Solutions

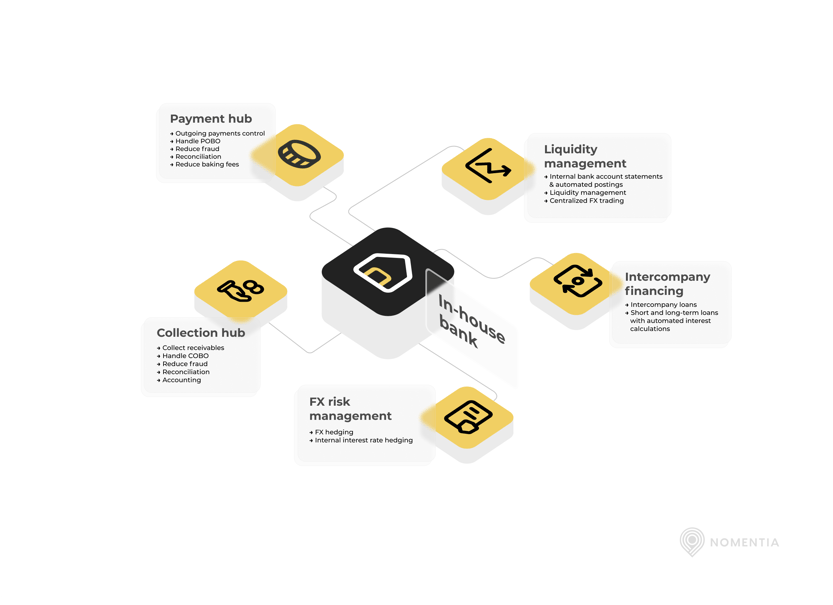

In-house Bank

Improve the group’s cash and treasury management processes by centralizing payment processes, liquidity and risk management, and taking control over intercompany financing.

.png?width=628&height=404&name=in-house-banking-hero-img%20(1).png)

Centralize cash management within your organization

Manage your organization’s cash, liquidity, and financial assets better while improving cross-organizational control and reducing banking fees

Centralize intercompany financing

Centrally control group IC investments and funding, netting, internal FX, routing of payments, and collections on behalf of.

Efficient structures

Leverage optimal intercompany processes and reduce costs by decreasing the required volume of external transactions.

Streamline netting and FX management

Centrally net intercompany settlements and use multi-currency accounts and payments to reduce external hedging costs.

Boost cash visibility

Boost company-wide visibility into cash by connecting all bank accounts to the in-house bank.

Improve your cash management with an in-house bank

Manage your cash management processes such as payments, collections, FX risk, IC loans, and liquidity all in one place with fewer external bank accounts.

A modern tool for better cash management

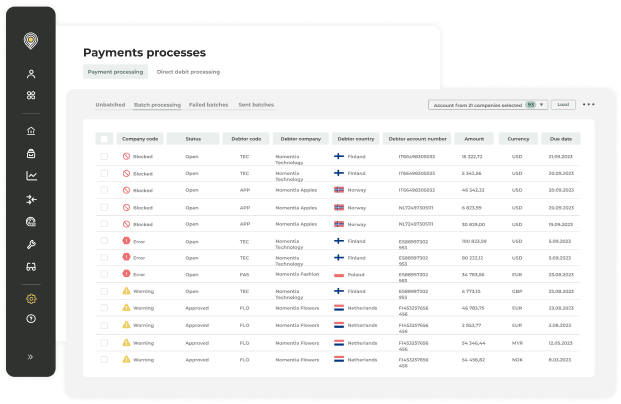

Create a payment factory within your in-house bank

Implement a payment hub within the in-house bank to go from manual payment processes to full automation by connecting all source systems and banks with your payment factory.

You can process domestic, regional, and global payments - even high-value complex international transfers.

Whether you aim to centralize or localize your payment processes, the payment hub will provide you with various functionalities.

