Risk management is one of the key jobs of any treasurer. By taking steps to understand and mitigate treasury risks, treasurers can protect their organization’s continuity and ensure its future success. But what are the main risks that treasurers face? And what are some of the strategies and tools to tackle treasury risk? This article discusses top treasury risks, the treasurer’s role in risk management, strategies to tackle risk, and technologies that can be used to tackle risk.

What is treasury risk management?

Treasury risk management is the practice of mitigating money-related risks in organizations, such as those in liquidity, investments, FX and interest exposures, and payments. It involves examining risks posed by treasury activities and developing appropriate response plans ahead of time to reduce potential downsides. This typically includes activities such as cash flow forecasts, structured debt repayments, hedging investments, liquidity planning, and setting up treasury policies. Treasury risk management may also involve treasury audits to ensure that financial positions are accurately reported.

What is the role of treasury in risk management?

Treasurers play an essential part in successful risk management. Treasury professionals assess how the business manages financial resources and advise other departments on managing financial risks. They also play a crucial role in reducing exposure to the financial threats associated with market volatility, changes in interest rates, liquidity risk, and credit infrastructure. Treasurers mainly do this by assessing the potential costs of specific scenarios and consequent steps that should be taken. The processes that treasurers set up help ensure that sound decisions are taken while protecting businesses from unnecessary losses.

Main types of treasury risk that organizations face

Treasury departments face many risks that need to be properly managed. The most common risks are typically liquidity, market, operational, and counterparty risks.

Liquidity risk

All companies face liquidity risks: the risk of insolvency resulting from an inability to pay obligations on time. Therefore, treasurers continuously need to monitor whether enough cash is available to access when needed. Undeniably, there are organizations with higher liquidity risk than others, depending on their financial health. However, it is in every company’s interest that liquidity risk is carefully monitored by its treasurers at regular intervals.

Market risk

It is safe to say that any company is exposed to market risk. Market risk derives from market prices and rates volatility, such as commodities, interest rates, and FX rates. A change in any of these market factors can significantly impact your company’s cash flows and treasury risk levels.

Operational risk

Operational risk includes various risks related to day-to-day activities, such as treasury processes, people, legal & compliance, treasury frameworks, payments, IT systems, etc. When issues occur in any of these activities, they can severely impact your cash flows and business continuity.

Counterparty risk

There is always counterparty risk. For example, it can happen that invested or deposited funds in a bank or company that fails are lost. A customer can also be unable to pay you according to contractual obligations, which impacts cash inflows, and might leave your company vulnerable because it also needs to pay its creditors. One of your employees might also execute payments to sanctioned or false beneficiaries, which can result in significant losses. There are many counterparty risks; therefore, knowing your customer (KYC) and all other parties you do business with is crucial.

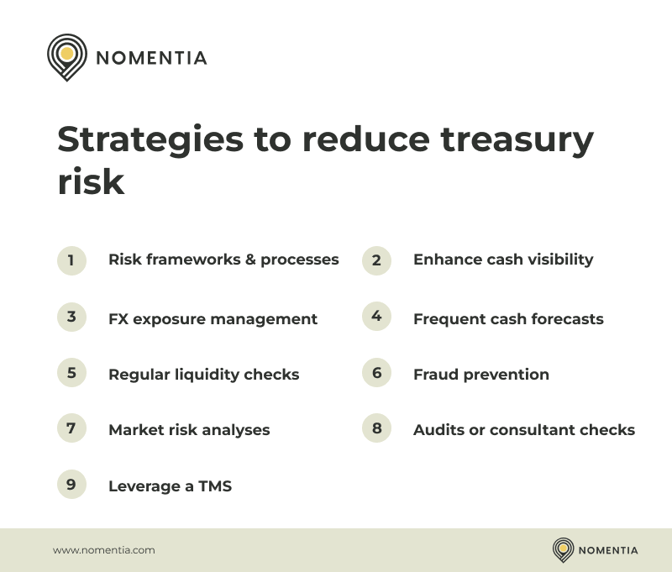

Strategies to reduce treasury risk

There are various strategies that treasurers implement to reduce treasury risk. These are key strategies to tackle liquidity, market, operational, and counterparty risk.

Risk management frameworks and processes

First, organizations should have all the necessary processes or frameworks in place to mitigate risk as much as possible. Nevertheless, uncertainty due to risks can always arise even when you have optimal processes. Therefore, you should also establish procedures for when things go wrong.

The association of corporate treasurers proposes a risk management framework that includes several steps may risks occur: risk identification, risk assessment, risk evaluation, risk response, and risk reporting. The whole process is followed by a feedback information loop that returns to the first step. Whatever framework you use, the importance of identifying risks, assessing them, and responding in an appropriate manner is vital. And the monetary impact of risks should ultimately be reported on and represented in your cash flow data.

Enhance cash visibility

One way to minimize treasury management risk is to enhance cash visibility. By enhancing cash visibility, you can gain insight into company-wide cash positions more quickly despite using several banks, an ERP system, and other systems. Improving cash visibility is usually done by acquiring tools that can centrally consolidate data from various source systems. For example, manual data collection in Excel sheets with several banks is often too slow and erroneous, which decreases the treasury’s ability to respond promptly to risk.

Implement FX exposure strategies

Typically, FX risks occur when transactions are done in foreign currencies or when treasury analyses are done with currency rates that are relevant at that specific point in time. Nonetheless, companies can adopt various strategies to mitigate FX risk.

