Every delayed invoice, every misplaced receipt, every manual approval is costing your business more than you think. Missed early payment discounts, late fees, and hours wasted on data entry silently drain your resources.

The good news?

The best AP automation software not only speeds up your payments, but can also transform how your business controls cash flow and gains real financial visibility.

Let's take a look at the best accounts payable automation software, compare their strengths, key features, and who they’re best suited for.

What is AP automation software?

Accounts Payable (AP) automation software is a tool designed to streamline and automate the accounts payable process. In general, AP automation software aims to help businesses to manage their invoices, payments, and vendor relationships more efficiently by improving processes related to capturing, reviewing and verification of invoices and bills, faster execution of error-free payments, archiving paid invoices and posting paid invoices to general ledgers

Key features of AP automation software

- No more typing in invoice details by hand: The software reads invoices for you and pulls out the important info—vendor, date, amount—so you’re not squinting at PDFs and typing line by line.

- Invoices get matched automatically: Instead of flipping between invoices, purchase orders, and receipts, the system checks if everything matches and flags anything that doesn’t—before it hits your inbox.

- Approvals don’t get stuck in someone’s email: You set the rules (like: “All invoices over $5,000 go to Sarah”), and the system routes them for sign-off. No more chasing people down or wondering who’s holding things up.

- You can pay a bunch of invoices in one go: Instead of logging into your bank account 20 times a week, you can review and send off payments all at once—whether it’s by ACH, wire, or something else.

- You always know what’s going on: No more juggling spreadsheets or digging through folders. You can see what’s approved, what’s paid, and what’s overdue, all in one place.

- You don’t have to re-enter the same info in your accounting system: Once something’s approved or paid, it updates automatically in your ERP or accounting software. No copy-paste mistakes, no double work.

- It helps you catch sketchy stuff: If someone submits the same invoice twice, or an unknown vendor appears out of nowhere, the system throws up a red flag before any money leaves your account.

- You can find any invoice in seconds: Everything’s stored in one searchable place. Need to pull up a receipt from six months ago for an audit? It’s there—no rummaging through filing cabinets or digging through email attachments.

Top 8 AP automation software solutions for you

- Nomentia: Nomentia provides a comprehensive cash and treasury management solution, including AP automation. It supports invoice capture, reconciliation, and payments while integrating with ERPs and over 10,000 banks. The software is ideal for businesses needing a global payment factory and liquidity management.

- Basware: Basware offers end-to-end AP automation with advanced invoice processing and procurement integration. It captures invoices digitally, automates matching, and provides analytics for AP performance improvement.

- Medius: Medius provides cloud-based AP automation, focusing on invoice processing, procurement, contract, and supplier management. It automates invoice matching and integrates with ERPs.

- Stampli: Stampli simplifies AP with a collaborative invoice management approach. It centralizes AP communication, integrates with ERPs, and uses AI for automation.

- Bill.com: automates AP from invoice capture to payments, supporting various payment types and accounting integration. Designed for SMBs, it streamlines approvals and expense management.

- Tipalti: Tipalti specializes in global AP automation, ensuring compliance and efficient supplier management. It supports PO matching, multi-currency payments, and financial controls.

- Orcale Netsuite: Oracle NetSuite integrates AP automation within its financial management suite, providing real-time insights, payment reconciliation, and scalable solutions.

- Sage Intacct: Sage Intacct offers cloud-based AP automation with financial management tools, automating workflows, multi-entity consolidation, and balance tracking.

- Coupa: Coupa provides a complete spend management platform, including AP automation, procurement, and expense tracking with advanced analytics.

