How does a payment hub centralize corporate payments?

The payment ecosystem has been gradually growing over the past years. To no surprise, when we conducted research a little while back, we found that over 80% of business leaders are prioritizing increasing cash and payment management efficiency. Partly also to enable optimal liquidity management.

And the current market trends are following this survey result. Topics like AP automation, developing an integrated technology framework, complying with regulations, as well as the emerging need for tackling payment fraud have all been drivers for enterprises to adopt payment hubs these days.

A major technology enabling this worldwide is payment hubs. The technology has been undergoing transformation to meet the needs of enterprise users for better connectivity with banks and systems, improved security, and even more visibility into company-wide cash flows.

While the transition to a payment hub can be a complex project, the investment is well worth it for most companies. In this article, we will look at how a payment hub works, why you need one, how it can be connected to different systems, and its main functionalities and benefits.

How do payment hubs work?

A payment hub is a platform for organizations to execute their payments. It centralizes outgoing payments and improves visibility and control. It often is also leveraged to reduce the chance of payment fraud and errors.

On top of that, payment hubs are great systems for compliance. They ensure that organizations can easily comply with ISO20022 as well as their own payment policies.

While multinationals most often prefer payment hubs, they can also be very useful software for companies doing business locally, especially if multiple bank and system connections are involved.

Where traditionally it was treasury and finance departments requiring payment hubs, today CIOs are increasingly interested in the implementation of a corporate payment hub. And for a good reason; they enhance security through rules and better user management, a task that often belongs to the IT team.

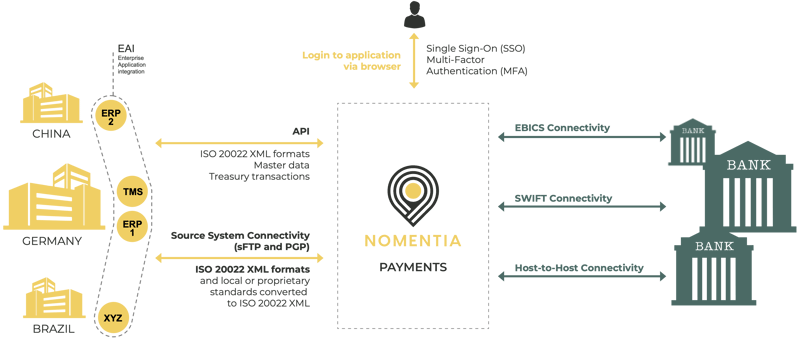

A payment hub's architecture is designed so that the platform sits between the organization's banks and the ERP system(s) (one or multiple), treasury management systems, and any other internal system where payment files are stored. That way, it creates a single source of truth for payments, that also allows central processing to banks and postings back to ERPs.

People often also refer to payment hubs as ‘payment factory’. This term is used to describe a combination of a platform that automates payments, including the workforce behind it that is actually tasked with handling payment processes.

Connecting a payment hub with other critical systems and banks

Payment hubs exist because they can be fully integrated into the organization’s technology and bank ecosystem. Since it involves so many systems and stakeholders, such software purchases are rarely the sole decision of the finance and treasury departments.

Such technologies can benefit accountants, procurement, business intelligence, finance, and IT teams, for example. IT teams are often burdened with the work related to creating and managing bank connections between ERPs and other internal technology stacks, while payment hub vendors fully manage this for them.

The organization's banks are normally all connected to the central hub, and depending on the bank or company's requirements there are different connectivity types; host-to-host connectivity, local connectivity options (e.g., EBICS), or connectivity through the SWIFT network.

Working with a payment hub provider that already has an extensive number of bank connections can speed up the implementation of the payment hub, as no additional connections need to be built.

“Once our IT understood that Nomentia can do magic by connecting to our ERP system, retrieve a file from the bank and send it to our ERP in the right format, it was easy to get their buy-in. Our team had a lot of experience with long ERP projects and they were impressed with Nomentia’s capabilities”

DOREEN LENK, MANAGER GROUP TREASURY & RISK MANAGEMENT.

