How are AI and machine learning used to prevent payment fraud?

AI and ML detect fraud by analyzing vast transaction data in real time to identify anomalies, patterns, and suspicious behavior. They enable predictive monitoring, adaptive rules, and automated alerts, which reduce false positives and detect new fraud types faster than manual checks. Adoption is rising, with nearly half of companies reporting fraud exposure and many investing in AI-based prevention.

Artificial Intelligence (AI) and Machine Learning (ML) are two technologies that have been widely discussed in recent years. They offer a range of tools that are being gradually integrated into our personal and professional lives. These technologies are particularly useful in situations where there are many time-consuming and manual tasks, or where there is a large amount of data to analyze. One such application is the detection of payment fraud. Before diving into the use of AI and ML in fraud detection, it is important to address these two technologies separately since they are not the same.

What is AI exactly?

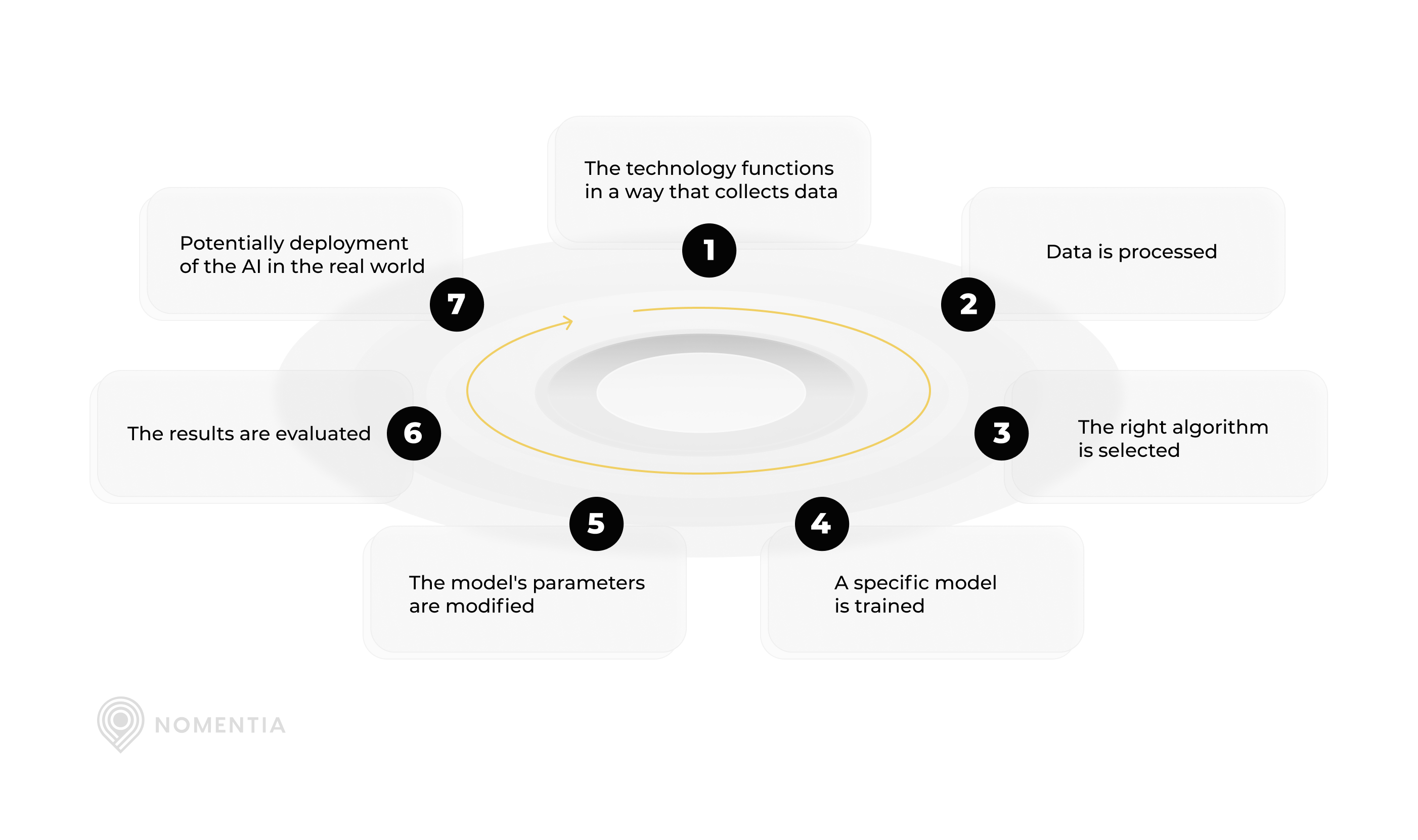

AI systems are designed to integrate vast amounts of data with intelligent algorithms, mimicking or simulating human-like actions and decision-making processes. AI can be utilized for various techniques like problem-solving, natural language processing, image recognition, reasoning, learning, and more. The technology functions in a way that collects data, processes it, selects an algorithm, trains a specific model, modifies the model's parameters, evaluates the results, and can then potentially be deployed in the real world. As it operates, AI typically uses feedback loops from its users to improve over time.

