What are the main benefits of centralizing and digitalizing treasury management?

Due to lower cash in circulation, rising interest rates and economic volatility, special skills are needed and are assigned to treasury management - to deal with both cash management and financial risk management. The primary objective of treasury management is to plan, organize, and control cash to meet the future financial goals of the organization. Treasurers seek to minimize losses by applying risk transfer and hedging techniques that comply with the company's internal policies - supported by a treasury management system.

What is treasury management?

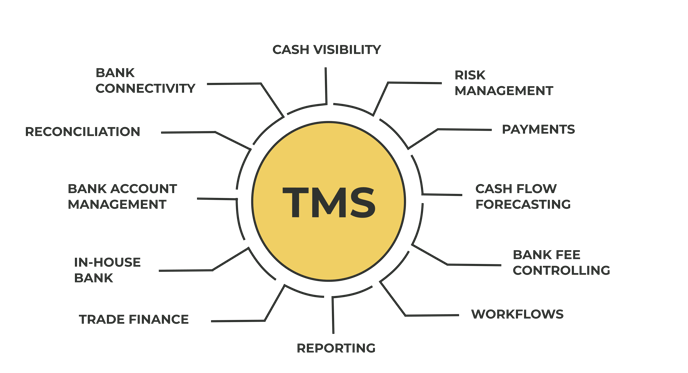

Treasury management refers to the management of a company's holdings, with the main objective to manage cash while minimizing reputational, operational, and financial risks by using a treasury management system. A treasury management system (TMS) is enterprise software, that allows treasury and finance teams to automate repeated treasury processes - such as communication with banks and retrieving real-time financial data to report and analyze all information in one centralized system - while ensuring the security of your financial data. This automation can help you to gain greater visibility into cash and liquidity while giving you better control over bank accounts, compliance, and management of in-house banking and financial operations.

Treasury management largely encompasses cash management, cash flow forecasting, payment, reconciliation, debt management, trade finance, and reporting.

Centralization and digitalization of treasury management

As companies expand into international markets, at some point they will have to decide whether to operate with decentralized treasuries in various countries or to take advantage of centralized and digitalized treasury management. Some companies still manage their treasury operations in a decentralized approach. Treasury teams struggle to get an accurate picture of the company's liquidity because they are not working with a unified treasury platform. Centralizing treasury management is the first step to eliminating errors and distractions.

Global centralization has several key benefits: it improves cash visibility, optimizes liquidity across the enterprise, increases efficiency and reduces duplication, lowers costs through economies of scale, and enables more effective risk management.

Although centralizing treasury has many benefits, it is important for the company to digitalize treasury to maximize automation, leverage resources, standardize processes, and use of economies of scale. In addition, digitalization has become a must for companies due to the pandemic. With the practice of remote working, corporate treasurers must be able to work from anywhere and have secure access to all information at any time to manage their day-to-day operations. This increased level of digitalization requires appropriate security standards to go along with it.

The top priority when implementing a centralized and digital treasury management solution is to ensure that security can be provided against cybersecurity threats - this must be a crucial part of the automation and digitalization strategy.

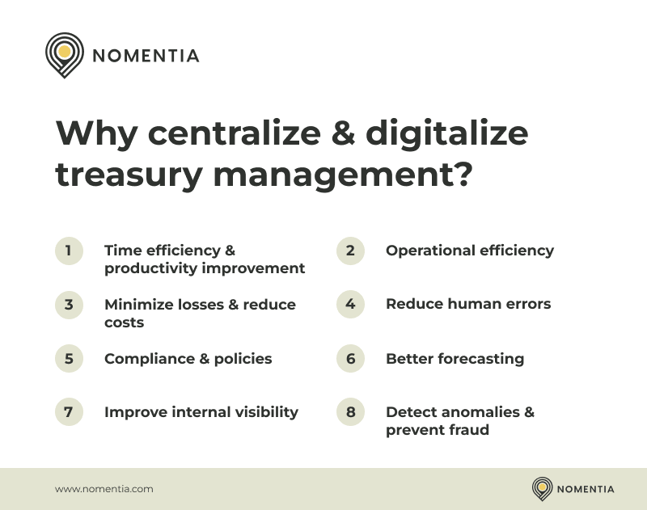

Why centralize & digitalize treasury management?