On the other end, the payment hub needs to connect to various systems, such as ERP systems (often SAP or similar), sometimes even multiple ones, especially when the company has mergers and acquisitions. Other systems could include treasury management systems or finance and accounting systems.

Connecting systems requires know-how, especially when organizations use outdated legacy systems with proprietary data formats. Thankfully, over the past decades, APIs and data standards have become more common, making it easier to connect to data sources and enabling two-way communication between systems.

An example of a typical setup

The image below shows the typical payment hub setup, in which the payment solution sits between banks, ERPs, TMS, and other financial systems, as discussed earlier.

The challenges companies often face while implementing a hub solution

The biggest challenges of implementing a hub are bank connectivity, integrations, and change management.

Finding a payment hub vendor that also offers bank connectivity as a service can be beneficial. Then, the vendor already has a number of host-to-host connections readily available, as well as the possibility to connect to banks via the SWIFT network.

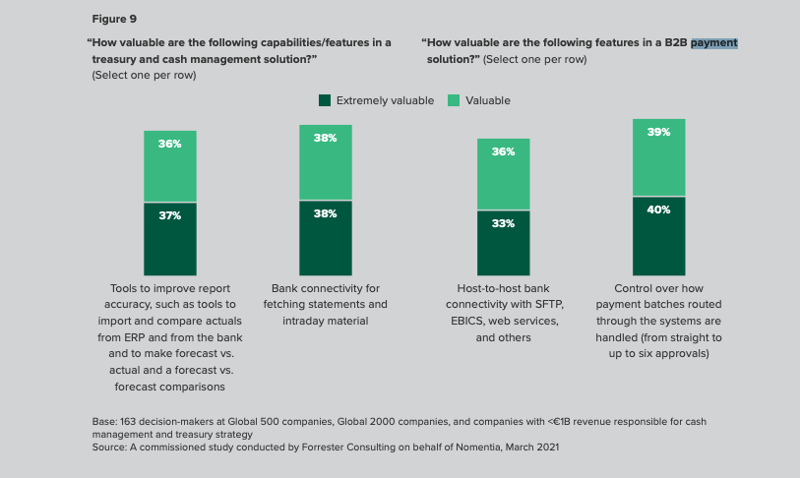

Bank connectivity is something that decision-makers have also found extremely valuable and according to our Forrester study.

When it comes to the source system side, a well-documented API as an endpoint and modern standardized data formats will make the integration much less challenging than when there are legacy systems and proprietary formats.

You will also notice that vendors have experienced hundreds of payment hub implementations, which has given them the expertise to manage change more effectively and efficiently.

In the end, a vendor who supports you thoroughly throughout the implementation process will be beneficial for the project's success.

A payment hub solution's main functionalities

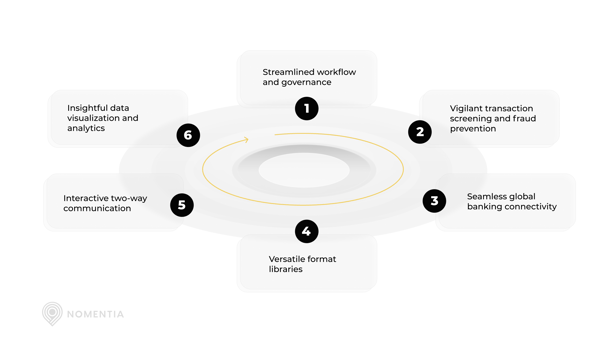

The main objective of using a payment hub is to automate and simplify local, cross-border, and global payments by importing all your payment files from different source systems. They do so through offering the following functionalities:

Centralized payment processing - with a centralized payment hub, you can optimize the overall control and efficiency of processing payments. The hub first collects payment files from various systems before bank transmission, and by integrating it with banks, the payment data mapping and conversions are automatically carried out and ready to be executed.

