Why are intercompany transactions important for corporations?

Intercompany transactions allow subsidiaries and parent companies to share goods, services, funding, and intellectual property within the group. They are essential for operational efficiency and tax compliance, but must be carefully documented, reasonably priced, and eliminated in consolidated reporting to avoid errors or regulatory issues.

Intercompany (IC) transactions (or intra-group transactions) are heavily used in the operations of multinational corporations, where financial exchanges between entities within the same corporate group occur frequently. While these transactions offer operational flexibility and efficiency, they also present unique challenges in terms of efficient accounting processes, compliance, and financial reporting. In this blog post, we'll dig into the intricacies of intercompany transactions and explore strategies for effectively managing them. There will also be a bonus case study on what optimized intra-group payment setups can look like. But first, let's have a closer look at what IC transactions actually mean and how they work.

The meaning of intercompany transactions

Despite there being various types of intercompany/intra-group transactions, they can generally be defined as transactions that occur between different entities within the same parent company or corporate group. These transactions can involve the transfer of goods, services, or financial assets between subsidiaries, divisions, or other affiliated entities within the organization.

Types of intra-group transactions

Intercompany transactions can be categorized into three main types based on the direction of the transaction and the relationship between the entities involved:

- Upstream transactions: goods or services flow from a lower-tier entity to a higher-tier one within the corporate group.

Example: A manufacturing subsidiary sells products to the parent company. - Downstream transactions: goods or services move from a higher-tier entity to a lower-tier one within the corporate group.

Example: The parent company provides funding to a subsidiary. - Lateral transactions: occur between entities at the same level within the corporate group.

Example: Two subsidiaries collaborate on a joint project.

The categorizations help to understand the directional flow of transactions and the dynamics within the corporate group. Each type of transaction serves specific business objectives and requires careful consideration of factors such as pricing, documentation, and compliance with local regulatory requirements.

Examples of intercompany transactions

When it comes to the actual transactions themselves, various examples are relevant for finance, accounting, and treasury teams. They illustrate how diverse the nature of intercompany transactions is and how crucial they are for multinationals to function properly. The most common examples of intercompany transactions include:

- Sale of goods/services: subsidiaries within the group may engage in the sale of goods or provision of services to meet operational needs.

- Transfer of intellectual property: transfer of patents, trademarks, and copyrights between entities for use in their operations.

- Intercompany loans: loans provided between subsidiaries for financing needs or capital projects.

- Transfer of assets: movement of assets like equipment, machinery, or real estate to optimize operations.

- Cost sharing: sharing of project costs or resources among subsidiaries for joint ventures or other collaborative projects.

- Management services: provision of management, administrative, or support services between entities.

- Royalty payments: payment for the use of intellectual property rights within the corporate group.

- Stock transactions: buying and selling of shares between subsidiaries or between a subsidiary and the parent company.

Each intra-group transaction requires a slightly different approach, varying stakeholders, documentation, or compliance. It can be very challenging for companies to manage them efficiently and transparently.

How does the intercompany transaction process work?

To provide more clarity about the actual work that goes into each example of IC transaction, you can look at the related processes that consist of several steps involving various stakeholders within the organization along the way. How these tasks are divided highly varies in each organization. Yet, you can usually see that the process looks similar to the one below:

1. Identification of intercompany transactions

Companies need to identify transactions that occur between different entities within the same corporate group. These transactions may include sales of goods, provision of services, loans, transfers of assets, royalties, or other types of financial exchanges.

2. Recording transactions

Once identified, intercompany transactions are recorded in the accounting records of the participating entities. Each transaction is recorded at fair market value, which is the price that would be agreed upon by unrelated parties in an arm's length transaction.

3. Elimination process

The transactions need to be eliminated in consolidated financial statements to avoid double-counting. When the parent company prepares its consolidated financial statements, it combines the financial results of all its subsidiaries into a single set of financial statements. To ensure accuracy, intercompany revenues, expenses, assets, and liabilities are eliminated during the consolidation process.

4. Intercompany pricing

One of the critical aspects of intercompany transactions is determining the transfer price, which is the price at which goods or services are transferred between related entities. Transfer pricing is crucial for tax purposes and to ensure that each entity within the corporate group is fairly compensated for its contributions.

5. Documentation and compliance

Companies must maintain proper documentation of intercompany transactions to comply with accounting standards, tax regulations, and transfer pricing rules. This documentation typically includes intercompany agreements, invoices, pricing policies, and other relevant records.

6. Tax implications

IC transactions can have significant tax implications, especially when they involve entities in different tax jurisdictions. Tax authorities scrutinize the transactions to ensure they are conducted at arm's length and that transfer prices are set in accordance with regulations to prevent tax evasion and profit shifting.

