Cash flow forecasting is often a guessing game for corporate treasurers. Fragmented data scattered across systems, complex global operations, and the constant uncertainty of market volatility – sound familiar? Adding in human error, siloed processes, and manual calculations, aren’t making the task any easier, for sure.

The reality is, too many businesses are operating without the tools they need to gain true clarity over their cash flow. It doesn’t have to be this way. With the right cash forecasting software, you can turn uncertainty into control, automate manual tasks, and make forecasting a more accurate, strategic process.

Let's take a look:

The key features to look for in cash flow forecasting software

Some of the most important forecasting software features include:

- Data integration capabilities across disparate systems: Integration ensures seamless data flow between ERP systems, banks, and other platforms helping you to answer questions like: “Where are our cash balances across all accounts and systems?” and “How can we consolidate cash flow data from multiple sources in one place?”. It reduces manual data entry errors and resolves inefficiencies caused by fragmented systems and siloed information.

- Real-time cash visibility: Real-time updates provide an accurate picture of cash positions, making it easy to answer questions like “what is our cash position” or “can we cover immediate obligations without additional borrowing.” You can say goodbye to reliance on outdated reports and respond to unexpected changes in cash flow.

- Scenario and variance analysis tools: These tools help businesses prepare for uncertainties by simulating different outcomes and identifying deviations from forecasts, allowing you to answer questions like “what happens to cash flow if sales drop by 20% next quarter” or “how does the forecast compare to actual performance, and why are there differences?”. Scenario and variance analysis tools help you to prepare for uncertainty and risk through contingency planning and identify causes of variances between forecasts and actuals.

- Automation to reduce manual effort and human error: Automation streamlines data entry and processing. It also reduces time spent on manual data collection, mitigates risks of incorrect forecasts, and allows treasury teams to focus on strategic tasks.

- Multi-currency and subsidiary management support: Essential for global operations, this feature simplifies cash flow management across different regions and currencies. You can easily answer questions about consolidated cash flow for all subsidiaries and currencies and about how exchange rate fluctuations impact your global cash flow. In the best cases, you get a unified view despite currency differences and can tackle inefficiencies in reconciling multiple subsidiary reports.

- Compatibility with existing bank account structures: Can the software accommodate you’re the complexity of your bank account hierarchies? Can it help you manage cash across multiple accounts efficiently? Compatibility with existing bank account structures ensures the software can easily integrate with bank account hierarchies without restructuring, supports operations with multiple banking relationships and eases cash flow tracking across complex account networks.

- Ability to adapt to changing market and business conditions: You need to be agile in response to market volatility. A flexible solution supports evolving business needs and external market shifts.

Evaluation criteria for cash forecasting software providers

When researching and comparing forecasting software providers, it’s advisable to pay attention to the following things:

- Accuracy & analytics: The question to ask is: how well does the software forecast cash flows and provide actionable insights? Accurate forecasting is the cornerstone of effective cash flow management. The ability to predict cash inflows and outflows reliably enables businesses to make informed decisions, such as securing funding or investing surplus cash. Getting actionable insights from analytics helps businesses identify risks and opportunities.

- Ease of Use: Always ask if the interface user-friendly and intuitive for treasury teams? Intuitive systems save time, reduce errors, and improve adoption rates across the organization. Complex software may discourage employees from using it effectively.

- Integration: It’s important that your future cash forecasting software integrates with ERP systems, banks, and other financial platforms. Integrations ensures seamless data flow, eliminating manual data entry and errors and enable real-time cash visibility and better alignment with broader financial processes.

- Scalability: Can it grow with your business's needs? As businesses grow, their cash flow management needs evolve. Software that can scale ensures businesses don’t outgrow their tools, avoiding costly and disruptive migrations to new systems.

- Customization: Does the cash forecasting software you’re considering cater to your specific industry or organizational structure? Different industries and organizations have unique cash flow requirements. Customizable solutions allow businesses to tailor the software to their specific needs.

- Customer support & training: This is important: Are there resources available to help your team get up to speed? High-quality support ensures a smooth implementation process and quick resolution of issues. Comprehensive training resources enable teams to maximize the software's potential, avoiding underutilization.

- Cost & ROI: How does the pricing compare with its value proposition? The software’s cost should align with its value proposition, delivering measurable benefits like improved cash flow accuracy, reduced manual effort, or faster decision-making. A high ROI ensures the software is a worthwhile investment.

Best cash flow forecasting software providers

In no particular order:

- Nomentia: Nomentia provides comprehensive solutions for cash management, forecasting, cash visibility and connectivity.