Manual payments - while the main objective is the automation of payment flows, sometimes it can still be necessary to create and send manual payments such as tax payments, customer credits, travel expense claims, and more. This is usually still completely possible in hubs.

Approvals - Payment approval-related processes can be fully automated, with up to six multi-approvals for safety measures, or by setting up automated rules for power of attorney users, for example.

Sending payments and receiving feedback - the payment hub is configured so that it’s possible to send payment batches to banks in the correct bank-specific format and receive automated bank remit feedback.

Monitoring and reconciling payments - within the payment hub, users can browse, search, and view individual payment files and payment batches to monitor and reconcile payments throughout their entire end-to-end lifecycle.

Audit logs for regulatory compliance purposes - for security and compliance reasons, it can be beneficial to have a payment hub since they often provide main users with payment history logs and audit trails for all processed payments.

"We see it as an administrative advantage to be able to have everything in Nomentia. It is also a security aspect, that we have control and easily get an overview of who gets access to NCC's money."NINA BRUN, HEAD OF TREASURY OPERATIONS, NCC

Fraud detection - financial fraud is a rising problem. Some payment hub providers have developed tools for anomaly detection to identify fraudulent, irregular, and erroneous payments with rule-based system functionalities or AI. The false positives resulting from that require a separate review but can also be automated and fine-tuned by implementing sets of rules.

Sanction screening - is another topic you may have been hearing a lot recently. When you adopt a sanction screening solution within a hub, you can screen your payment files against sanction lists and blacklists before sending payments to your designated bank. This screening facility allows you to automatically detect, identify, and stop payments that should not proceed further.

All the main benefits of using a payment hub

At this point, you may already understand some of the main benefits of using a payment hub, but we wanted to shed light on some of its other core benefits additionally:

-

One hub for all payments - automated and manual payments: While the main purpose of a payment hub is automation, being able to create manual payments and manual payment templates can be just as important. The payment hub can also go beyond Account Payables (AP) processes—depending on the integration level, it’s also possible to automate salary payments, for example.

-

Centrally controlled: Centralized control is usually important for finance teams, especially when the company operates in many countries and has several subsidiaries. Control is then necessary to ensure that there are efficient payment processes, but also to ensure sufficient funds in all bank accounts to make payments, hence having visibility into cash on each account.

Also, having secure processes and adequate workflows to prevent fraud is important for ensuring the security of the company’s funds.

"We were in need of a global tool that could be used in all of our locations for all of our payments. The goal was to create a harmonized way of working. One of the main drivers was security: we wanted to improve the safety of our cash outflows and simplify user rights management."

SIRKKU MARKULA, CORPORATE TREASURER, SENIOR VICE PRESIDENT AT KONE

-

Multiple users & compliance: to ensure compliance and effective user management, having audit trails and payment history available should be a no-brainer. In addition, setups like multiple people verifying outgoing payments can help the company’s compliance.

-

Easy to add new bank connections: A vital benefit of using a payment hub is the ability to add new bank connections. As your company expands, you will open additional bank accounts. Automation needs to be in place to scale the operations by connecting each bank to the payment hub and ERPs.

-

Growth readiness: The payment hub enables you to add new source systems as your company grows, for example, in case of mergers and acquisitions.

It’s also quite typical that a company starts with one country using the payment hub and only later tries to add more entities and users.

-

Security of the payment hub: A cloud-based payment hub comes with the security of the cloud. Having single-sign-on (SSO) and multi-factor authentication (MFA) are essential features, and anomaly detection and sanction screening are becoming a must for many at the moment.

Transformational times call for improved payment processes

As challenges around payments continue to exist for companies, payment solutions for cash flow efficiency will keep rising in popularity in the years to come. Beyond improving treasury and finance processes, compliance and security are major drivers in the shift towards adapting enterprise payment systems.