How can companies implement multi-bank connectivity reliably and securely?

Multibanking is a big topic for finance and treasury teams, and to no surprise: if you have global operations, you are likely to work with tens of different banks and tens or hundreds (if not thousands) of bank accounts.

Working with several banks can be unnecessarily complex and time-consuming, and the lack of centralization of group-wide bank account information often causes many headaches, such as manually logging in to the different accounts and a lack of central visibility into cash positions for instance. Yet, with the right multi-bank approach, companies can remove the burden of working with several bank accounts.

What is a multi-bank exactly?

A multibank is a solution designed to consolidate several bank accounts from various banks into one interface, allowing you to view account-specific data from a single system. Multibanks are beneficial for finance and treasury teams with many bank accounts because each account requires continuous monitoring of cash positions. To do so, you typically need to log in to each account separately daily, which can become very time-consuming on a larger scale. In contrast, this isn’t required with a multibank since all key data is centralized.

How does multi-bank connectivity work?

A multi-banking solution works by connecting it to each bank account through different connectivity options such as SWIFT, host-to-host, EBICS, or APIs. Once the connections to all accounts are established, the system can pull all key data directly into one interface, ready to be analyzed. Some multibanks also provide centralized functionalities, such as executing payments and payment reconciliation, to name a few.

The benefits of multi-banking for corporate finance and treasury

Clearly, multibanking has many benefits, such as eliminating manual processes and centralizing all bank account data. In brief, these are some of the main benefits our clients have experienced after implementing a multi-bank solution:

- Consolidate all bank accounts in one place – better cash visibility

Connecting all your bank accounts to a single system allows you to gain complete cash visibility from a single source without logging on to each account individually. Needless to say, knowing group-wide cash positions instantly at any point of the day is of enormous value to any finance or treasury team.

- Daily time savings

Without a multibanking solution, each bank’s balance is checked separately and usually manually documented in a spreadsheet. This process becomes incredibly time-consuming when it needs to be done for many banks daily and isn’t very instantaneous. In contrast, with a multibank solution, you can view everything in one dashboard with one login and track how balances evolve over time.

- Payments can be centralized

An additional benefit that our customers experience is that a multibank offers the central management of payments. Instead of managing transactions in each bank account, you can combine payments from various accounts, execute them straight from the multibanking solution, and even use reconciliation for faster matching.

On top of that, there are solutions that can even offer payment screening, validation, and enrichment to prevent fraudulent or erroneous payments or payments of sanctioned counterparties.

- Possibility to link to your ERP system or other systems

Why not connect other systems that hold valuable cash flow data with your multi-banking system too? It's possible to do with most solutions and has provided our clients with even greater transparency over cash flows since you can combine bank account data with system data, such as receivable and payable data from ERPs, in one interface and see the impact on cash flows.

- Optimize cash and enhance prompt decision-making

By having greater cash visibility, it becomes easier to identify hidden cash surpluses or shortages in different accounts, based on which you can take appropriate measures. You can also speed up decision-making due to the quick insights that a solution can provide.

Two main challenges related to setting up a multibank

There are two main hurdles that finance or treasury usually need to tackle when implementing a solution. They relate to multi-bank connectivity and technical integrations with other systems.

-

The first obstacle is bank connectivity. Setting up and maintaining bank connections in-house requires at least one dedicated specialized person. Building bank connections, especially host-to-host, is a lot of work from scratch. In addition, once connections are established, they need to be maintained; the bank can change connection protocols or file formats, which can suddenly affect your connectivity, for example.

Instead of building and maintaining their connections, companies often work with third-party multi-bank connectivity systems that already have established the required bank connections and maintain them for you. Indeed, a wise choice when you have tens or hundreds of banks to connect with.

Another way to tackle in-house connectivity challenges is by tapping into existing networks, such as SWIFT, which gives you access to over 10,000 banks worldwide. Before you can benefit from the network, you must complete an application and fulfill specific requirements, which is time-consuming. Using the SWIFT network can also be costly when you need to execute many payments, for example. Like H2H connectivity, SWIFT connections methods are usually provided by specialized third-party solutions as well.

