Solutions

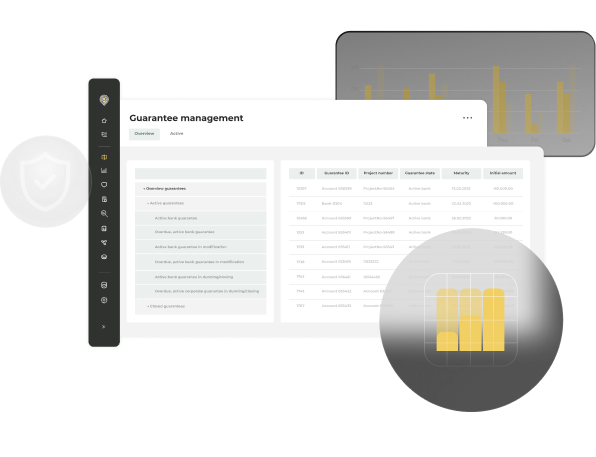

Guarantee management

Automate and digitalize the management of guarantees and letters of credit, providing instant visibility into group-wide guarantees and their status, all within a unified platform

Manage all guarantees and letters of credit in one place

Have a holistic overview of your bank guarantees and letters of credit in a single place and improve collaboration across different teams

Central group-wide administration

Globally manage end-to-end processes of guarantees and letters of credit (LCs) in one platform. Get instant access to any of your group’s bank guarantees.

Digitalize the guarantee management process

Use one digital standardized form for all requests and manage entire guarantee lifecycles digitally. Communicate with your colleagues within the same platform.

Bank integration and communication

Digitalize your information exchange with banks associated with requesting, amending, and returning guarantees with the aid of SWIFT standard formats.

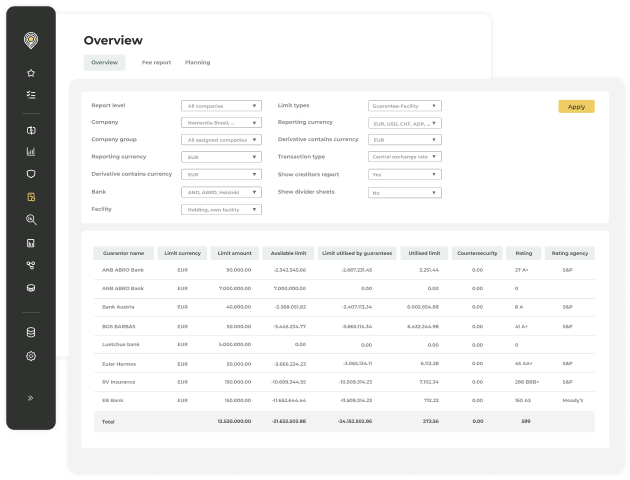

Efficient reporting and fee management

Filter guarantees by many different criteria, report on bank fees, and leverage automated settlement systems and automated internal billing.

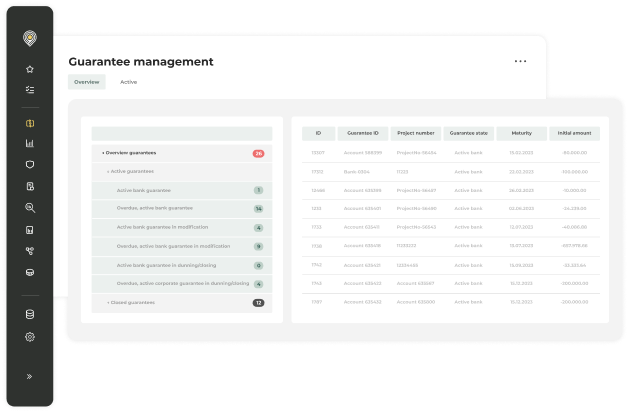

Stop managing bank guarantees by email or spreadsheets

Consolidate all bank guarantees & LCs

Enable a common efficient way of managing guarantees from requesting to approval to billing.

