How does digitalized guarantee management improve risk control and transparency?

“Three hundred and seventy-five thousand and thirty-three Swiss francs”. If you are involved in guarantee management, you’ll know that it is often still necessary to write guarantee volumes in words. Besides this, treasurers also spend plenty of time dealing with complex requests, ticking numerous boxes correctly and accurately transferring addresses. The margin of error is zero.

What is guarantee management?

A guarantee is a commitment from a financial institution that covers the beneficiary in case of default or breach of a contractual obligation. The guarantor (e.g. the bank) agrees to pay the beneficiary if the other party does not fulfill its obligations to settle the payment.

Guarantee management is a complex task. It is a specialist area where details really matter, and where a well-trained eye, top levels of concentration and lots of hard work are preconditions. At corporate groups, guarantee management often involves countless of subsidiaries and parties.

Guarantee management challenges

When a subsidiary needs a guarantee, it often takes several days and no-end of coordination until the bank guarantee is finally available. During these tedious coordination processes, it is often necessary for a colleague to pick up the phone after the fifth email and personally ask about the guarantee – but that doesn’t make things any more efficient. Double data entries are not rare, cost everyone involved lots of time and increase the error rate. The process often requires several approval steps and compliance checks and even more patience are necessary.

Digitalizing guarantee management with treasury workflows

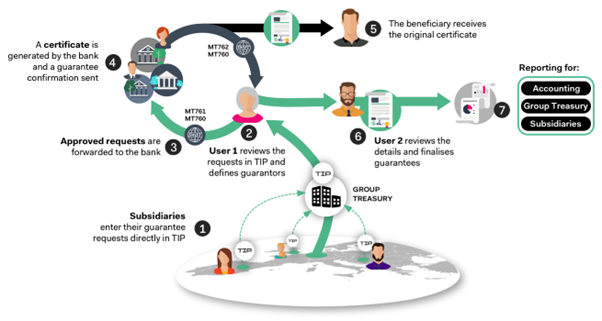

It’s time to forget this nightmare of a paper chase and digitalize the guarantee management process as far as possible. Starting with the request for a guarantee, the approvals process and distribution, all the way to issuing the associated documents for the approved guarantee. Paper-based applications which are circulated within the group and later forwarded to the bank by fax, email or post, would become a thing of the past.

Digitalizing the guarantee management process is possible with a digitalized process and tailor-made workflow. Setting up a guarantee management workflow will reduce processing times and eliminate tedious typing work so that there’s more time for performing analyses. The following case study highlights how guarantee management works in practice.

Digitalized guarantee management: a case study

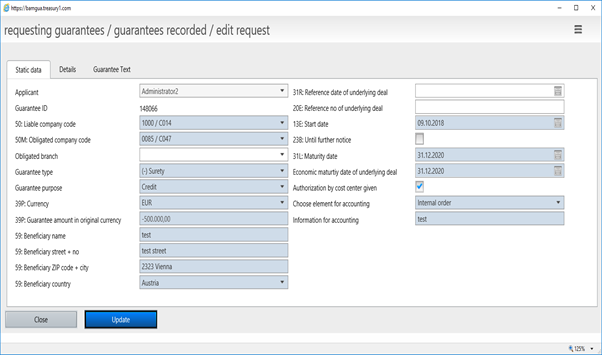

When a subsidiary needs a guarantee, it simply enters the request via a standardized form directly through Nomentia. Upon the submitted request, the Group Treasury is automatically informed about the guarantee request using a custom workflow and then treasury can move forward to decide how the request should be processed. If the guarantee is granted, the competent treasurer can directly select in Nomentia the relevant bank or credit insurer which should issue the guarantee. Depending on the agreed guarantee limit, Group Treasury can adjust the ideal utilization level and manage the allocation of business among the group’s banks.

Form for subsidiaries to locally request a guarantee: Straightforward field names and mandatory fields ensure from the first working step on that all necessary information is provided.

Standardizing the process of managing guarantees at different banks

Every bank issues its own forms for guarantees, each of which needs to be processed separately. Given that the information required for a guarantee request hardly varies from bank to bank, this complexity is unnecessary. For this reason, Nomentia offers a standardized form which is already pre-filled with the master data, meaning that you only need to add the details of the relevant guarantee. Printing, signing and scanning the documentation is not necessary with this digitalized guarantee management process due to the fact that you sign the guarantee request digitally and can send it directly from Nomentia to the bank via email at the click of a button.

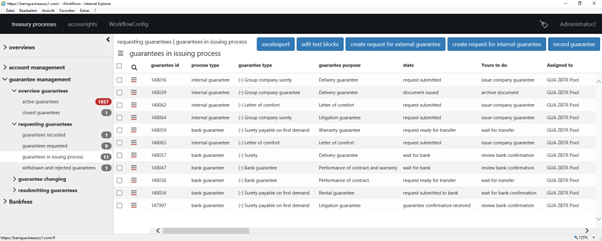

An overview of the process: From the local generation of subsidiaries’ guarantee requests to analysis options, TIP allows you to manage and track the entire process.

It is also possible to generate bank guarantees in MT798 formats directly in Nomentia which the system forwards to the bank via SWIFT FileAct. The electronic bank confirmations are subsequently imported into the system and compared with the guarantee request for security purposes. If everything is correct, the process can be closed with just a few clicks.

