Solutions

Risk management

Implement a structured and systematic approach to risk management and hedging. Identify key risk drivers and optimally manage FX and interest rate risk to avoid losses during your day-to-day trading activities.

End-to-end exposure analysis, hedging,

risk management & reporting

Intuitively analyze risk exposure and develop automated proposals for optimal risk hedging.

Fully integrated risk management

Facilitate automation by connecting all relevant data sources such as ERPs, banks, trading platforms, and other source systems into one risk management platform.

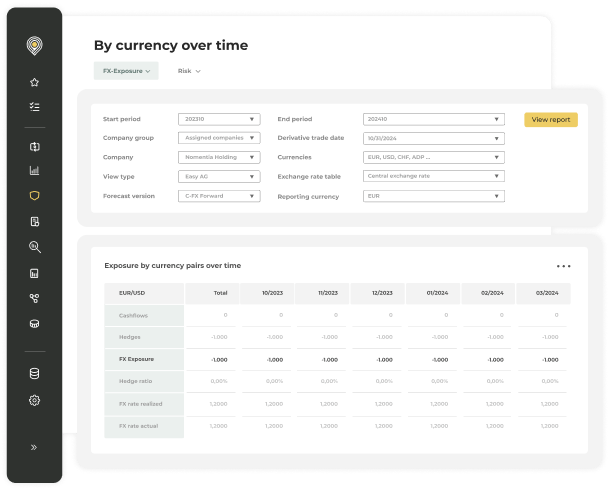

Forecast & analyze exposures

Automatically run short- and long-term exposure forecasts and analyze data on various levels, such as per entity, unit, division, or group level.

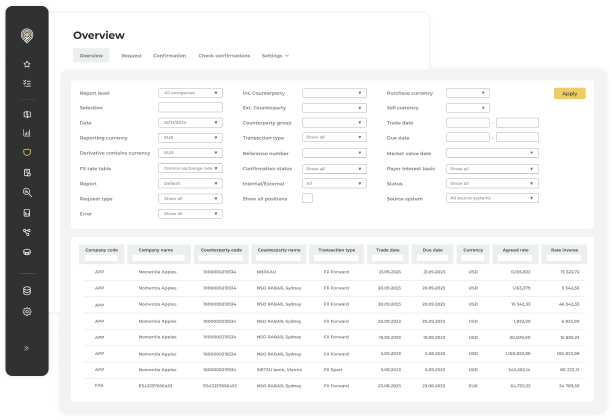

Manage deals & instruments centrally

Benefit from end-to-end processing with any electronic trading platform and manage instruments in one place.

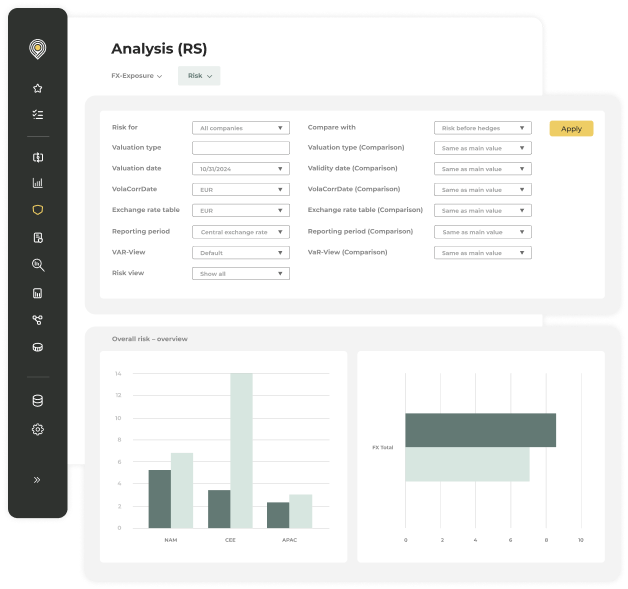

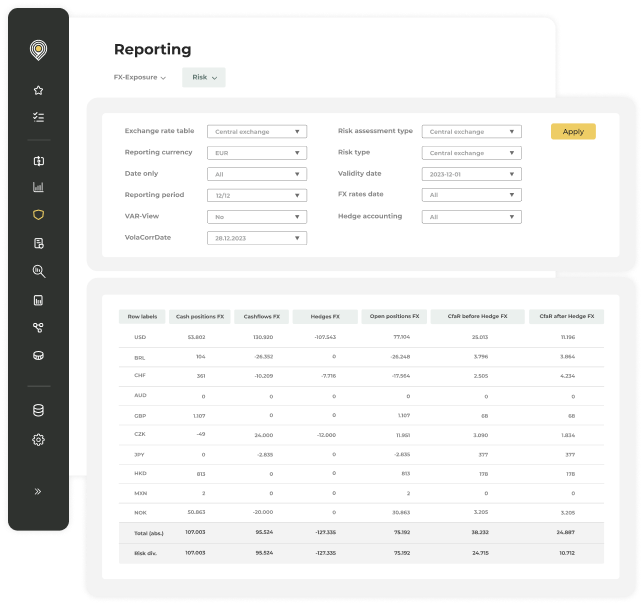

Quickly calculate risk & develop hedge proposals

Automatically develop risk calculations, like VaR and CfaR, and hedge proposals to measure the impact of simulated hedging on currency portfolios.