- Manage all internal and external guarantees and end-to-end guarantee processes in one place

- Optimal user management with role- and entity-based permissions

- Full transparency over the history of guarantees and modifications through audit trail

- Easy tracking of all guarantees status in each process step

- Digitally modify guarantees, create text, and add attachments

- Review all data and follow up by allocating credit facility, requesting more information, approving or rejecting applications

- Communicate with colleagues through the platform with a commenting functionality

Speed up guarantee management through process automation

Unify guarantee management by leveraging automation and digitalization and put an end to handling bank guarantee requests by email.

- Automate the entire guarantee management process of internal requests, reviews, external requests, and certificate issuance

- Digitalize your information exchanges with banks associated with requesting, amending, and returning guarantees with the aid of SWIFT standard formats

- Replace bank-specific request forms with a standardized request form

- Sign request forms to banks digitally with DocuSign, Adobe Sign, or other signatory integrations, and send them to banks directly from the platform

- Fully automate the internal billing process

- Add an automated settlement system to your guarantee management and administration tasks

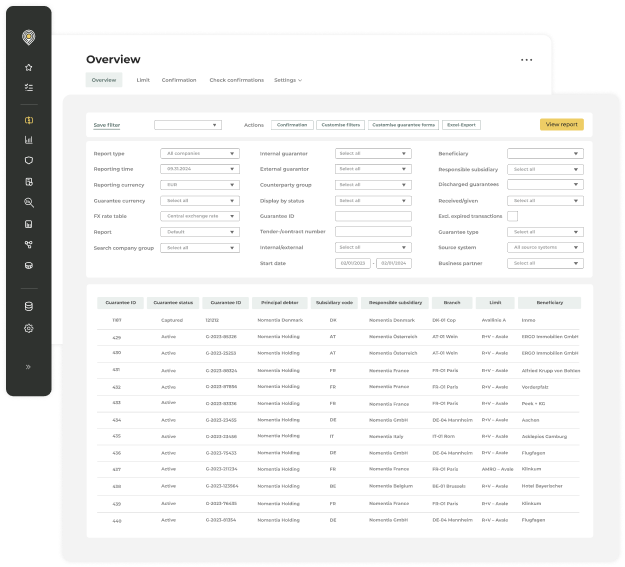

Run intuitive reports on all guarantee related matters

Run all the relevant guarantee reports for comprehensive analyses and gain actionable insights on all your guarantees.

- Filter your worldwide portfolio of guarantees based on criteria like guarantee type, purpose, beneficiary, due date, guarantor, counterparty, or currency

- Set up various external, internal, statistical, and flexible fee categories, including the related guarantee fees and commissions

- Drilldown to different guarantee status in all phases of the guarantee management process

- Run different reports like guarantee engagement reports, counterparty reports, and detail-reports

- Analyze guarantee bank fees to identify any overcharges

Connect to any system to gather all relevant information

Fully integrated management of guarantees and letters of credit for optimal processes.

- Send guarantees to banks via SWIFT, H2H, EBICS or email from the platform

- Connect to any ERP system to receive business-critical data

- Connect to any treasury management system

- Integrated SAP R3 and S4HANA connectivity

- Digital signatory with DocuSign, Adobe Sign, or other signatory integrations

Security & compliance

Security is always at the core of our solution.

- Login is available via multi-factor authentication or SSO

- Centralized user rights management allows you to gain better control over employee’s access based on their roles for SOX compliance

- Full audit trail & archive functionality to ensure compliance

- Nomentia Guarantee Management is hosted on Microsoft Azure to ensure highest possible security

- Nomentia holds the following certifications:

ISO/IEC 27001 Information Security Management System (ISMS),

ISAE 3402 TYPE 2 and SWIFT Certified Application (Cash Management for Corporates and CSP compliance)

.png?width=1354&height=813&name=Frame%202376%20(1).png)

Trusted by 1400+ customers worldwide

Carsten Linker

Head of Group Treasury, DNV GL

Carsten Linker

Head of Group Treasury, DNV GL

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday

Find out more