Top AP automation software: Key features, strengths, considerations & best for

1. Nomentia

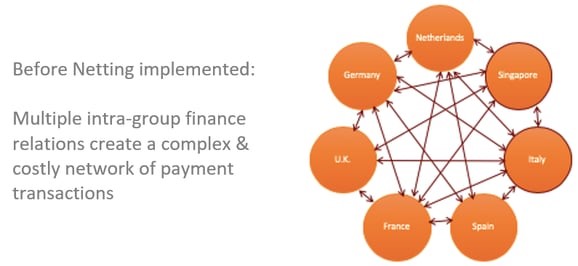

Nomentia offers a flexible cash and treasury management platform with strong AP automation capabilities. It enables businesses to capture, process, and reconcile invoices while integrating with ERPs, accounting software, and over 10,000 banks. Its modular approach makes it suitable for companies looking for either basic AP automation or a comprehensive global payment solution.

| Key features | Strengths | Considerations | Best for |

|

|

|

|

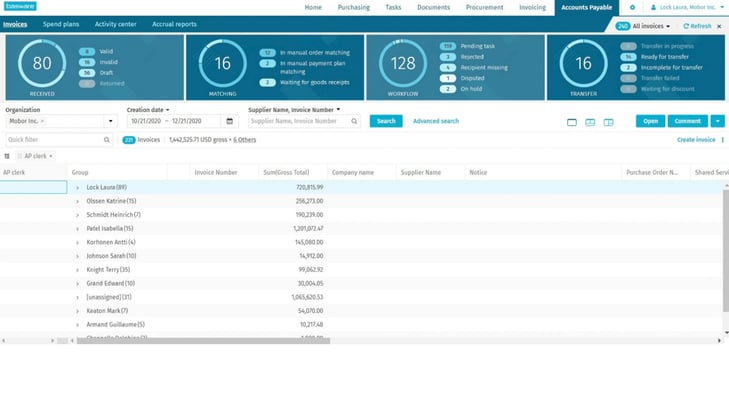

2. Basware

Basware specializes in end-to-end AP automation, digitizing invoices and matching them with purchase orders to improve accuracy. It automates recurring payments, ensures global compliance, and provides analytics for optimizing AP performance. Ideal for enterprises with complex procurement and AP needs, Basware enhances efficiency and control over financial workflows.

Source: basware.com

| Key features | Strengths | Considerations | Best for |

|

|

|

|

3. Medius

Medius streamlines AP automation with cloud-based invoice processing, three-way matching, and automated approval workflows. The platform integrates with ERPs for real-time financial visibility and fraud prevention. With its user-friendly interface and strong workflow automation, Medius is well-suited for mid-to-large businesses aiming for efficiency.

Source: medius.com

| Key features | Strengths | Considerations | Best for |

|

|

|

|

4. Stampli

Stampli simplifies AP with a collaboration-first approach, centralizing invoice communication and approvals. AI-powered features detect duplicate invoices, automate reminders, and analyze payment trends. With seamless ERP integration and an intuitive interface, it’s ideal for small to mid-sized businesses seeking a more interactive AP solution.

Source: stampli.com

| Key features | Strengths | Considerations | Best for |

|

|

|

|

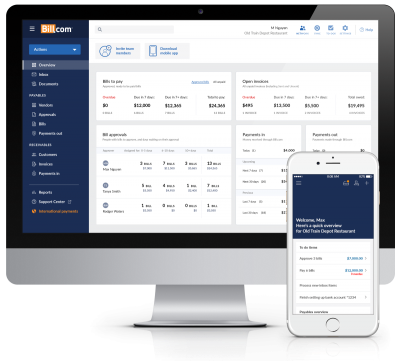

5. Bill

Bill.com automates AP processes for small to mid-sized businesses, covering invoice capture, approvals, and payments via ACH, international transfers, and virtual cards. It integrates with leading accounting platforms, ensuring seamless financial data synchronization. Its workflow automation and fraud detection make it a secure and efficient payment solution.

