Solutions

Cash visibility

Monitor global cash positions in Nomentia’s centralized cash visibility solution. Automatically retrieve data from all internal and external systems and banks.

.png?width=550&height=444&name=hero%20(7).png)

Gain instant transparency into global cash positions

Cash visibility enables your treasury team to make better informed strategic decisions.

Central group-wide visibility

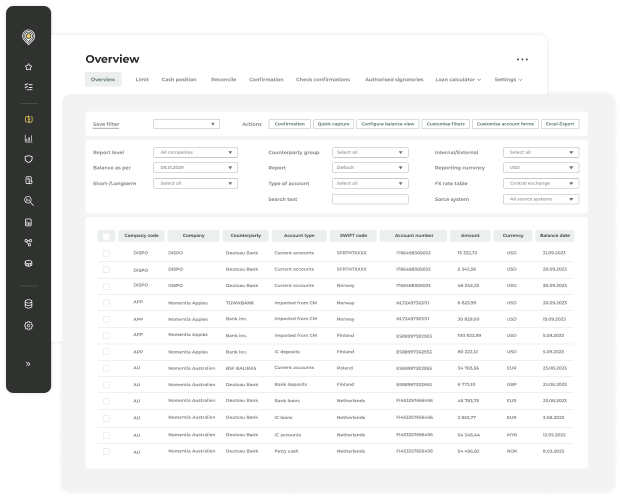

A centralized view on group-wide cash positions by consolidating all necessary data from different source systems and banks.

Monitor cash in detail

Monitor bank accounts, petty cash, bank fees, deposits, loans, intercompany loans, financing transactions, investments, intercompany clearing accounts, credit lines, securities, and cash inventories.

Analyze at any level

Create dashboards and reports and analyze financial data at any level, from subsidiaries to bank groups or currencies.

All financial data available in a single place

Instant global cash visibility

Boost central cash visibility and control.

- View all cash management data in a single system

- Analyze daily statements, upcoming payments, and customer payments

- Clear accounts with the help of payment reconciliation

- Automated clearing proposals that can be send to the relevant banks

- Manually add missing data to adjust cash positions

Extensive reporting and analytics

Leverage the intuitive creation of reports and analyze them in-depth.

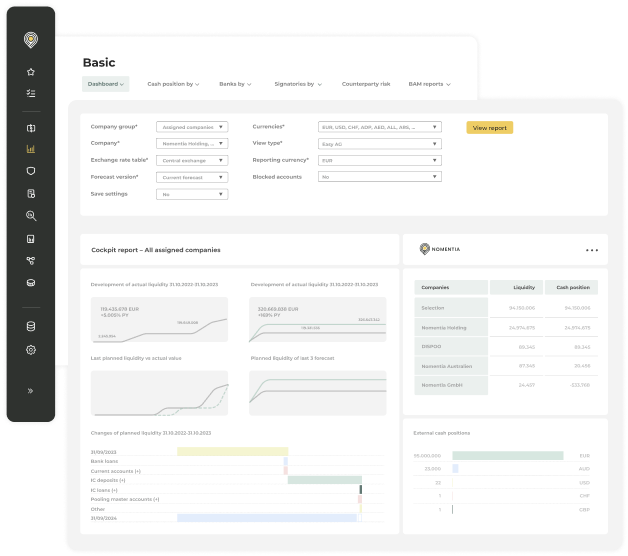

- Dashboards with global insights

- Clear management reports with the most important information

- Intuitive user interfaces

- Comprehensive dashboards with analysis functions to analyze large data volumes

- Flexible report structures adaptive to adjustments and different circumstances

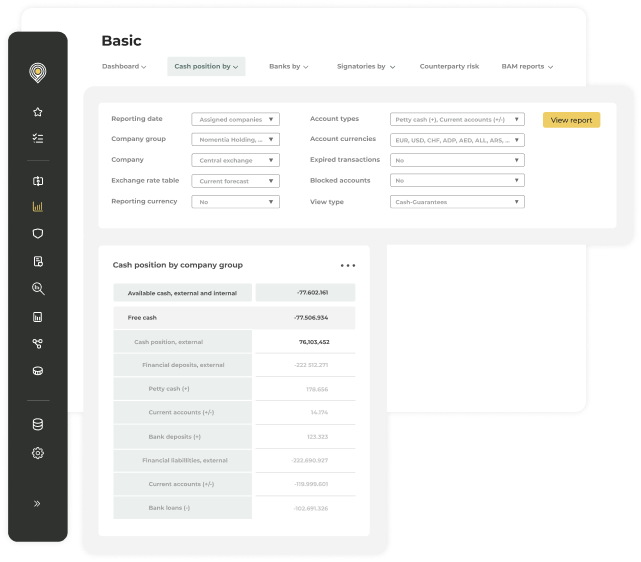

Full visibility into financial status

Analyze any cash flow data at any level.

- View all financial status positions on a group-wide level or drill down to entity levels

- Overviews of all external and internal cash positions

- Monitor bank accounts, petty cash, bank fees, deposits, loans, intercompany loans, financing transactions, investments, intercompany clearing accounts, credit lines, securities, and cash inventories in one place

- Analyze financial data at any level, from subsidiaries to bank groups or currencies

- Drill data down to the smallest level such as transaction levels

Fully integrated cash visibility

Pull all relevant cash flow data from any source system.

- Connect to any bank using host-to-host, EBICS, SFTP, and SWIFT Alliance Lite2 connectivity

- Connect to any ERP system

- Connect to any treasury management system

Security & compliance

Security is always at the core of our solution.

- Login is available via multi-factor authentication or SSO

- Centralized user rights management allows you to gain better control over employee’s access based on their roles for SOX compliance

- Full audit trail & archive functionality to ensure compliance

- Nomentia Cash Visibility is hosted on Microsoft Azure to ensure highest possible security

- Nomentia holds the following certifications:

ISO/IEC 27001 Information Security Management System (ISMS),

ISAE 3402 TYPE 2 and SWIFT Certified Application (Cash Management for Corporates and CSP compliance)

.png?width=1354&height=813&name=Frame%202376%20(1).png)

Trusted by 1400+ customers worldwide

Helmut Schäfer

Head of Treasury Controlling, REWE Group

Helmut Schäfer

Head of Treasury Controlling, REWE Group

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday.

Find out more

Want to know more about our

cash visibility module?

Let's discuss the future of your treasury processes together.