- Easily identify uncompleted and pending tasks

- Ensure that the right people are part of the treasury processes at the right point in time

- Communicate through one platform

Automate processes wherever possible

Get the most out of different treasury processes with the help of automation workflows.

- Automate end-to-end processes for guarantees, intercompany loans, master data, derivatives, bank fees, and bank accounts

- Consolidate data and communication flows between local departments, shared service centers, and corporate treasury as well as ERP systems, TMS, and trading systems

- Automated task allocation according to specific set process rules

- Set up automatic role-specific reminders for tasks in processes to eliminate the need for queries

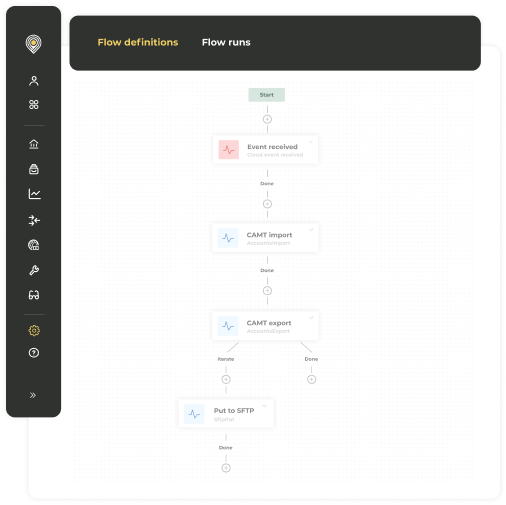

Workflows that work, regardless of the

systems you use

Fully integrated workflows that enable the automation of intersystem processes.

- Connect to any bank using host-to-host, EBICS, SFTP, and SWIFT Alliance Lite2 connectivity

- Connect to any ERP system

- Connect to any treasury management system

- Connect to FX trading platforms

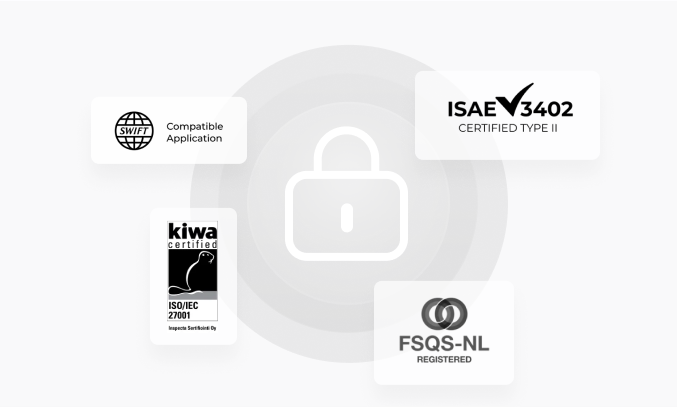

Security & compliance

Security is always at the core of our solutions.

- Login via multi-factor authentication or SSO

- Centralized user rights management allows you to gain better control over employee’s access based on their roles for SOX compliance

- Nomentia holds the following certifications:

ISO/IEC 27001 Information Security Management System (ISMS),

ISAE 3402 TYPE 2 and SWIFT Certified Application (Cash Management for Corporates and CSP compliance)

Trusted by 1400+ customers worldwide

Dieter Worf

Head of Treasury, Schott AG

Dieter Worf

Head of Treasury, Schott AG

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday.

Find out more