Source: bill.com

| Key features | Strengths | Considerations | Best for |

|

|

|

|

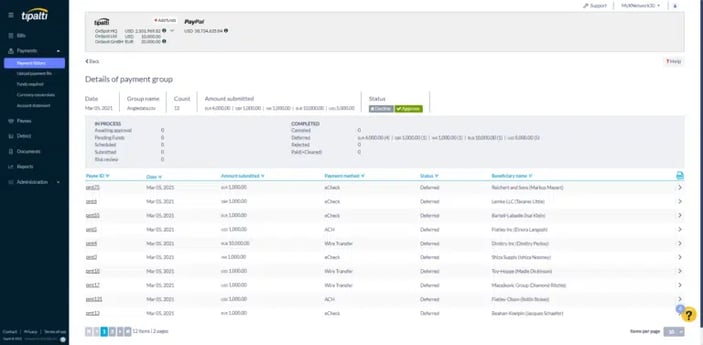

6. Tipalti

Tipalti specializes in global AP automation, handling supplier onboarding, tax compliance, and multi-currency payments. Its platform supports payments in over 190 countries, with built-in fraud prevention and automated reconciliation. Designed for companies with high transaction volumes, Tipalti reduces payment complexity and ensures regulatory compliance.

Source: tipalti.com

| Key features | Strengths | Considerations | Best for |

|

|

|

|

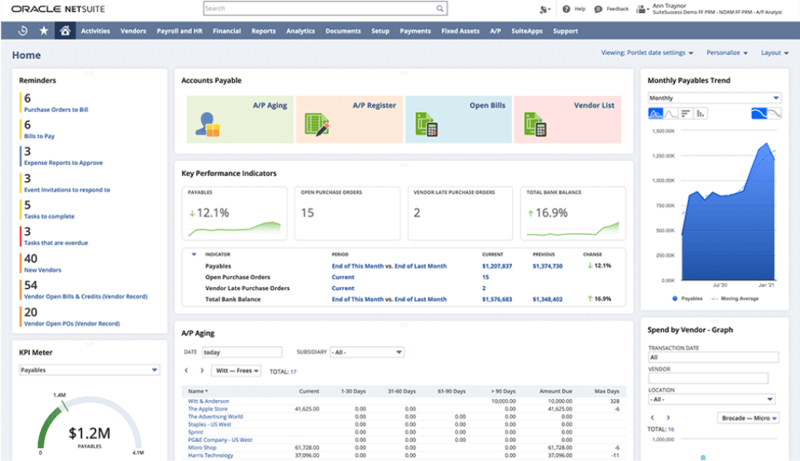

7. Oracle NetSuite

NetSuite provides robust AP automation as part of its ERP suite, automating invoice processing, payment approvals, and supplier reconciliation. It offers real-time visibility into AP workflows and financial reporting, helping businesses manage cash flow effectively. Scalable and feature-rich, it’s ideal for growing enterprises seeking a comprehensive financial management solution.

Source: Oracle NetSuite

| Key features | Strengths | Considerations | Best for |

|

|

|

|

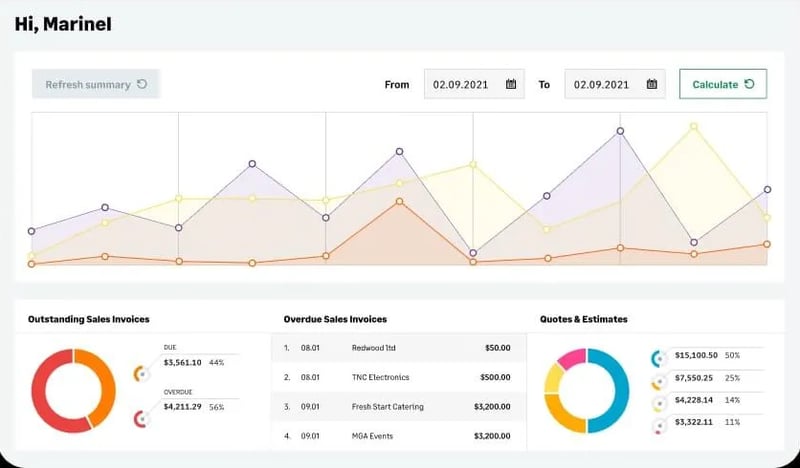

8. Sage Intacct

Sage delivers cloud-based AP automation, optimizing invoice approvals, payment scheduling, and multi-entity consolidation. It provides real-time financial insights, workflow automation, and multi-currency support. Best for mid-sized businesses, it integrates seamlessly with other financial systems for a streamlined AP process.

