Solutions

Payments

A global payment hub to centralize, control, and manage your end-to-end payments cycles to optimize cash and working capital while minimizing the risk of financial fraud.

Automate your work with a robust payment hub

Whether you are processing payments globally or locally, our payment factory will help to improve your day-to-day operations

Centralize & localize

Combine all payment files from various systems and banks into one system. Process payments either centrally or locally.

Process any payment type

Connect ERPs, financial systems, and banks to process outgoing payments for accounts payable, treasury, payroll, and manual payments.

Central control & improved visibility

Gain better visibility and control over where your cash is going and where it’s needed. This can help improve working capital management.

Enhanced payment security

Add payment process controls to boost security, such as sanctions screening, anomaly detection, fraud detection, data validation rules, and 6-eyes principle.

Make, control and scale payments with Nomentia

Use pre-built bank format templates — no custom coding required.

Make payments in any currency to any bank while staying ISO 20022 compliant.

Replace multiple bank portals with one unified interface.

Execute manual payments easily using pre-defined templates when needed.

Build your payment factory

Implementing Nomentia Payment Hub will help you go from manual payment processes to full automation by connecting all source systems and banks to it.

- Connect all your ERPs – no more custom builds across multiple systems

- Access all your banks through a single interface – no need for multiple logins

- Make payments to any bank, in any currency – no more bank-specific reformatting

- Catch errors automatically – no more missing or incorrect data

- Stop payment fraud and sanctions fines – automated checks and protections

- Prevent duplicate payments – no more time-wasting

Connect to any bank in the world

For achieving full automation, you can connect with any bank across the world through host-to-host connectivity, local connectivity (EBICS), SWIFT Alliance Lite2 for Business or API connections.

Send payment batches to banks in the correct bank-specific format - like ISO20022 - and receive confirmation from the bank automatically.

- Leverage a distribution point for bank statements

- Automatically communicate with the bank in their preferred payment file format - the payment hub supports ISO20022

- Get confirmations from the bank in the file format that your system supports

- Bank connections are monitored and maintained to ensure uninterrupted communication

Integrate with any ERP and system

Automatically import your payment files from any ERP or other source system to the payment factory and send them to the bank using secure integrations.

Connect with any ERP system, for example, SAP, Oracle, Microsoft, Sage, NetSuite, and more, via API or SFTP.

- Connect with any system where payment files are located

- Integrations available to any other treasury management systems

- The payment hub supports payment schemes like SEPA, P27, and instant payments

- File format conversion enable seamless two-way communication between your systems and the banks