Strong brands can transact in their preferred currency, which phases out exchange risk onto the counterparty. Sometimes, it is also possible to add clauses to long-term international trade deal contracts where any significant exchange rate deviations are to be covered by the counterparty. Another strategy is a form of natural FX hedging that restructures your organization according to where your counterparties are located, for example, by opening a German retail point when your supplier is also based in a country that trades in Euros.

A common way of hedging is through forward exchange contracts or currency options. In a forward exchange contract, both parties agree to buy or sell an amount of foreign currency at a certain point in the future. As a result, the initiating party is protected from any future currency fluctuations. Currency options are similar to forward exchange contracts but eliminate the mandatory transaction when the contract expires. With currency options, companies have the right to buy or sell a currency at a decided rate on or before a specific date. You can either exercise options when rates are favorable or let them expire if the market is less favorable. The flexibility of currency options does come at a premium price.

Run frequent cash flow forecasts

One way to mitigate treasury risk is by staying on top of your cash flow projections. You can effectively reduce risk by knowing what future cash flows will look like. For example, cash flow forecasting helps you identify cash shortages that may require additional funding. On the other hand, it can also help reveal cash surpluses that can be allocated to optimizing processes that further reduce risk. Some advanced cash flow forecasting tools can even include market risk factors, industry trends, or even seasonality indicators. Preparedness for what is coming in the future provides the best foundation to manage treasury risk.

Regularly check liquidity positions

Liquidity positions must be checked regularly because they can reveal your company's financial health. With proper liquidity management analysis methods in place, you can mitigate most risk types associated with poor liquidity, such as the inability to pay creditors, challenges to attract additional financing, liquidity visibility challenges, low cash conversion cycles, working capital ratios, and fraud.

A best practice is to centralize liquidity management with a system that automatically gathers all the relevant data needed for liquidity analyses. By doing so, you can quickly analyze liquidity risk exposure and see which possible risks require further attention.

Work on preventing fraud

Financial fraud comes in many forms but is most associated by treasurers with payment fraud. Fraud is a substantial risk to mitigate because it can result in significant company losses. There are different types of payment fraud out there that should be closely watched by treasurers and security teams, such as phishing, kickbacks, identity theft, fake reimbursements, malware, or duplicate payments.

There are several strategies to tackle fraud. It starts with setting up the right processes and using the payment hubs to eliminate most risks. But it also requires training staff and increasing their awareness of possible fraudulent techniques criminals may use against them. Sanctions screening can also help avoid payments from being processed to unwanted beneficiaries. In addition, continuously auditing payment processes can reveal improvement points or anomaly activity.

Familiarize yourself with market risks

The best way to be prepared for shifts in market risk is to stay on top of what is happening in the world that could impact FX, commodity prices, and interest rates. Often, solely geopolitical tensions can already affect all three elements. Other causes like economic booms or recessions can also majorly impact market risk.

In addition, strategic risk techniques, such as working with derivatives, foreign exchange hedging, and interest rate risk management, can all help lessen your company's market risk exposure. For example, many companies use interest rate swaps, caps, or corridors to lower their risk profile.

Have external auditors or consultants check financials

One way to guarantee that your treasury risk will not have any drastic consequences is to go over your financials with an external auditor or consultant. These experts can give you valuable input or identify potential risks you may not have seen yourself. Auditors can also be hired to mitigate risks associated with compliance or regulations.

Get a treasury management system (TMS)

Treasury management systems are there to help treasurers achieve their primary goal of mitigating risk. They automate error-prone and manual tasks and enhance analysis possibilities by centralizing data from all systems. A TMS becomes an inevitable asset to your team to manage treasury risk when you are a larger company with several banks and technologies.

Treasury risk management technology providers

Managing treasury risk often starts by selecting the right technologies to help. We have listed five typical treasury risk management software providers that can help you better mitigate treasury risk.

1. Nomentia

Nomentia is a modern SaaS treasury management system from Europe that offers either a full treasury suite or a best-of-breed approach. Best-of-breads allows you only to pick the solutions you truly need and expand with additional solutions as your treasury operations grow.

Nomentia has over 1,600 customers, including more prominent firms like Lufthansa, Kone, DHL, SWECO, and Porsche, as well as SMEs. Its treasury and cash management suite includes solutions such as payment automation, automated reconciliation of payments, liquidity management, bank account management, in-house banking, cash flow forecasting, risk management, trade finance, reporting, and treasury workflows.

2. Treasury systems

Treasury Systems is another European treasury technology provider that offers risk management, treasury reporting, workflow automation, and cash management solutions. Their approach is also best-of-breed when you are not ready to get an entire treasury suite. Treasury Systems is an established company founded in 1984 and has a significant presence in the Nordics, where it serves large customers.

3. Coupa

Coupa is an American treasury management system provider that offers business spend management solutions for different business needs, such as payment automation, risk management, workflows, and liquidity management. Coupa has various customer profiles, ranging from larger to smaller enterprises.

4. Kyriba

Kyriba is a treasury management technology provider headquartered in the United States. Their enterprise liquidity solution includes treasury risk, working capital management, cash flow forecasting, payments, and connectivity. Kyriba mainly serves larger companies.

5. SAP

SAP is a German software company that develops enterprise software. Even though they are most known for ERP system solutions, they also offer treasury management functionalities. Its main solutions include bank account management, cash operations, and liquidity management. SAP is heavily focused on serving large enterprises.

Tackling treasury risk management

How you tackle treasury risk management highly depends on your business needs. The more extensive and increasingly sophisticated treasury operations become, the higher the need for treasury management technology will become. If you are a smaller company with fewer needs, you can opt for best-of-breed solutions or start thinking of some of the treasury risk strategies we have mentioned in this article.