Source: sage.com

| Key features | Strengths | Considerations | Best for |

|

|

|

|

9. Coupa

Coupa is an all-in-one spend management platform with AP automation, procurement, and expense management. It automates invoice capture, approvals, and payments while providing AI-driven analytics for cash flow optimization. Designed for enterprises, it offers strong compliance features but may require a higher investment due to its extensive capabilities.

| Key features | Strengths | Considerations | Best for |

|

|

|

|

Benefits of Accounts Payable automation software

AP automation software enhances efficiency, accuracy, and visibility in managing accounts payable. By centralizing all AP data in one interface, businesses can streamline workflows, improve cash flow forecasting, and eliminate the need to switch between multiple systems. Automated payment processing reduces human errors and fraud risks, while real-time tracking ensures transparency and compliance. Additionally, automation boosts punctuality in payments, strengthening vendor relationships and optimizing working capital.

- Centralized AP management: AP automation software combines invoice, payment, and cash flow data from multiple systems (banks, ERP, accounting software) into one interface for easier tracking and decision-making.

- Improved payment accuracy: AP software reduces human errors and fraud by automatically flagging discrepancies and ensuring correct payment execution.

- Enhanced data transparency: Automated AP software provides a clear audit trail, tracking invoice status, responsible users, and payment history for better internal visibility.

- Greater efficiency: The AP software automates invoice capture, reconciliation, payment batching, and ledger posting, reducing processing time.

- Stronger security & compliance: Advanced AP automation software features like sanctions screening, multi-step approval workflows, and audit trails enhance financial security and regulatory compliance.

- On-time payments: Centralized invoice tracking with due dates helps prevent missed payments, improving supplier relationships.

- Cost savings: Automated software lowers processing costs by reducing manual labor, paper use, and inefficiencies.

- Improved cash flow management: AP automation software provides better visibility into outstanding liabilities and payment schedules, which improves liquidity planning and cash flow forecasting accuracy.

- Scalability: AP automation software can handle higher invoice volumes as business needs grow.

How to select the right AP automation software?

The key to selecting the best accunts payable automation software for your business starts with analyzing your current processes and requirements for improving them and see which software can help you do so the best.

Steps to choose AP automation software:

- Assess your AP automationeeds

- Identify pain points: Determine the specific challenges you face in your current AP process (e.g., manual data entry, approval delays, high processing costs).

- Define requirements: List the AP software features and functionalities you need, such as invoice capture, approval workflows, payment processing, and integration capabilities.

- Set a budget

- Determine costs: Consider the total cost of ownership, including software licensing, implementation, training, and ongoing support.

- Evaluate ROI: Assess the potential return on investment by considering the time and cost savings the software can provide.

- Research options

- Compare solutions: Look at different AP automation software options and compare their features, strengths, and pricing.

- Evaluate integration capabilities

- Check compatibility: Ensure the software integrates seamlessly with your existing ERP, accounting, and other business systems.

- Assess data flow: Verify that the software supports smooth data flow between systems to avoid data silos.

- Consider user experience

- Ease of use: Choose software with an intuitive interface that is easy for your team to learn and use.

- Training and support: Ensure the vendor provides adequate training resources and customer support.

- Review security and compliance

- Data security: Check that the software has robust security features to protect sensitive financial data.

- Check scalability

- Future growth: Choose a solution that can scale with your business as it grows and can handle increased invoice volumes.

- Flexibility: Ensure the software can adapt to changing business needs and processes.

Conclusion: Making the right choice

Throwing software at a bad process won’t magically make it better—it’ll just make mistakes happen faster. AP automation should fix your biggest headaches, not just digitize them. If invoices are still getting stuck in approval limbo, if payments are still late, if your team is still drowning in manual work—what’s the point?

Before you buy, be brutally honest: Will this system actually solve my AP problems, or will it just add another layer of complexity? A flashy demo means nothing if the software doesn’t make your life easier. The wrong choice could cost you time, money, and sanity. The right one? It’ll free up your team, tighten your cash flow, and turn AP from a cost center into a competitive advantage.

Choose wisely—your AP process depends on it.