Solutions

Bank account management

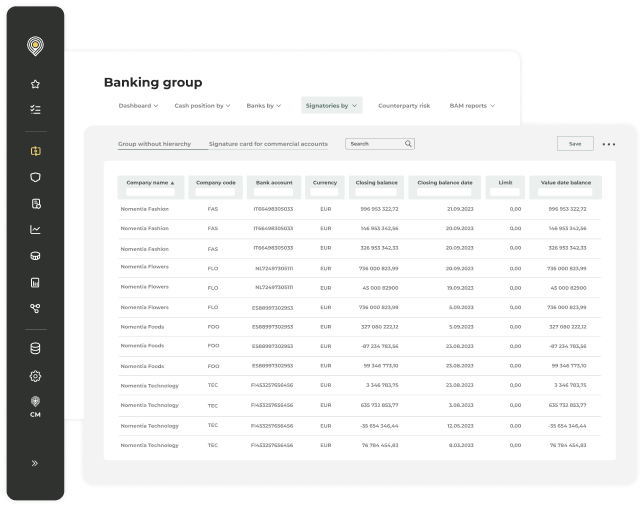

Retrieve, view, analyze and monitor cash flows, account statements, and payments centrally by connecting all your bank accounts to Nomentia Bank Account Management. Leverage eBam functionalities wherever possible.

.png?width=620&height=509&name=hero%20(11).png)

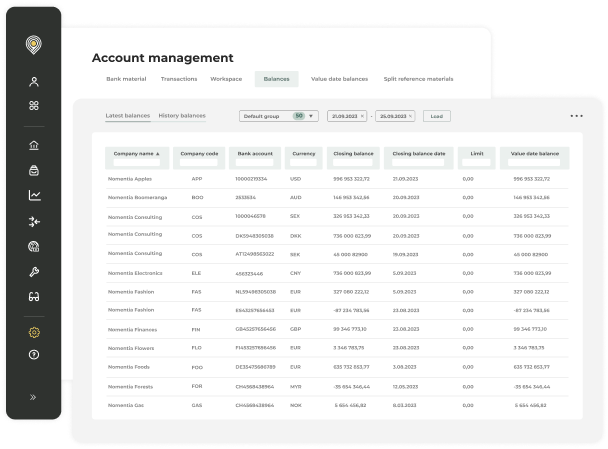

Effectively oversee & control bank accounts

Optimize cash flow management by gaining visibility into bank account balances. Enhance financial controls and improve decision-making on group or entity level.

Central account management

Connecting all bank accounts to gain central visibility and control.

Enhance security

Optimal user management with controlled user rights and full audit trail transparency supports compliance.

Intuitive reporting

Leverage comprehensive analysis options and filter by any relevant parameter based on group-wide account data.

Boost cash visibility

View opening and closing balances, intraday transactions, currency payments, and use balancing techniques for optimal cash management.

Manage all your bank accounts in one place

Centralized account management

Centralize all your group’s bank accounts for better control and start optimizing your organization’s cash flows.

- Connect your group’s global bank accounts to improve visibility and control

- Automate processes such as data transfers, interfaces, and postings to minimize manual work and errors

- Optimal user management with controlled user rights and full audit trail transparency

- Enhance scalability with an unlimited number of bank accounts

- User-friendly reporting, filtering, and visualization of all account data

- Connect to any ERP, Treasury Management System, or other financial system

- Schedule the retrieval of account statements, specifications, and reference materials

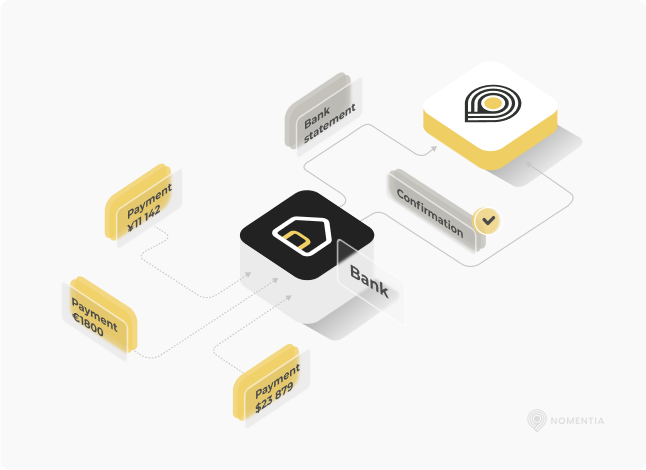

Connect to any bank account

Connect all your bank accounts to better manage your organization’s liquidity while boosting financial control and compliance.

