Solutions

Bank fee analysis

Gain a comprehensive understanding of your bank fees to pinpoint disparities between fees paid and those invoiced and start negotiating more favorable terms with your banks.

.png?width=530&height=449&name=hero%20(2).png)

Enhancing financial transparency over bank fees

Implement automated controls to prevent overcharges and ensure you always pay the rates that you agreed on.

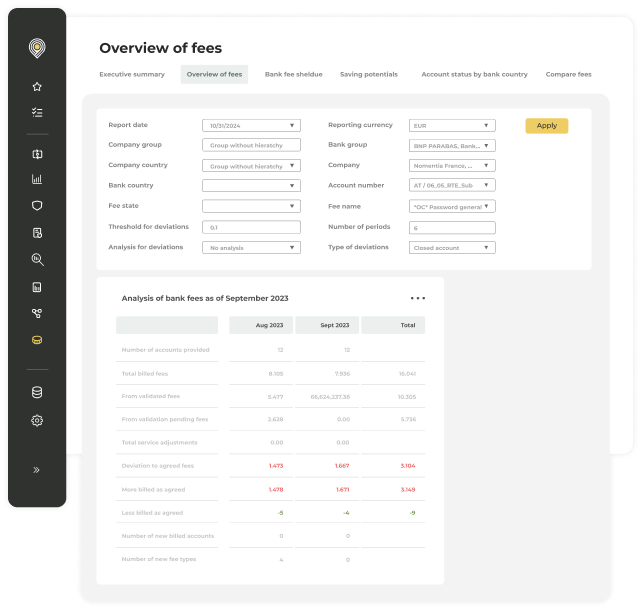

Automated bank fee reports

Run automated bank fee reports on a regular basis to identify any deviations from your agreed bank fees.

Negotiate more favorable terms

Acquire data about fee types, volumes, and charges on all your bank fees to have a better negotiation position with your banks for any upcoming RFP.

Never overpay again

Automate bank fee controlling

Leverage bank fee automation wherever possible.

- Upload your bank fee schedules as the base for analysis of all your bank charges

- Use smart workflows to detect any new accounts, new fees,

or any deviations to your agreed fees - Import bank charges in formats like CAMT.086, TWIST BSB, EDI.822

and CSV - Acquire data about fee types, volumes, and charges on all your bank fees to have a better negotiation position with your banks for any upcoming RFP

- All the work is done in Nomentia - no separate system needed

Create insightful fee reports

Comprehensive bank fee reports with all the information you need.

- Get an overview of all your bank accounts and their related fees globally, by country, company, banking group, fee group, or more

- Get a comparison report to make products and prices comparable between banks

- The deviation report automatically shows whether you have been overcharged or undercharged

- The savings reports will show you if uniform prices are applied within the same banking group and the same country for the same service

- The exception report shows you any expensive fees like manual or urgent pays and allows you to detect internal process or static-data issues

- The Executive Summary report wraps everything up for your management

Trusted by 1400+ customers worldwide

Dieter Worf

Head of Treasury, Schott AG

Dieter Worf

Head of Treasury, Schott AG

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday.

Find out more

Want to know more about our

bank fee analysis module?

Let's discuss the future of your treasury processes together.