-

The second hurdle relates to an additional step that finance or treasury teams often take to do with system integrations. Not all cash flow data is hiding in bank accounts. Most companies want to combine bank data with cash flow insights from ERP systems or other finance and accounting systems to gain complete visibility beyond bank accounts. As a result, connectivity must also be established between multibanking systems and the other relevant systems.

Most of the time, API connections can help with this, but they also require expertise and resources. Like with bank connections, third-party vendors can help you set these up in no time since they likely already established API connections between their systems and other relevant systems for other customers.

The most common multi-bank connection options

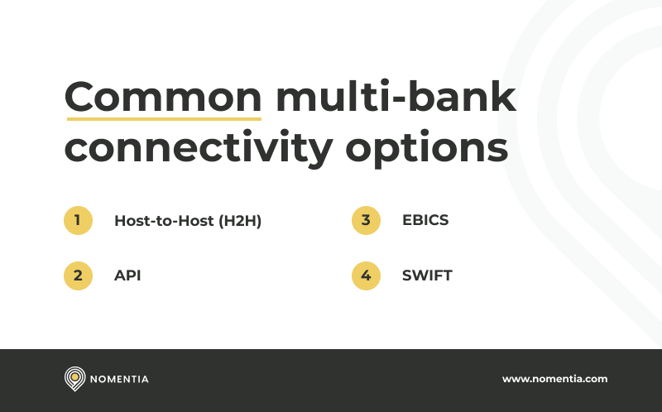

Several main connectivity options are used for building connections between banks and multibanking systems. Here’s a short introduction to each one of them.

Host-to-host

A host-to-host (H2H) connection is made between banks and their corporate customer’s tenant. It allows a high volume of data to flow between the two parties in different file formats, network protocols, with various security standards. The most common H2H connection methods are Secure File Transfer Protocol (SFTP), Simple Object Access Protocol (SOAP), and AS2. Most of the time, SFTP connections are used to establish H2H connectivity.

API

Banks and corporates have started to realize that Application Programming Interfaces (APIs) are highly beneficial connection methods. They’re becoming increasingly popular but still require further development and collaboration between stakeholders to reach the desired benefits. An API for bank connectivity is essentially a modern version of an H2H connection that is real-time, and once API connection points are built, they don’t need to be reinvented anymore and many parties can potentially benefit from them.

EBICS

The Electronic Banking Internet Communication Standard (EBICS) is a transmission connection method established in Germany used for transferring financial data between banks and corporate customers. It sends messages over HTTP(S) in XML format to exchange data. EBICS is primarily used in Europe and especially Germany.

SWIFT

One way for corporates to connect to many different banks is to leverage an already existing network facilitated by SWIFT. More specifically, its Lite2 for Business Applications can directly connect banks that are part of SWIFT’s network with your financial technology solutions, such as cash management solutions, treasury systems, or trading platforms. Before joining SWIFT’s network, you need to meet certain criteria to become an authorized user and reap the benefits of its network.

Multibank connectivity solutions

Most companies realize that it’s often more beneficial to leverage existing multi-bank connectivity platforms instead of building and managing bank connections themselves and burdening occupied finance, treasury, or IT teams. There are several vendors, each with similar solutions at competitive prices, that can help you with bank connectivity.

Most of our clients mention that they want to centralize almost all treasury operations in one platform, which some solutions can’t accomplish. If you're looking for more than just connecting bank accounts and want to add features like cash flow forecasting, risk management, trade finance, payments, and reconciliation - choosing a system that can grow with your changing needs is best. A best-of-breed solution provider is a suitable option in such cases, as they offer modular solutions you can add without implementing a whole treasury management system from the start.

.png?width=750&height=153&name=Bank%20connectivity%20-%20mid%20(1).png)