- Leverage a distribution point for bank statements

- Automatically receive information from all connected bank accounts

- Connect to banks via host-to-host, SWIFT, or local connectivity options

- Bank connections are monitored and maintained to ensure uninterrupted communication

- Fully managed data mapping and file format conversions to ensure uninterrupted data sharing

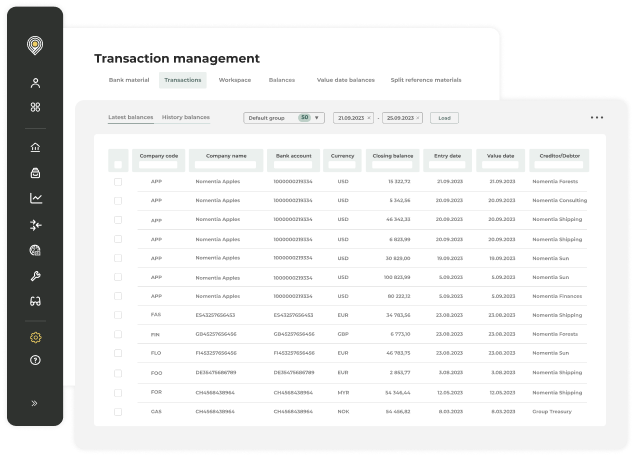

Smooth transaction management

Streamline transaction management through automation to have all essential data quickly available to your team.

- Retrieve all account transactions and FX rates through one interface

- Add or modify transaction-specific reference numbers and divide reference transactions into separate files

- Calculate account-specific value-date balances with transaction data

- Automatically transfer account statements and reference transactions to general ledgers, sub-ledgers, desired treasury systems, or other systems

- Set up posting rules to automatically pre-process and post statement transactions

- Manually retrieve data or adjust voucher numbering and FX rates to tackle deviations

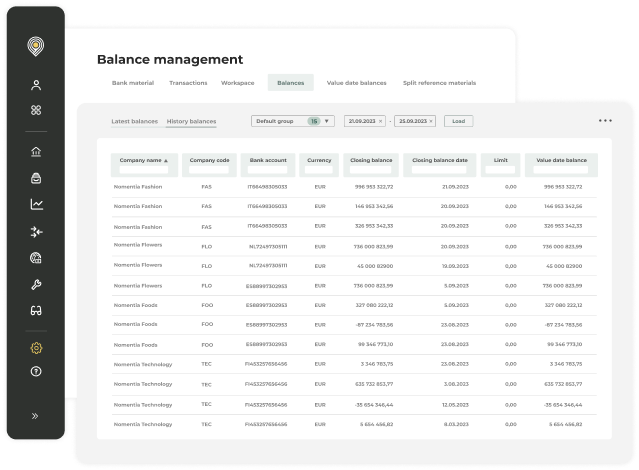

Optimize balance management

Better manage bank account balances across all your bank accounts globally.

- View opening and closing balances, net flows, limits, and available funds at any time

- Retrieve intraday transactions, currency payments, and reference materials

- Calculate daily value date balances

- Utilize the global target balancing functionality

- Possibility for zero account balance (ZBA) to optimize company liquidity by transferring funds when needed from a central account

- View reports about positive or negative interest-bearing accounts or account hierarchies which are calculated based on value date balances

Electronic bank account management with selected banks

Manage the entire process of opening, maintaining, using, and closing bank accounts electronically with the banks that support eBAM.

- Manage all eBAM-qualified accounts from Nomentia

- Set up automated workflows and rules to manage the accounts

- Open and close bank accounts electronically

- Maintain bank accounts from Nomentia

- Update account and transactional signatory rights whenever necessary

- Easily generate reports for regulatory purposes

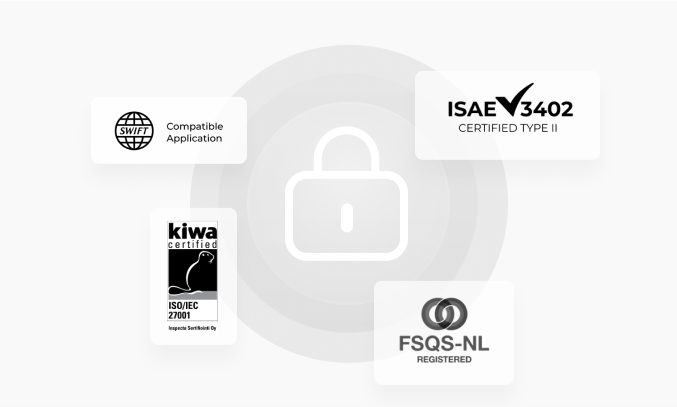

Security & compliance

Security is always at the core of our solution.

- Login is available via multi-factor authentication or SSO

- Centralized user rights management allows you to gain better control over employee’s access based on their roles for SOX compliance

- Full audit trail & archive functionality to ensure compliance

- Nomentia Bank Account Management is hosted on Microsoft Azure to ensure highest possible security

- Nomentia holds the following certifications:

ISO/IEC 27001 Information Security Management System (ISMS),

ISAE 3402 TYPE 2 and SWIFT Certified Application (Cash Management for Corporates and CSP compliance)

Trusted by 1400+ customers worldwide

Dieter Worf

Head of Treasury, Schott AG

Dieter Worf

Head of Treasury, Schott AG

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday.

Find out more

Want to know more about our bank

account management module?

Let's discuss the future of your treasury processes together.