Why should group treasurers consider setting up an in-house bank?

An in-house bank centralizes payments, collections, financing, and liquidity across all subsidiaries. It reduces external banking costs, improves visibility, enables intercompany netting and financing, and strengthens FX and risk management. Compared to cash pooling or virtual accounts, an IHB offers deeper centralization and more strategic control for group treasury.

The popularity of in-house banks has been on the rise during the last decade. Pioneering treasurers have been using an in-house bank for years to centralize payments, collections, and loans as well as optimize liquidity and risk management.

As the in-house bank is a proven concept that can be adopted at the own pace of an organization, group treasurers are starting to show increasing interest in an in-house bank solution.

To help you understand whether an in-house bank is for you, we have collected some of the questions we have been receiving. While the concept may be clear for many, the question may still arise: do we really need an in-house bank? How does it compare to virtual accounts or cash pooling? What are the core features? How do we implement it? Keep reading till the end to get the answer to all of your questions.

What is an in-house bank?

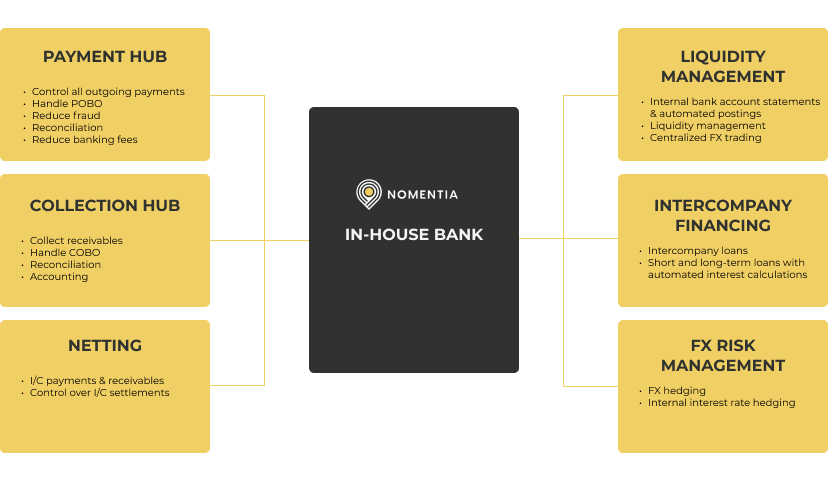

An in-house bank is a centralized bank that is specifically set up for your organization for centralized, transparent group-level cash management. An in-house bank (also referred to as IHB) provides the following cash management features:

-

Payment hub

Manage all internal payments through an in-house bank. For more control, execute payments-on-behalf-of (POBO) using the in-house bank to minimize banking and FX fees.

-

Collection hub

To reach more visibility over the group’s liquidity position, the group treasury can centralize the collection of receivables (collection-on-behalf-of, (COBO)) to optimize working capital management.

-

Intercompany financing

Instead of the individual subsidiaries applying for bank loans to finance investments, the group can decide to do intercompany financing or apply for a bank loan when it’s necessary for more favorable interest rates and terms.

-

Netting

Treasury can gain control over intercompany settlements, payments, and receivables to reduce the costs of payments and the operational risk.

-

Liquidity management

By setting up internal bank accounts for all subsidiaries and entities, the group treasury can have more visibility into the balances of each entity instantly. Having an in-house bank in place, it’s easier to eliminate idle cash sitting in the bank accounts of subsidiaries while the group treasury can ensure that there is an optimal cash amount allocated in each and every account for payments that cannot be done in POBO & COBO manner (e.g., tax payments are normally done locally).

-

Financial risk management

IHB is a step towards more effectively managing FX risk by internally hedging foreign exchange and interest rates.

Treasury and in-house bank:

“Do we really need this?”

This is a question that we frequently hear, especially, when there are alternatives such as virtual accounts or cash pools for the in-house bank (we will take a look at those in a bit).

So, do you really need an in-house bank? The answer: of course, it depends on your strategic initiatives and on your business case, and how they align with the main features and benefits of an in-house bank.

IHB features and benefits

First, consider your company’s structure, the more subsidiaries you have, the more benefits you can gain from having an in-house bank in place as it is a great tool for centralization. When you are looking for a payment factory, you may need to consider whether that is enough for you or if could you gain more benefits from an in-house bank.

Payment factory vs. IHB

When you work with a payment factory and you roll it out for all your subsidiaries, you will need to connect all the bank accounts that are used for settling payments. Working with a cash management vendor that can provide a payment hub and bank connectivity will tackle the challenge of connecting all your banks, however, it's more time-consuming than setting up internal accounts within the in-house bank for each subsidiary. The more banks you work with and the more bank accounts you have, the more reasonable it could be to consider an in-house bank over a payment factory.

Bank connectivity vs. internal accounts

First of all, the payment factory part of the solution (at least in our case) is the same. The difference is when you decide to implement an IHB, that you do not need to work with countless bank accounts. Instead, entities will have their own internal accounts.

When you are setting up internal accounts, you will not need to connect all the existing bank accounts for all subsidiaries. It will be enough to connect the group’s bank accounts and the group can take care of payments-on-behalf (POBO) and collections-on-behalf (COBO) and then distribute the funds to the adequate internal accounts.

POBO & COBO for centralization

Working with internal accounts and utilizing POBO and COBO will also help decrease bank fees and as there will be less data, you can also simplify the bank fee analysis and management.

Collections are automatically allocated in the appropriate subsidiary’s internal account and can be reconciled.

Improve liquidity management & cash visibility

When you use an in-house bank, authorized personnel will have access to all internal accounts so there is more visibility into balances than before. It also means that with IHB it is easier to manage a company’s liquidity and optimize where cash is located to reduce idle cash. It is also possible to create balances for all entities.