Certificates for group-level guarantees

Group-level guarantees can also be requested and even issued in Nomentia. Once the purpose of the guarantee has been clarified and the group internal guarantor defined, the only thing missing is the certificate. In order to handle this digitally, the guarantee text is dynamically generated based on the previously captured guarantee details. This automation saves time and streamlines the process. It will only take Group Treasury a few digital steps instead of numerous manual steps to issue the guarantees. Thanks to the guarantee management workflow and the standardized forms with an in-built commenting feature, the number of queries in the entire request process has been significantly improved compared to its manual counterpart. Manual reprocessing is not necessary.

Fee accounting and analysis reports

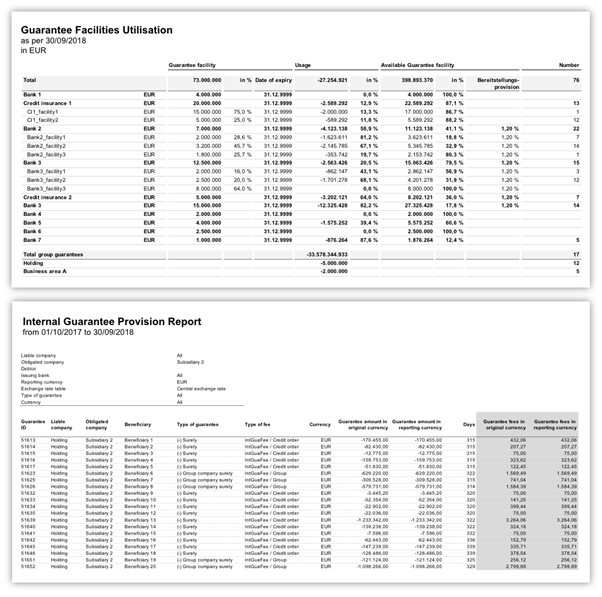

Once a guarantee has been issued, the next step is to deal with the associated fees and charges. This involves breaking guarantee-related charges down into different classes so that these can be calculated and allocated in Nomentia. Issuing and amendment charges as well as minimum commissions can be clearly differentiated between. External charge classes can be used to check that the charges billed by banks and credit insurers are correct. Due to the internal charge classes, Group Treasury can also see which amounts needed to be passed on to the relevant subsidiaries. This is made possible by clearly structured reports. This will save the accounts department a considerable amount of work related to booking guarantees and setting up accruals, and allow the treasury department to analyze the utilization of guarantee lines directly in Nomentia.

Reports on guarantee charges and line utilisation: The biggest advantage of digitalisation becomes obvious at the end of the process – The availability of the complete data means that all relevant information and calculations can be accessed directly in Nomentia.

More transparent & 100% compliant guarantee management

Independence from specific individuals and policy compliance are often the key arguments in favour of considering a new system solution for guarantee management. Approval levels and deputization rules need to be clearly defined and also complied with. In addition, Group Treasury also needs accurate and full process documentation in order to ensure that an end-to-end audit trail exists. Every guarantee request in the workflow module passes through various statuses, each associated with specific tasks. Besides this, those involved can also add comments to requests at every stage of the workflow. As a result, the question of “Who did what when?” can be easily answered at any time and it is obvious where a request currently is in the process and which tasks need to be completed by whom.

Audit trail and to-do list in the workflow module: Does a guarantee request still need to be approved or has the request already been sent to the bank for the certificate to be issued? These questions can be easily answered with the aid of the workflow module and therefore accelerate the smooth process.

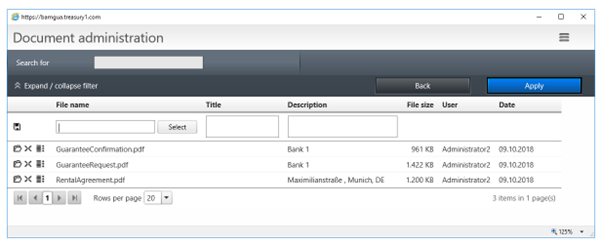

Digitalized document management

With digitalized document management, treasurers can store all of the documentation relating to the underlying transaction and the copies of guarantee certificates directly linked to the data record and speedily access these again. Archiving also supports treasurers with ensuring compliance.

Document management based on the guarantee data record.

Document management based on the guarantee data record.

Conclusion

Digitalized guarantee management significantly streamlines the once crumblesome and manual guarantee management process. Naturally, you still need the expertise of an experienced treasurer, but the tedious coordination/clarification work and the manual processing of numerous forms and certificates are a thing of the past. With Nomentia Guarantee Management, you can create a group-wide database for comfort letters and bank guarantees with completely digitalized document archive which makes it possible to generate reports.

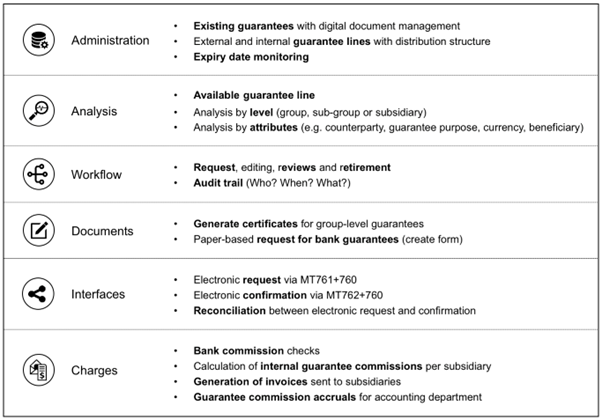

An overview of Nomentia Guarantee Management