- CashAnalytics: CashAnalytics specializes in automated cash flow forecasting and liquidity management for mid to large-sized businesses.

- Kyriba: Kyriba provides a robust treasury and risk management platform with real-time cash visibility and advanced security features.

- TIS (Treasury Intelligence Solutions): TIS delivers a cloud-based platform for global payments, cash flow forecasting, and liquidity management.

- HighRadius: HighRadius offers integrated receivables, cash forecasting, and treasury management solutions powered by advanced automation.

- GTreasury Cash forecasting: GTreasury provides a comprehensive treasury and risk management platform with real-time cash flow forecasting and liquidity management.

- Agicap: Agicap is a user-friendly cash flow management and forecasting tool designed for small to medium-sized businesses.

- Serrala: Serrala offers financial automation solutions, including cash flow forecasting, accounts payable and receivable automation, and treasury management.

- Coupa: Coupa provides a comprehensive business spend management platform that includes cash flow forecasting, expense management, and procurement.

- Cobase: Cobase simplifies multi-bank cash management and treasury operations with a single interface for managing multiple bank accounts.

Top 10 cash forecasting solutions: Key features, strengths & best for

1. Nomentia Cash flow forecasting

Nomentia provides a comprehensive treasury and cash management platform designed for businesses that need robust cash flow forecasting and liquidity management tools. Its real-time visibility and strong ERP integration capabilities make it an excellent choice for mid-to-large enterprises with complex financial operations. Advanced security features ensure sensitive financial data remains protected.

| Key features | Strengths | Considerations | Best for |

| AI-powered cash flow forecasting, liquidity management, bank connectivity, risk management, reporting & analytics | Comprehensive cash and treasury management suite, strong ERP integration, real-time cash visibility, advanced security features | Solution customizability and modularity increase implementation complexity and time requirements | Mid to large-sized enterprises needing intelligent, integrated cash management |

2. CashAnalytics

CashAnalytics specializes in automating cash flow forecasting and liquidity management. The platform minimizes manual effort by consolidating data automatically, providing real-time insights and detailed reporting. It’s ideal for businesses seeking to reduce errors and streamline their cash forecasting processes.

Source: https://www.cashanalytics.com/cashflow-forecasting/

| Key features | Strengths | Considerations | Best for |

| Automated forecasting, real-time integration, detailed reporting, scenario analysis | Focus on automation, real-time insights, reduces manual errors | Significant initial setup effort | Mid to large-sized businesses needing streamlined forecasting |

3. Kyriba

Kyriba offers a global treasury and risk management platform that includes advanced cash flow forecasting and liquidity solutions. Its strong integration with ERP systems and focus on security make it suitable for large enterprises with complex, multi-national financial operations. The platform supports real-time cash visibility and risk mitigation.

Source: https://www.kyriba.com/

| Key features | Strengths | Considerations | Best for |

| Real-time cash visibility, risk & treasury management, ERP integration | Global reach, advanced security, comprehensive treasury capabilities | High cost, requires significant training | Large enterprises with complex treasury needs |

4. TIS

TIS is a cloud-based platform that focuses on managing global payments, cash flow forecasting, and liquidity. With a user-friendly interface and robust reporting features, it helps businesses maintain real-time visibility and control over cash across global operations. The solution is particularly beneficial for companies managing complex banking relationships.

Source: https://tispayments.com/resources-archive/knowledge-hub/

| Key features | Strengths | Considerations | Best for |

| Cash forecasting, global payments, liquidity management, bank connectivity | Real-time visibility, strong integration, user-friendly interface | Complex implementation, higher cost | Mid to large-sized enterprises with global payment and liquidity needs |

5. HighRadius

HighRadius combines treasury management, cash flow forecasting, and AI-driven automation in a single platform. Its advanced automation capabilities reduce manual intervention and streamline cash flow processes for large enterprises. The platform excels in integrating seamlessly with ERP systems.

Source: https://www.highradius.com/software/treasury/cash-forecasting-ai/

| Key features | Strengths | Considerations | Best for |

| Integrated receivables, cash forecasting, advanced automation, treasury management | Advanced automation, ERP integration | High cost, complexity, requires significant training | Large enterprises with complex cash flow and treasury management |

6. GTreasury

GTreasury is a comprehensive treasury and risk management solution with strong cash forecasting and liquidity management tools. It provides real-time visibility into cash positions while offering robust integration with banks and ERP systems. The platform is well-suited for businesses with advanced treasury needs.