Remove FX risk

IHB doesn’t only make it possible to have an overview of the account balances, but also to have more visibility into what currencies the company holds. With intercompany payments, you eliminate currency conversion rates that the banks are imposing, and instead you can define your own rate based on your treasury policy. Overall, having an IHB in place improves internal FX hedging and interest rate hedging.

The eternal question: intercompany loan or bank financing

An important feature and benefit of the in-house bank is that the group treasury can grant intercompany loans to subsidiaries both for short-term and long-term with interest settlement.

What are the reasons for choosing in-house financing over bank financing?

First of all, if the in-house loans are clearly defined in the treasury policy and there is a process in place, it’s a lot less complex to hand out loans to subsidiaries than apply for a bank loan. It is not just less red tape, but the treasury also gets more control over finances, and it removes unnecessary banking fees and avoids paying high-interest rates that may even fluctuate.

If an investment requires a loan from a bank, the group will have more negotiating power to get better rates and more favorable terms than if the subsidiaries are applying for loans on their own.

Virtual bank accounts vs. IHB

To set up a virtual bank account, the organization must have a traditional bank account where they can set up a virtual bank account that is often referred to as a settlement account. The purpose of virtual accounts is to manage intercompany ledgers such as to do the transactions with the company’s actual bank accounts – such as payments on behalf and collections on behalf of the virtual account’s owner and the amounts are settled between the main bank account and the virtual accounts. Virtual accounts are always dependent on a bank, and they act as a sub-ledger within the “traditional” bank account. Virtual accounts have opening and closing balances and records of all incoming and outgoing transactions. Virtual accounts also come with a unique reference number such as each transaction has its own reference number.

Most major banks offer virtual accounts and they may refer to them as an in-house bank, however, compared to an actual in-house bank, the virtual account solution is quite limited. It is a good first step for a smaller treasury group to centralize cash management, but the limitations should not be forgotten. Virtual accounts are highly dependent on banks – this may be a good solution if the company does not have countless banking partners. When you have multiple banks, the virtual accounts should be set up at each bank, however, it adds unnecessary complexity to your operations. Working with virtual accounts is also reliant on the banks to set up the banking structures and match incoming payments to invoices. Batching invoices to a single payment is also not possible. The solution is also entirely maintained by the bank.

While virtual accounts can be a feasible solution for smaller groups, an in-house bank is a future-proof solution. As the company is growing, for example, by opening new subsidiaries or acquiring companies in other countries and regions, these entities can be added to the in-house bank simply so the centralization stays intact, and all parties can comply with the treasury policy.

Earlier, we have been holding a webinar together with experts from Bank of America to discuss whether virtual accounts or in-house bank is the right way to go. Tune in to hear the verdict.

Cash pooling vs. IHB

Cash pooling has been around for decades, and treasury teams have been using this method to centralize cash management by balancing the accounts of the group’s subsidiaries. The goal of cash pooling has been to reduce the number of banking partners and thus decrease banking fees. In addition to that, the cash balance is centralized, and the group can have control over the cash and payments of the subsidiaries.

With a centralized account, the group treasury can have visibility to all account balances of the company’s subsidiaries and understand and follow the cash flows of various accounts globally. It is possible to transfer funds to negative balance accounts to avoid paying higher interests or to transfer funds to an account to get dividends for the credit balance.

Cash pools are still dependent on banks and the framework should be mutually agreed upon with the bank based on your group’s cash pooling strategy so that you can set up hierarchical levels and roles for each account.

IHB has more power and function for treasury teams. Instead of intercompany payments and lending money for subsidiaries an IHB can be used to improve liquidity management, deal better with FX risk, and to become less reliant on banks.

In-house bank selection

If you are convinced that you would like to discover the implementation of an in-house bank, you need to start with the selection process. It’s always good to start with your own research: what’s available on the market?

If you want to move beyond the in-house banks that banks offer (that tend to be merely virtual accounts), the options on the market are limited.

S/4 HANA provides a house bank where it’s possible to set up multiple accounts with company codes to process payment transactions, and it’s a powerful tool for adapting an in-house bank.

Nomentia In-house bank is also widely used in enterprises as it includes all the above-mentioned IHB features.

To find the best in-house bank, we always suggest identifying your requirements, use case, and business case and getting in touch with IHB vendors to discuss your specific needs and how it would work in practice. Only then you can get answers to all the questions you may have to identify what the best solution for your business is.

In-house bank implementation

It’s vital to agree beforehand on how the IHB implementation is going to happen because typically, the process is gradual. Before implementation, the project plan needs to be clear to understand which participating entities will be added and in which order – and of course, it must be sure that all entities meet the legal requirements to be added to the in-house bank. It is also necessary to clearly agree on which features will be implemented first and in what order.

Consider the following before implementation:

- Legal and taxation requirements

- Which countries/entities will be added in what order?

- Which banks and bank accounts must be connected to make the most out of the solution with the lowest possible cost involved but full efficiency

- Which features and functionalities do you need and what is your priority order?

- Plan together with corporate IT on how they support when the vendor needs to connect ERPs and other systems

- The updated treasury policy for when the solution is implemented so everyone is on the same page on how to use IHB

Achieve the end goal with an in-house bank: the centralization of group treasury

To gain the most control over your cash and treasury management, the in-house bank can be an excellent tool. If you are not yet utilizing a payment factory, it is a good time to identify whether you would get the most benefits out of a payment hub, or would you actually have a business case for an in-house bank? Could you realize more centralization but also significant savings on bank fees and hedging foreign currencies more effectively? It is definitely worth taking the time to identify your possible benefits and whether the implementation of an IHB would be the right fit for your business.