- Centralize all payment processes

- Create fully automated payment processes

- Execute manual payments when necessary using templates

- A single platform for communicating with banks

- Take better control of cash movements

- Optimize cash & working capital

- Receive real-time payment balance information

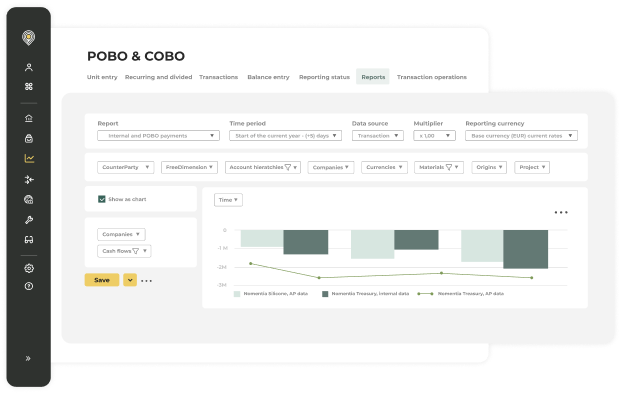

Implement POBO & COBO for more control

To take more control over the outgoing and incoming payments, you can implement the payment-on-behalf-of (POBO) and collection-on-behalf-of (COBO) processes.

- Set up internal accounts for subsidiaries

- Execute payments on behalf of the subsidiary centrally

- Collect payments on behalf of the subsidiary centrally

- Receive and send payments from the group treasury’s account to the subsidiary’s internal accounts

- Increase payment process centralization and operational efficiency

- Reduce the number of bank accounts and decrease dependency on banks

- Decrease banking fees

- Optimize working capital management

- Reconcile payments automatically

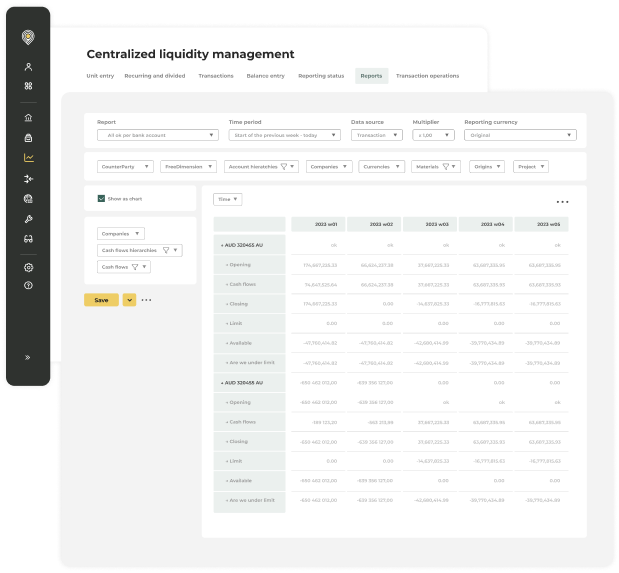

Centralized liquidity management

Collect all financial data, analyze historical cash flows, evaluate your working capital to gain complete insights into your company’s liquidity position.

- Get complete visibility into the company’s cash positions throughout the entire organization

- Connect all data sources (ERP, TMS, financial systems, banks) to automatically fetch financial data

- Central visibility into bank account balances of entities

- Automatically collect data from all your subsidiaries

- Dynamic data views using a variety of functionalities such as aggregation, grouping, filtering, multiple time periods, and grid or graph views.

- Fully customizable dashboards allow you to create insightful reports

- View historic and current liquidity positions

- Create both short & long-term liquidity forecasts

- Compare actuals vs forecasts

- Set up scenario analyses

- Drill downs to the smallest details such as transaction levels

- Set up cash pool structures

- Monitor your FX hedging requirements

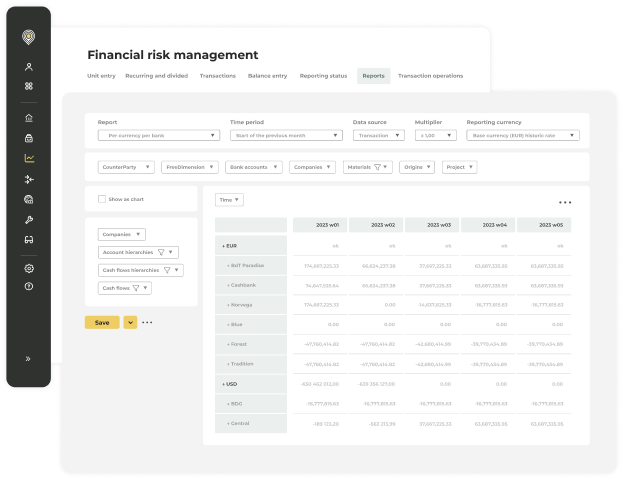

Improve financial risk management

Effective central liquidity management helps mitigate financial risk.