Source: https://gtreasury.com/platform/product/cash-management/cash-forecasting/

| Key features | Strengths | Considerations | Best for |

| Cash forecasting, liquidity management, risk management, bank connectivity, reporting | Comprehensive risk and treasury features, real-time visibility, strong ERP integration | Complex implementation, higher cost | Mid to large-sized enterprises with complex treasury and cash management needs |

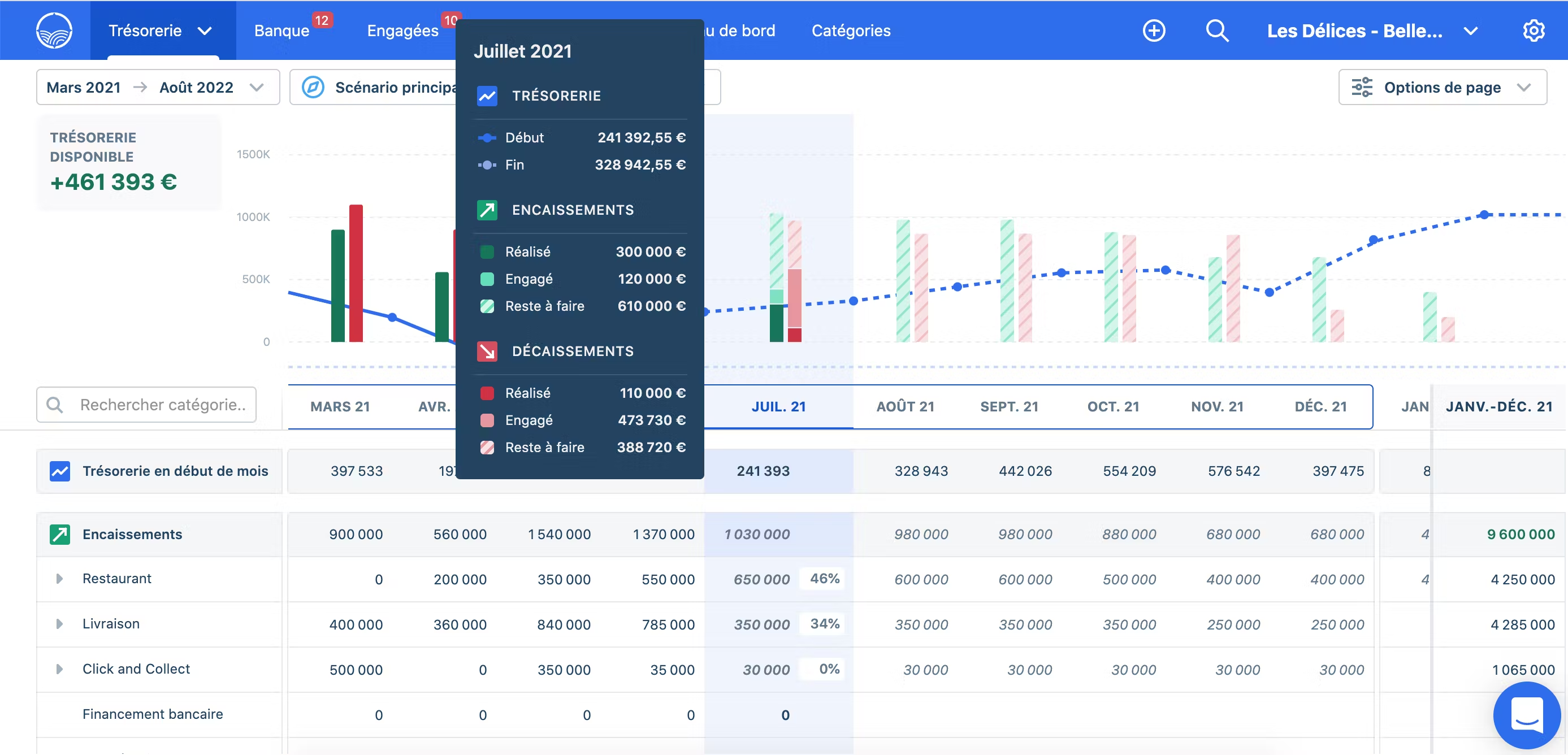

7. Agicap

Agicap is an intuitive cash flow management solution designed for small to medium-sized businesses. It offers real-time tracking, scenario planning, and easy integration with bank accounts and accounting software. The platform’s user-friendly interface and affordability make it a favorite among SMBs.