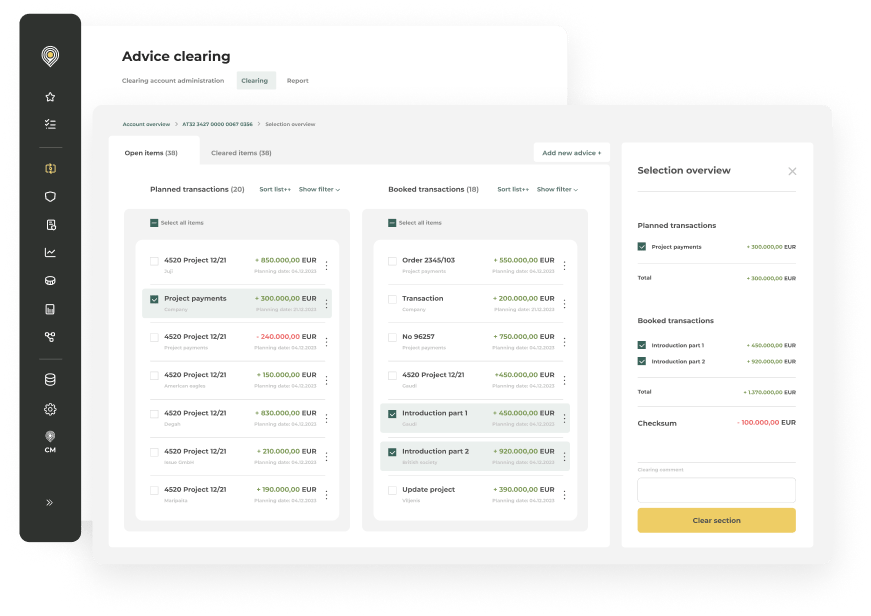

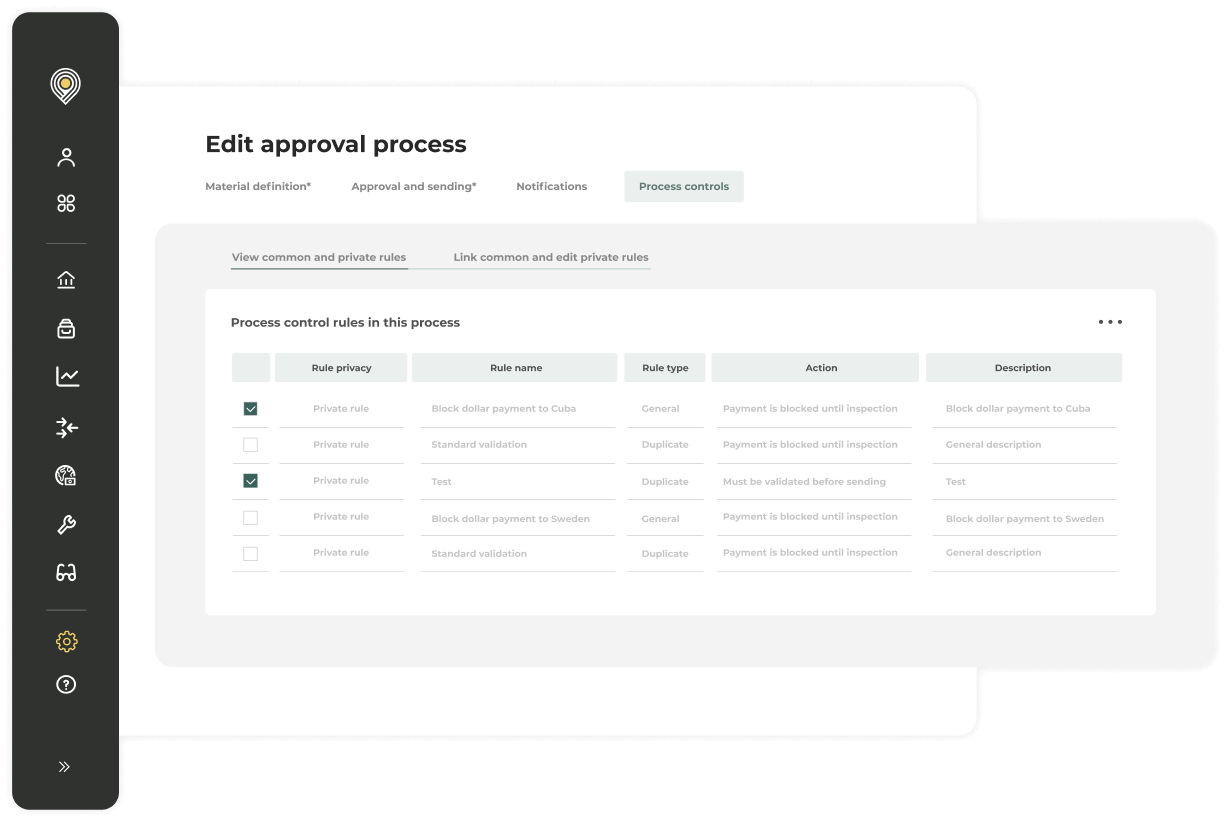

Detect & prevent payment fraud

Our rule-based payment process controls is the perfect add-on if you want to catch and review payment irregularities automatically. After reviewing, you can reject or process the payments.

You can set up your own rules to prevent fraud or to detect accidental double payments.

- Set up your own rules by your own or with the help of our consultants based on the issues you have experienced with payment processing

- Use multi-factor authentication (MFA) to approve payments batches to reduce the chances of fraud

- Create different rules for different payment batches: it’s possible to process payments as straight-through processing or require up to six people’s approvals for superior security

- You can choose to add also sanction screening to automatically prevent sending payments to sanctioned beneficiaries.

Security & compliance

Security is always at the core of our solution.

- Secure access — login via multi-factor authentication (MFA) or single sign-on (SSO).

- Role-based access control — centralized user rights management ensures employees only see what they need, supporting SOX compliance.

- Full audit trails & archives — every action is tracked for accountability and regulatory compliance.

- Enterprise-grade hosting — our solution runs on Microsoft Azure for the highest levels of security.

- Certified for trust — Nomentia Payments holds ISO/IEC 27001, ISAE 3402 Type 2, and SWIFT Certified Application (Cash Management for Corporates and CSP compliance).

Safeguard your business from payment fraud

Detect suspicious signals and stop payment fraud using our intelligent rule-based solutions

Compliance screening

Automatically stop sending payments to sanctioned beneficiaries by screening your outgoing payments against any type of sanction list.

Find out morePayment process controls

Develop rules for better control over outgoing payments to prevent fraud, comply with treasury and finance policies, and validate data.

Find out moreTrusted by 1400+ customers worldwide

Antti Puttonen

Sr. Service Manager of Finance Solutions

Antti Puttonen

Sr. Service Manager of Finance Solutions

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday

Find out more

Frequently asked questions (FAQs)

What is Nomentia Payment Hub?

What are the key features of Nomentia Payment Hub?

- Connects multiple ERPs and source systems.

- Converts files into the correct bank formats automatically.

- Validates payments before release to prevent errors.

- Detects duplicate payments.

- Supports multi-currency payments and ISO 20022 compliance.

- Tracks payment status in real time.

- Provides audit trails and role-based controls for compliance.

What are the advantages of Nomentia Payment Hub compared to other payment solutions?

- Works with multiple ERPs at once, no need for custom builds.

- Consolidates all bank connections into a single interface.

- Automates validation, duplicate detection, and compliance checks.

- Provides real-time visibility and reporting.

- Reduces manual effort and risk compared to TMS or ERP-only payment modules.

What types of payments can be processed with Nomentia's payment automation software?

- Supplier invoices – pay vendors quickly and accurately.

- Employee salaries and payroll – automate recurring payments to staff.

- Intercompany transfers – balance accounts between your own bank accounts.

- Domestic and international payments – send money anywhere in the world.

- Standard payment schemes – SEPA, P27, BACS, SWIFT, and more.

- Multi-currency payments – handle different currencies seamlessly.

- Instant or batch payments – execute payments individually or in bulk