The process of digitization is not something to be taken lightly. Especially for companies entrenched in manual treasury practices, the leap to centralized digital management can be daunting. But as the saying goes, nothing worth having comes easy, and the benefits of implementing a digitalized treasury management outweigh the challenges that must be overcome during the implementation. Good reasons why you should centralize and digitalize your treasury management:

1. Time efficiency & improvement in productivity

By centralizing treasury activities and technology, productivity increases, and higher output is achieved. You can streamline your payment process and reduce the time required to approve and initiate payments. A streamlined and distributed authorization process further minimizes time and eradicates organizational bottlenecks. You can then use the time saved for other pertinent business operations.

2. Achieving operational efficiencies

A digitalized treasury management system serves as an aggregated and consolidated analysis and reporting platform, providing actionable insights to expose inefficiencies and optimization opportunities - data is directly available, insights are more valuable, and decisions can be made more clearly. These can help you to implement strategies and achieve greater financial success. At the same time, you are free from many of the restrictions that have previously existed in traditional systems.

3. Minimize loss & reduce cost

A volatile market, unstable exchange rates, and negative interest rates require accurate and reliable reporting - you can automate reports that allow you to minimize losses with minimal effort. Additionally, the clarity and complete information provided by a treasury management system allow you to detect and identify the costs of bank transactions and other related payment fees. Having access to this data can help you identify where additional fees are being incurred and work to mitigate this.

4. Reduce human errors

Establishing digital automation treasury workflows for data entry and data verification helps to reduce haphazard work and directly minimize the potential for manual errors.

5. Compliance and policies

Centralized treasury management and the implementation of policies help to reduce operational disparities between regions. Managing your treasury operations through a single platform not only ensures that everyone has access to the same data, but also that everyone in your organization is operating under the same cash management protocols.

6. Better Forecasting

Part of a treasurer's task is to evaluate future risks and balance them against potential uses of capital, the accuracy or ease of cash flow forecasting can enhance this. With a digitalized TMS, the data capabilities are greatly enhanced - through integration with financial APIs and extraction of internal figures, data is both highest accuracy and available in real-time. This can enhance decision-making, liquidity management, and reporting.

7. Improve internal visibility

Having access to real-time financial data for all relevant stakeholders is another benefit of treasury digitalization, so they can gain better insight from their company's cash position – which is especially important for companies that work with multiple banking systems and subsidiaries around the world. In general, digital treasury management involves the use of a central system that presents key data in real-time in an easy-to-understand format. This allows all relevant parties to have appropriate access to the treasury department's insights.

8. Detecting anomalies & fraud prevention

With a large amount of financial data and information coming in and out at the same time, it's hard to detect anomalies and missed opportunities without a digitalized treasury management system. Therefore, a digitalized TMS with fraud detection and payment process control capabilities can help you to make quick changes, which means you miss fewer opportunities to save or make money.

Using a TMS helps you detect and protect against potential financial risks, such as fraud, by seeing in real time if suspicious activity is happening. That means that you are less likely to experience extreme financial or asset losses.

How to centralize & digitalize treasury management

Whether a company should choose a centralized treasury structure depends on its global presence, available resources, management commitment, and available technology. Successful implementation needs a clearly defined strategy - in order to remain successful, each strategy must be in place once:

- Strong, clear, global treasury strategies

- Effective tools and treasury technologies

- Valuable management reporting

With an effective treasury structure and capable resources, the treasury can meet even the most challenging demands of a global business.

There are many different treasury management solutions on the market, and it can be difficult to find the right one among the wide range of providers. However, which option is right for you depends on your specific business needs. To help you, we've listed 10 of the best treasury management providers.

The treasury department plays an essential role in business operations - monitoring short- and long-term cash and risk management to achieve business goals. The centralization and digitalization of treasury management can evoke the potential and redefine the role of treasurers.

From hugely improved cash visibility over potential treasury strategies, the impact of digitalization is effective. Efficiencies can be anything from better use of working capital to quicker responses to financial crises. Whatever they may be, they benefit both the treasury department itself and the company as a whole.

However, central and digital treasury management can essentially be summarized as a way of leveraging technology to enable better visibility and control over a company's finances.