Source: https://gdm-catalog-fmapi-prod.imgix.net/ProductScreenshot

| Key features | Strengths | Considerations | Best for |

| Real-time tracking, scenario planning, budgeting, bank/accounting software integration | Easy-to-use interface, affordable, real-time insights | Limited customization, lacks advanced features for large enterprises and complex cash management | Small to medium-sized businesses needing real-time cash management |

8. Serrala

Serrala provides a powerful suite of financial automation tools, including cash flow forecasting, treasury management, and accounts receivable/payable automation. Its strong ERP integration capabilities and real-time cash visibility features are ideal for businesses with complex financial processes. Advanced security ensures data integrity and protection.

Source: https://treasury360.net/treasury-news/system-demos/tackle-the-transparency-issue/

| Key features | Strengths | Considerations | Best for |

| Cash forecasting, treasury management, financial process automation, ERP integration | Comprehensive automation, real-time visibility, advanced security features | Complex implementation, higher cost | Mid to large-sized enterprises needing financial automation and treasury management |

9. Coupa

Coupa is a business spend management platform that includes cash flow forecasting, expense management, and procurement features. It provides real-time visibility into spending and integrates seamlessly with ERP systems. Its user-friendly interface and comprehensive capabilities are best suited for mid-to-large enterprises.

Source: https://www.coupa.com/solutions/unlock-liquidity-and-streamline-payments

| Key features | Strengths | Considerations | Best for |

| Cash forecasting, expense management, procurement, real-time spend visibility, ERP integration | Comprehensive spend management, user-friendly interface, real-time cash flow insights | Expensive for smaller businesses, requires training | Mid to large-sized enterprises needing a comprehensive spend management solution |

10. Cobase

Cobase simplifies the management of multiple bank accounts and streamlines cash and payment operations. The platform offers real-time visibility into cash positions and strong integration capabilities, making it ideal for businesses with complex banking relationships. Its multi-bank connectivity is a standout feature for large enterprises.

Source: https://ctmfile.com/story/cobase-multi-banking-made-simple-much-more

| Key features | Strengths | Considerations | Best for |

| Multi-bank connectivity, cash forecasting, payment processing, treasury management | Simplifies multi-bank management, real-time visibility, strong integration | Limited advanced features for larger enterprises, higher cost for smaller businesses | Mid to large-sized businesses with multiple bank accounts and streamlined treasury needs |

How to choose the right forecasting software for your business?

Choosing the right cash flow forecasting software involves a detailed understanding of your business's unique challenges, aligning them with the features offered by potential solutions, and making a strong business case for investment. Let’s break it down:

1. Identify your specific challenges

Every business faces unique pain points in cash management and forecasting. Common issues include:

- Lack of visibility: If your cash positions are unclear or scattered across multiple accounts and systems, you can’t make timely decisions. Example: A global SME with accounts in different countries struggles to know its daily cash balance, leading to overdraft fees and missed investment opportunities.

- No central control: Decentralized cash management leads to inefficiencies and misaligned forecasts across subsidiaries. Example: A manufacturing firm has ten subsidiaries, each using its own cash management process, causing delays in creating consolidated cash flow reports.

- Manual processes: Manual data collection and reconciliation are time-consuming and prone to errors. Example: An e-commerce retailer manually consolidates sales and payment data from several platforms, leading to inaccuracies in cash forecasts.

- Integration issues: Disparate systems for ERP, banking, and treasury tools create fragmented data. Example: A healthcare company struggles to integrate its new forecasting tool with an outdated ERP system, delaying data updates.

- Subsidiary management: Managing cash flow across multiple entities and currencies adds complexity. Example: An SME expanding into new markets faces challenges reconciling multi-currency accounts and projecting consolidated cash flows.

2. Match cash forecasting software features to your needs

Before you look at vendors, take stock of your current processes.

- Map out existing structures: List the number of locations, currencies, and entities you manage, and understand how cash flows through these.

- Involve key stakeholders: Include treasury teams, finance managers, IT staff, and operations heads.

Once your challenges are clear, prioritize features that align with your improvement goals.

- If real-time cash visibility is a priority, choose software with integrated bank feeds and instant updates real-time dashboards.

- For businesses with global operations, look for multi-currency support and subsidiary management.

- To address integration issues, select solutions that seamlessly connect to your ERP, bank portals, and other systems.

- If increased forecasting automation, is you goal, go for software that provides features to automat data collection, consolidation, and reporting.

- If Scenario and variance analysis is key, you need scenario analysis tools to model multiple cash flow possibilities and variance reporting to improve forecast accuracy over time.