A complete suite to manage financial risk better

Integrations to retrieve all essential FX data

A fully integrated risk management platform.

- Facilitate automation by connecting to all relevant data sources (e.g., any ERP, SAP Business Warehouse, and more) and consolidate group-wide exposure data

- Supplement data as needed via uploads and/or central and local data-inputs

- Integrate market data sources or allow the solution to calculate volatilities & correlations

- Benefit from automated, two-way connectivity to and from trading platforms (send out hedge requests and retrieve traded deals)

Exposure forecasting & analysis

Comprehensive exposure forecasting and risk analysis.

- Cover the short-term by combining financial assets & liabilities with data from ERPs (e.g., AP/AR, orders, actual cash flows) or other sources

- Forecast the long-term by translating budget data into planned exposures or apply anticipated growth rates to historical, actual cashflows to ‘build’ your exposure

- Analyze exposures per entity, business unit, division, or on group-level

Derivative dealing & management

Centrally manage and deal instruments for hedging through system integrations.

- Leverage system-generated hedge proposals to reduce your exposure

- Ensure compliance with treasury guidelines and limits via check/approval workflows

- Benefit from end-to-end processing with any electronic trading platform (e.g., 360T, FXall, Bloomberg)

- Automatically create ‘back-to-back’ IC-deals when centrally hedging local exposures

- Ensure hedged items and hedges are completely linked via ‘post-trade’ fields

- Utilize customizable FX/IR and commodity deal types

- Perform mark-to-market valuations for plain-vanilla instruments

- Scenario analysis by simulating hedges and their effect on exposure and risk

Quick and automated at-risk calculations

Automatically calculate risk at various levels.

- Use the variance/covariance approach or Monte Carlo simulations

- Consider currency correlations

- Calculate value-at-risk and/or cashflow-at-risk (CfaR)

- Use Incremental CfaR to evaluate the impact of hedging a particular currency on risk

- Flexibly define parameters such as risk horizon, holding period, and confidence interval

Optimize hedge portfolios

Analyze your hedge portfolio and identify optimization possibilities.

- Identify cost-optimal hedges for any desired level of risk (= absolute VaR/CfaR)

- Simulate hedging costs (“cost of carry”) for any selected level of risk reduction

- Flexibly combine fixed ratios with hedge portfolio optimization

- Minimize the number of necessary hedge deals and/or volumes

- Make informed decisions and implement the hedging strategy that best balances cost and risk mitigation

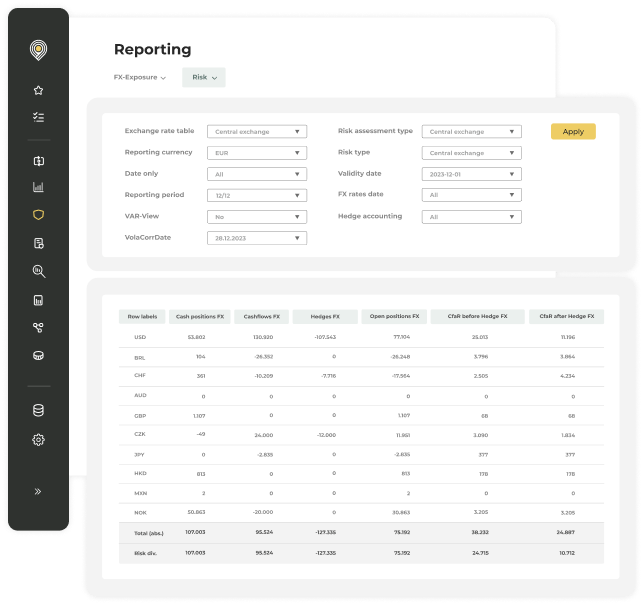

Comprehensive reporting and analytics

Create intuitive risk management reports and dashboards.

- Benefit from plug-and-play base exposure reports

- Use self-service-BI (powered by Nomentia Data Cube) for flexible analyses

- Create powerful dashboards using third-party BI tools such as Microsoft PowerBI

- Easily export all relevant data to spreadsheets

Trusted by 1400+ customers worldwide

Mark Blatt

Strategic Projects Finance and Controlling, Drägerwerk AG & Co. KGaA

Mark Blatt

Strategic Projects Finance and Controlling, Drägerwerk AG & Co. KGaA

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday.

Find out more