Solutions

Liquidity

Consolidate all cash flow data and maximize visibility into your organization’s liquidity, cash flows, and FX positions to optimize external & internal funding.

Ensure financial stability with cash flow and liquidity management

Know your company’s liquidity position to capitalize on opportunities, while meeting your financial obligations and effectively managing your risk

Better overview of your cash positions

Combine all cash flow data from various systems and banks in our liquidity management tool to easily analyze group-wide cash flows and liquidity positions.

Mitigate financial risk

Effective liquidity management helps mitigate financial risk.

Available cash can protect against unexpected expenses, economic downturns, or market volatility.

Optimize short-term liquidity

Ensure smooth day-to-day operations by having enough cash and convertible assets to cover short-term obligations like payroll, invoices, or inventory purchases.

Capitalize on opportunities

Understanding your company’s liquidity position can help you to realize investment opportunities, acquiring assets at favorable terms, or making strategic investments.

Create comprehensive liquidity strategies using versatile reports

Uncover your liquidity position

Collect all financial data, analyze historical cash flows, evaluate your working capital to gain complete insights into your company’s liquidity position.

- Using all your cash flow data, gain a single source of truth about your company’s cash positions throughout the entire organization

- Automatically collect data from all your subsidiaries

- Connect all your data sources to automatically fetch financial and cash flow data

- Monitor global cash positions across entities, business units, multiple banks, and systems

- Role-based user rights help to restricting data visibility according to each user's specific permissions

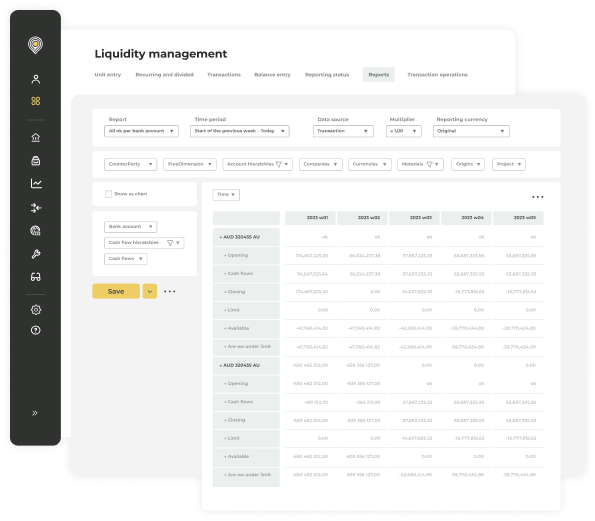

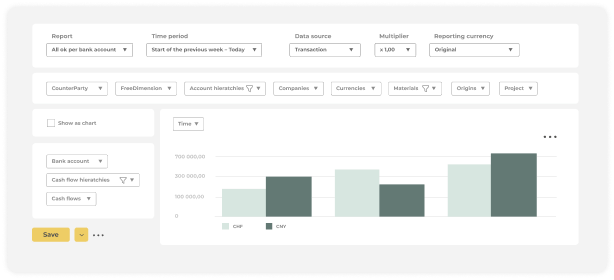

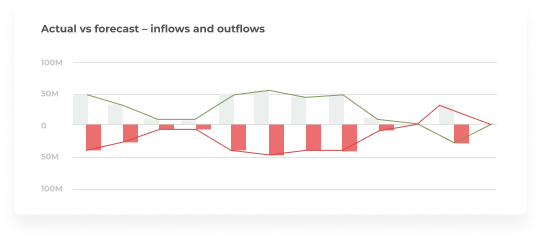

Effortless liquidity analysis & reporting

Create dynamic data views using a variety of functionalities such as aggregation, grouping, filtering, multiple time periods, and grid or graph views.

- Fully customizable dashboards

- View historic and current liquidity positions

- Create short and long-term liquidity forecasts

- Easily compare actuals vs forecasts

- Create scenario analysis to discover different opportunities

- Drill down to the smallest data details such as transaction levels

- Set up cash pool structures

- Monitor your FX hedging requirements to minimize your risk

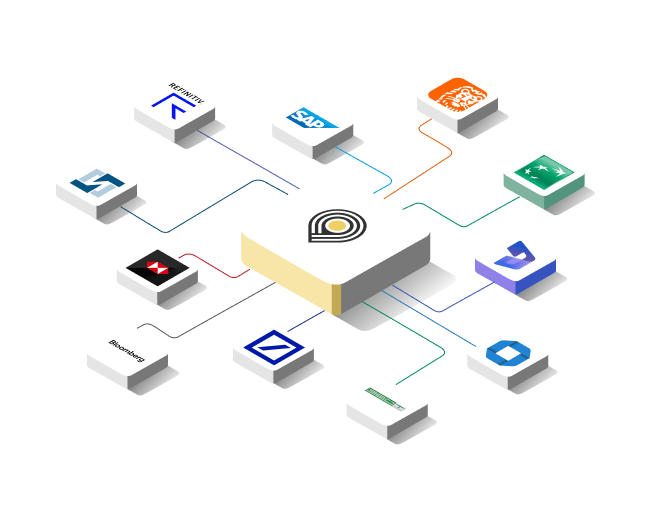

Integrations & format conversions

Fully integrated liquidity management to ensure all the right data is quickly available for analysis.

- Connect with any ERP system, for example, SAP, Oracle, Microsoft, Sage, NetSuite, and more

- Integrations with other treasury management systems are possible

- Establish connections with any other financial system that has cash flow data

- Move all your data into one place regardless of the data format to create cash flow and liquidity reports

Connect to banks to monitor cash balances

Make sure your liquidity positions are up-to-date by connecting a single system to all your banks.

- You can get all essential data from banks to follow your cash balances in all your bank accounts globally

- Connect to banks directly through host-to-host connectivity

- Utilize local connectivity types such as EBICS

- Bank connections are also available through SWIFT Alliance Lite2

- Bank connections are monitored and maintained to ensure uninterrupted communication

Know your liquidity positions to mitigate financial risk

Improve informed strategic decision-making with the help of quickly available liquidity data.

- Minimize liquidity risk by identifying potential liquidity gaps or vulnerabilities using accurate reports and insights

- Mitigate credit risk by forecasting future cash positions

- Ensure you have the necessary financial resources to make strategic investments

- Make informed strategic decisions based on the available cash flow and liquidity reports

- Minimize the need for short-term external funding and fund projects internally

- Leverage liquidity analysis to attract external funding for development and investment

- Ensure timeliness with defined deadlines, reminders, and status updates

- Analyze how many overdue invoices you have in your AP and AR

Security & compliance

Security is always at the core of our solution.

- Login is available via multi-factor authentication or SSO

- Centralized user rights management allows you to gain better control over employee’s access based on their roles for SOX compliance

- Full audit trail & archive functionality to ensure compliance

- Nomentia Liquidity is hosted on Microsoft Azure to ensure highest possible security

- Nomentia holds the following certifications:

ISO/IEC 27001 Information Security Management System (ISMS),

ISAE 3402 TYPE 2 and SWIFT Certified Application (Cash Management for Corporates and CSP compliance)

Trusted by 1400+ customers worldwide

Viljami Vainikka

Head of Group Treasury, Caverion Group

”We decided to have a best-of-breed technology stack set up in Caverion’s treasury department and choose the solutions that best fit our goals.

We have seen that liquidity management is one of Nomentia’s core strengths and as cash forecasting and visibility are strategically important for our operations, we’ve expanded our relationship with Nomentia.”

Viljami Vainikka

Head of Group Treasury, Caverion Group

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday.

Find out more