- If cost and resource management is critical user-friendly interfaces that reduce training needs.

- If scalability and long-term planning are priorities, you need solutions that can evolve with your operations.

- If you need improved reporting and insights advanced reporting, consider tools with customizable dashboards.

3. Evaluate your budget and resources

Cash flow forecasting software varies significantly in cost and complexity. Consider:

- Cost structure: Subscription-based pricing works for SMEs, while larger firms may opt for custom pricing.

- Implementation resources: Evaluate internal capacity for onboarding and training. If resources are limited, choose user-friendly solutions with strong support.

- ROI potential: Analyze potential savings, efficiency gains, and accuracy improvements to justify investment.

How to implement cash flow forecasting software effectively

Choosing the right solution is just half the battle. To successfully implement a cash flow forecasting software, start with:

- Preparing for integration challenges

- Evaluate current systems: Check compatibility with ERP, accounting software, and bank portals.

- Plan connectivity: Ensure seamless integration with all banks and systems globally. For example, a business with twelve banks in different currencies needs smooth multi-bank, multi-currency integration.

- Budget for IT support: Allocate resources for potential technical issues during integration.

- Build a detailed implementation timeline

- Start with a pilot: Roll out in a single location or entity to test functionality and gather feedback.

- Set realistic goals: Break the process into steps like data integration, training, and testing.

- Allocate resources carefully

- Prevent Overburdening Staff: redistribute non-critical tasks during the rollout phase.

- Tap external expertise: If your team lacks the skills to handle integration or configuration, hire consultants or use the vendor’s onboarding team.

- Address multi-currency and multi-entity complexity

- Set standardized reporting parameters: Ensure consistency in exchange rates, periods, and consolidation methods.

- Automate currency conversion: Use the software’s multi-currency tools to calculate exchange rates in real time, factor in daily fluctuations.

- Focus on employee readiness

- Tailor training programs: Different teams have different needs. For example, treasury staff may need deep dives into forecasting tools, while IT may focus on connectivity and security.

- Keep it simple: Use practical, relevant examples during training.

- Create champions: Designate well-trained employees to support others.

- Test thoroughly before full rollout

- Simulate real scenarios: Test the software with actual data, like multi-location cash flows or currency conversions for a full reporting period.

- Validate reports: Compare software outputs with manual calculations to ensure correctness.

- Start with partial implementation

- Roll out in phases: Begin with a small subset of your organization—perhaps a single entity, region, or subsidiary. This allows you to refine the process and troubleshoot before scaling up.

- Prioritize entities with the greatest need: Choose locations or subsidiaries with the most pressing cash management challenges (e.g., manual processes or high transaction volumes).

- Document lessons learned: As you onboard each new entity, capture insights and apply them to future phases.

- Establish clear reporting and communication lines

- Create standardized reports: Create, use, and share templates and predefined dashboards to ensure consistency across locations.

- Schedule regular reviews: Set up weekly or monthly calls to review forecasts, identify discrepancies, and refine processes.

Common cash flow forecasting software implementation pitfalls to avoid

- Skipping training: Underestimating the learning curve leads to frustration and poor adoption.

- Failing to involve key stakeholders early: Not engaging treasury, finance, and IT teams in the planning can cause misalignment and overlooked requirements.

- Neglecting process alignment: Implementing software without first streamlining cash management processes can complicate setup and perpetuate inefficiencies.

- Overlooking integration requirements: Failing to properly plan integration with ERP systems, bank portals, and accounting tools leads to disconnected data and extra manual work.

- Underestimating multi-entity complexity: Ignoring regional differences in regulatory compliance, currencies, or workflows can disrupt operations, especially for global businesses.

- Poor change management: Without clear communication and a phased onboarding approach, employees may resist new systems and slow adoption.

- Rushing the rollout: Skipping proper testing can cause errors to snowball across locations.

- Ignoring data cleanliness: Outdated or inconsistent data undermines the benefits of automated forecasting.

Selecting the right software to improve your cash flow forecasting

Selecting the right cash flow forecasting software is essential for modern businesses looking to optimize their cash management operations. Whether you’re a small business seeking simplicity or a large enterprise with complex global needs, the right solution can streamline processes, enhance accuracy, and improve visibility.

For businesses looking for advanced AI-powered forecasting, real-time insights, and seamless automation, Nomentia offers a robust and scalable solution. With its comprehensive features and strong integration capabilities, Nomentia is the ideal partner to take your cash management to the next level.