Making sure there’s enough cash to protect against unexpected expenses, economic downturns, or market volatility.

- Minimize liquidity risk with accurate and real-time data

- Mitigate credit risk by forecasting future cash positions

- Speed up informed strategic decision-making based on reliable data

- Minimize the need for short-term external funding

- Leverage liquidity analyses to attract external funding

- Ensure timeliness of reporting with defined deadlines, reminders, and status updates

- Use multi-currency accounts and payments to reduce external hedging costs

- Expand visibility into the group’s foreign exchange exposure and the currency position

- Internal FX hedging

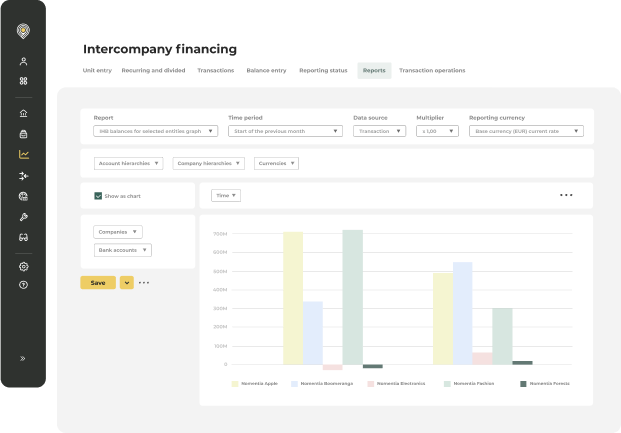

Intercompany financing

Adopt intercompany financing practices to optimize capital allocation and reduce borrowing costs, while also gaining greater control over financial operations and tax efficiency within the group.

- Cover short-term financing needs internally by efficiently allocating capital within your corporate structure, using funds where needed the most

- Eliminate unnecessary bank loans and lower borrowing costs

- Automatically calculate and set interest rates for internal loans

- Automatically net and invoice internal debts with clearing

- Debt relationships between internal accounts are netted to gain control over intercompany settlements

- Achieve greater transparency over subsidiaries’ financing activity and monitor it to minimize risk

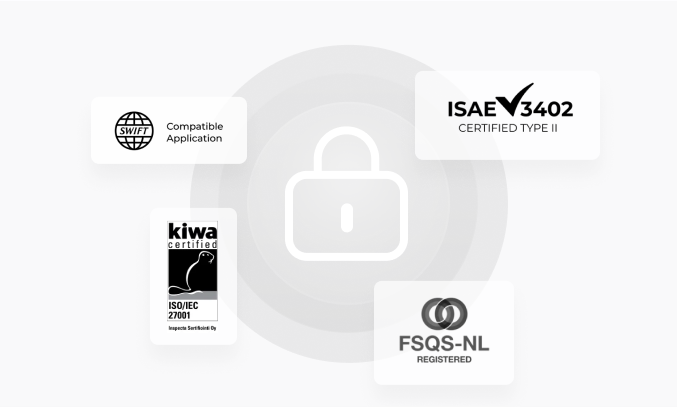

Security & compliance

Security is always at the core of our solution.

- Login is available via multi-factor authentication or SSO

- Centralized user rights management allows you to gain better control over employee’s access based on their roles for SOX compliance

- Full audit trail & archive functionality to ensure compliance

- Nomentia In-house bank is hosted on Microsoft Azure to ensure highest possible security

- Nomentia holds the following certifications:

ISO/IEC 27001 Information Security Management System (ISMS),

ISAE 3402 TYPE 2 and SWIFT Certified Application (Cash Management for Corporates and CSP compliance)

Trusted by 1400+ customers worldwide

Bas Meijer

Interim Treasury Manager (external), Greenchoice

Bas Meijer

Interim Treasury Manager (external), Greenchoice

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday.

Find out more