Customer story

In-house Bank

Loan management

Liquidity & forecasting

Payments

Cash visibility

Risk management

CGM

Automation of IC loan Workflow to improve transparency, security and compliance.

.png?width=277&height=88&name=TMI-CGM%20(1).png)

Year founded

1987

Industry

IT Services and IT Consulting

About

CompuGroup Medical SE & Co. KGaA (also CGM) is a software company headquartered in Koblenz, Germany, that develops and offers software for the healthcare industry. It produces application software to support medical and organizational activities in medical practices, pharmacies, medical laboratories, and hospitals. CGM employs more than 8500 people worldwide and has more than 1.6 million users in 56 countries.

Download pdfChallenge

CGM was looking for a treasury management solution to simplify and automate the internal application process of group loans and deposits to achieve efficiency through group-wide standardization and automation while also improving transparency, security, and compliance.

Solution

The CGM solution utilizes a digital workflow developed by Nomentia where firms can apply for group loans and deposits from group treasury following a standardized process. The Workflow connects to the Nomentia loan calculator, bank account management, and the available financial status so that the entire process is fully integrated within the existing Nomentia treasury management system. In addition, derivatives for hedging foreign currency loans/deposits are automatically processed via the FxAll trading platform and then transferred back to Nomentia Risk Management, to the derivatives module where the derivatives are also valuated for accounting purposes.

“Nomentia's Intercompany loan and deposit workflow is an excellent example of how to automate the entire process across the group to ensure greater visibility into the whole application process as well as digitalize how subsidiaries apply for loans and how the group confirms them.”

Stefan Herkommer, Head of Group Treasury

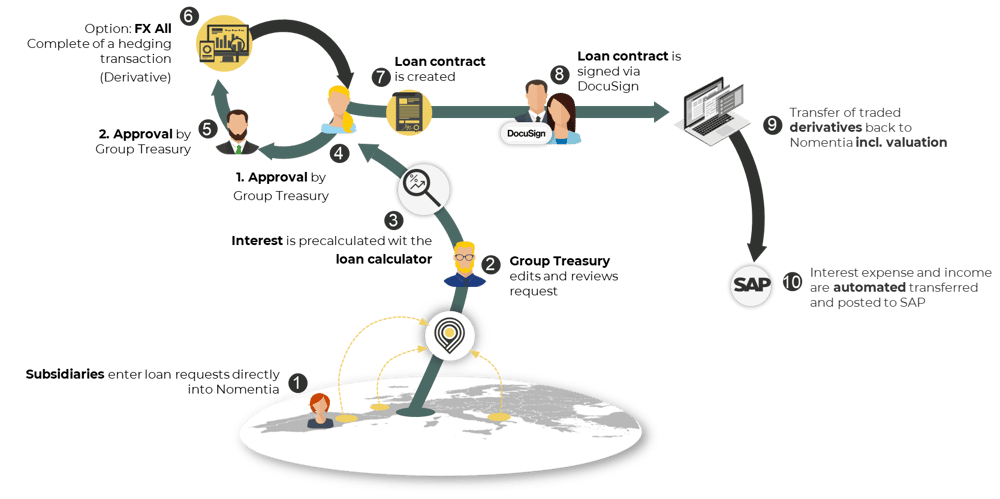

The Nomentia IC loan Workflow used at CGM consists of 10 steps.

Step 1

The application for a new IC loan or IC deposit is submitted by an employee of a subsidiary or the group treasury. The application requires the critical data of the IC loan or deposit, and it is checked whether an internal line of credit (LOC) is available for the combination of applicant and beneficiary and whether it is sufficient for the requested amount. For this task, the LOC available at the start time is determined and checked with the new loan/deposit amount. If no corresponding LOC is available, the requester must first request a master agreement from the group treasury to proceed.

Step 2

The application is then forwarded to the group treasury for approval. The group treasury checks the application and, if necessary, extends it to include additional information such as the interest rate, interest method, etc. The data can also be modified by the group treasury as needed.

Step 3

The data is automatically transferred to the loan calculator, and the loan/deposit is calculated with all its cashflows.

Step 4

Then the application is approved, rejected, or returned to the subsidiary for revision by the group treasury.

Step 5

After the first approval, the second approval follows. A 4-eyes principle is guaranteed to complete the approval process.

Step 6 (optional)

Since the loans or deposits are bullet loans where the interest is capitalized, the hedge for a foreign currency loan or deposit is a basic foreign exchange swap. If withholding tax has to be considered in the requestor's country, the far lag of the swap is automatically deducted by that specific amount, and an uneven swap is traded. All trades are automatically transferred to the FXall trading platform, and a trader must execute the deal with the best bank available without filling in any amounts or dates. After the trade is executed, the deal is transferred back to the Nomentia derivatives module where the deals are also valuated for accounting purposes.

Step 7 & 8

Once the application is approved, the loan or deposit contract is automatically generated in the workflow with all the information entered before. The agreement can then be created in DocuSign where Group Treasury enters the respective signers. After that, all parties are informed by e-mail via DocuSign that an application is available for signature. A signature can then be generated in DocuSign directly.

Once all signatures have been obtained, all signers get an automated e-mail from DocuSign that the signing process is finished. Via the Nomentia-DocuSign-API, the signed contract is directly attached to the respective workflow item. The loan or investment is set to "active", which places it in the collective status "Active loans and investments".

In the "Active loans and investments" status, the transactions that are due within the next thirty or ten days are marked. If the loan needs to be extended, this can be triggered via the workflow even before the due date and the data from the existing loan is transferred to a new application screen. Due to the limit check, the new loan/deposit should start at the earliest when the old loan expires. The process for the extension will then start again from the beginning.

Step 9

After the trade is executed in FxAll, the deal is transferred back to the Nomentia derivatives module, where the deals are also valuated for accounting purposes.

Step 10

In addition to the fully integrated workflow and the FxAll interface, the interest expenses and income generated from the loans and deposits are transferred and posted directly to SAP.

Output

- Group-wide automation and standardization, more transparency and security, and efficiency gains in regular activities.

- Centralized risk management of foreign currency loans or investments

- Direct connectivity to the loan calculator, interest rates can be pre-calculated, and the digital process is fully integrated into the existing CGM treasury IT landscape.

- Traded derivatives transferred back to Nomentia, including valuation of foreign exchange transactions.

- IC-Loan/Deposit inventory with digital document management.

Improved treasury management starts with Nomentia

Would you like to discover how we can assist your treasury team?