7. Risk management

Managing risks associated with intercompany transactions is crucial. Companies need to ensure compliance with regulations, mitigate transfer pricing risks, and maintain transparency in their financial reporting to avoid legal and financial repercussions.

It is clear that IC transactions play a vital role in the operations of multinational corporations, facilitating the efficient allocation of resources, sharing of expertise, and coordination among different entities within the corporate group. Simultaneously, it's a time-consuming process that requires many steps, stakeholder management, and documentation. Let's zoom in on the documentation aspect further, since that's where companies can optimize processes in particular.

Documentation is a critical part of managing IC transactions

Traditionally, intercompany transactions are documented through various means to ensure proper record-keeping, compliance, and transparency within the corporate group. Some common documentation methods include:

Intercompany agreements: formal agreements that are drafted to outline the terms and conditions of intercompany transactions. These agreements specify the nature of the transaction, pricing mechanisms, payment terms, and any other relevant provisions.

Invoices and billing statements: invoices are issued for goods sold, services rendered, or other transactions conducted between entities within the corporate group. These invoices detail the quantity, description, price, and total amount due for the transaction.

Transfer pricing documentation: transfer pricing documentation is prepared to support the pricing of intercompany transactions in accordance with applicable tax regulations. This documentation typically includes a transfer pricing study, analysis of comparable transactions, and documentation of the pricing methodology used.

Accounting records: each intercompany transaction is recorded in the accounting records of the participating entities. These records include journal entries, ledgers, and other financial documents that capture the details of the transaction for internal and external reporting purposes.

Intercompany reconciliation: there need to be regular reconciliation processes in place to ensure that intercompany balances and transactions are accurately recorded and reconciled between the entities involved. This helps identify and resolve any discrepancies or errors in the accounting records.

Even if this documentation process sounds labor-intensive, there are ways to make it more efficient, by adopting dedicated tools, for example. Other improvements and strategies we'll discuss more in detail below.

Strategies to optimize intercompany transactions

Optimizing the documentation and other laboursome tasks related to intercompany transactions involves implementing efficient processes and leveraging the right technologies. Some of the most common strategies to optimize intercompany documentation include:

Create efficiency with standardization

Establish standardized templates, formats, and procedures for documenting intercompany transactions to ensure consistency and efficiency across the organization.

Automation through technology

Utilize accounting software and enterprise resource planning (ERP) systems to automate the generation of invoices, recording of transactions, and reconciliation processes. To take it a step further, you can connect these systems to a treasury management system to fully integrate the processes with all entities' banks. Automation through technology typically reduces manual errors, saves a lot of time, and improves data accuracy and transparency.

Establish a centralized repository

Maintain a centralized repository or digital database to store all intercompany agreements, invoices, and documentation. This ensures easy access to relevant information and facilitates better compliance monitoring and auditing access. This can also be done with dedicated technology.

Implement electronic signatures

Implement electronic signature solutions to expedite the approval and execution of intercompany agreements and other documents. Electronic signatures streamline the workflow and reduce administrative delays associated with manual signatures. You can often fully integrate them with different processes and tools you already use.

Real-time reporting

Real-time reporting provides stakeholders with punctual insights into intercompany transactions and financial performance. It can help enable proactive decision-making and enhance organizational transparency for all relevant stakeholders.

Combining these strategies will allow your team to work more efficiently and open up the possibility to focus on other essential tasks that are otherwise neglected due to resource constraints.

Different technologies to streamline IC transactions

Let's elaborate more on the technologies that you can actually use to improve IC transaction operations. Like with most processes, the answer to making intercompany transactions more efficient is technology. Several technologies can help streamline and optimize intercompany transactions. This is a list with the main technologies you can leverage:

- Enterprise Resource Planning (ERP) systems: ERP systems integrate various business processes, including accounting, finance, inventory management, and procurement. They can automate transaction recording, streamline workflows, and provide real-time visibility into intercompany activities.

- Electronic Data Interchange (EDI): EDI enables the electronic exchange of business documents, such as purchase orders, invoices, and shipping notices, between different computer systems. The technology focuses on faster and more accurate data transmission, reducing manual errors and processing times in intercompany transactions.

- Blockchain: blockchain offers a decentralized and transparent ledger system that can securely record and track intercompany transactions in real-time. Although companies do not commonly use it, it can help with tamper-proof records of transactions, enhance trust among parties, and reduce the risk of fraud or disputes.

- Cloud-based technology: cloud-based platforms enable secure storage, access, and collaboration on intercompany transaction data from essentially any place with an internet connection. They offer scalability, flexibility, and cost-effectiveness, allowing companies to efficiently centralize and manage their intercompany transactions.

- Automated workflow tools or robotic process automation (RPA): workflow automation tools streamline intercompany transaction processes by automating repetitive tasks, approvals, and notifications.

- Electronic signature solutions: electronic signature platforms enable the digital signing of intercompany agreements, contracts, and other documents, eliminating the need for physical signatures and paper-based processes. That way, you can really accelerate transaction execution.

- Data analytics and Business Intelligence (BI) tools: data analytics and BI tools provide insights into intercompany transaction patterns, trends, and performance metrics. They will help you identify opportunities for cost optimization, risk mitigation, and process improvement on a group level.

- Artificial Intelligence (AI) and Machine Learning (ML): these days, AI and ML technologies can analyze large volumes of intercompany transaction data to identify anomalies, predict future trends, and optimize decision-making. They can also automate routine tasks and provide personalized recommendations based on historical data. There will likely be many more AI use cases in the future.

All in all, various technologies exist that can really help ease the management of IC transactions. Some tools require more expertise or know-how than others. As a result, most companies opt for software-as-a-service that provides the convenience of the technology being fully implemented, updated, and created by a specialized vendor.

The connection between IC accounting and IC transactions

In the context of IC transactions, IC accounting is often mentioned and also plays a big role. Intercompany accounting encompasses the recording, reconciliation, and elimination of these transactions in the financial records of the participating entities. The connection between intercompany accounting and intercompany transactions lies in how intercompany transactions necessitate accurate accounting practices to ensure transparency, compliance, and reliability in financial reporting. Intercompany accounting ensures that intercompany transactions are properly recorded, reconciled, and eliminated in the consolidated financial statements of the parent company. Ultimately, intercompany accounting plays a vital role in providing a comprehensive view of the financial performance and position of the entire corporate group.

Bonus: Case study on what an optimized IC payment setup can look like

One good example of intercompany process optimization is for example company netting. A netting solution can help organize payments and receivables between entities in a structured and cost-efficient manner based on a centralized netting centre. We wrote an entire article dedicated to it that you can find here: what is intercompany netting and how does it work?

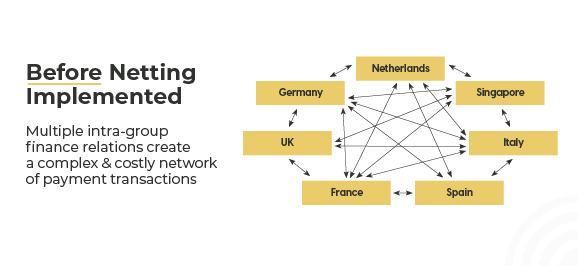

In short, a traditional intra-group transaction model looks very challenging to manage, with high transfer costs, many costly FX deals, unresolved disputes between subsidiaries, lots of communication, and difficulties with achieving cash visibility. To illustrate, the setup looks like the one below:

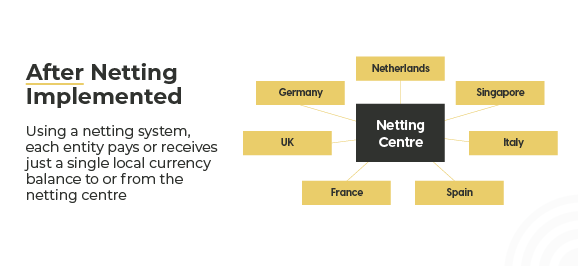

A strategy to improve this traditional way of working is to implement a netting centre, or better yet, in-house bank, that can streamline processes. The benefits of such a setup are standardized processes controlled centrally, improved timeliness of payments, fewer transactions equals lower transaction costs, FX managed centrally and traded at larger volumes allowing more favorable rates, high central visibility into all intercompany transactions, and often you will need fewer banks to which can reduce float. In theory such a setup looks like the following:

Navigating intercompany transactions: optimizing efficiency and compliance

In conclusion, navigating the complexities of intercompany transactions requires a thorough understanding of their meaning, types, and related processes and documentation. By implementing the right strategies and leveraging technology, multinational corporations can streamline their operations. The crucial connection between intercompany accounting and transactions highlights the importance of accurate recording, reconciliation, and elimination in consolidated financial statements. Through case studies like intercompany netting, organizations can witness firsthand the impact of optimized frameworks in improving efficiency, reducing costs, and enhancing visibility across their corporate groups. As businesses continue to evolve in a global landscape, effectively managing intercompany transactions remains crucial for sustainable growth and success.