What is machine learning exactly?

Machine learning is a form of AI that teaches a system to think in similar ways to humans, as it learns and improves based on previous experiences. Machine learning algorithms typically need little supervision because they are learning by themselves.

We usually distinguish between three techniques of machine learning:

Supervised learning

Supervised ML algorithms are taught to make predictions or decisions primarily based on previous data patterns. Here, the ML learns based on already labeled data. Therefore, input data needs to be categorized beforehand, and the algorithm will use it as a benchmark to come to conclusions when analyzing new data.

Unsupervised learning

In unsupervised ML, there is no need for labeled or categorized data. Instead, the algorithm tries to find patterns or relationships in the data without explicit guidance. Typically, the goal of unsupervised ML is to explore data and find clusters or relationships.

Reinforcement learning

With reinforcement learning, you train the algorithms to make sequential decisions in an environment with a reward or penalty feedback mechanism that it learns from to improve its subsequent decisions. Usually, no labeled data is available, and the algorithm needs to learn from its own experiences and the feedback it receives.

The difference between AI and machine learning

AI refers to the simulation of human intelligence in machines that are programmed to mimic human-like actions and decision-making processes. AI encompasses as a wide range of techniques, including problem-solving, natural language processing, image recognition, and expert systems, among others. It aims to create systems that can perform tasks that typically require human intelligence, such as reasoning, learning, perception, and problem-solving.

Machine Learning is a subset of AI that focuses on developing algorithms that enable computers to learn from and make predictions or decisions based on data. ML algorithms allow machines to improve their performance on a task through experience without being explicitly programmed for that task. It does so by using statistical techniques to enable computers to learn patterns and relationships from data and make decisions or predictions.

Why are these topics relevant to payment fraud?

Recent research by PwC shows that 59 % of organizations globally report experiencing economic or financial fraud within the past 24 months, up from ~51 % in the 2022 survey. Fraud continues to lead to financial losses, but respondents also cite operational disruption, reputational damage, and loss of customer trust as serious consequences. Many organizations highlight the need for advanced technologies—especially AI and machine learning—to detect anomalies, enable real-time monitoring, and safeguard revenue, brand reputation, and customer relationships.

research by PwC showed that 59% of organizations have experienced fraud in the past two years — An Increase from 51% in 2022

PwC’s Global Economic Crime and Fraud Survey 2024

With the rise in cybercrime and the evolving sophistication of financial threats, we've come to an era where humans cannot keep up with processing an abundance of data efficiently and securely. We can by no means compete with the speed and thoroughness of data interrogation that AI and ML can deliver today. As a result, we need to embrace and team up with such technologies. To support this view, a recent study by the Association of Certified Fraud Examiners revealed that 17% of organizations already leverage AI and ML to detect and prevent fraud, and 26% of organizations are actively planning to adopt fraud detection AI or ML in the next two years. On top of that, technology providers are now heavily investing in developing practical AI-driven solutions to tackle payment fraud.

How can AI and Machine Learning be used in fraud detection?

These days, ML and AI can help you with fraud detection in various ways. Let's focus on some of the main ways how organizations currently leverage the technologies and what the future may bring:

-

It helps with transactional efficiency

For example, AI and ML can streamline payment processes and enable faster risk identification in payables, receivables, and reporting. They can help manage exceptions or spot anomalies in large data sets based on previous patterns it has studied.

-

Large payment data files can be fed to AI

AI can analyze large datasets much faster than human beings, and it provides good insights and points to pay attention to. Faster analysis will also help speed up decision-making. Especially with more data than ever and little time to analyze, it will become essential to save time while deriving insights by leveraging tools like AI and ML.

-

Automate and streamline routine tasks

AI can help automate essential but manual tasks such as data entry, reconciling payments, or generating reports. Minimizing manual processes, in turn, reduces the room for errors and fraud.

-

Reconciling payments

Reconciliation of payments is essentially comparing two data sets with each other and finding matches, which AI and ML are incredibly good at. Even when anomalies arise, you can train AI to handle them in pre-set ways.

-

Identifying complex relationships

Machine learning tools are great at uncovering complex relationships from data humans may overlook. Hence, it can provide quick and valuable insights that are potentially strategically important or can impact cash flow.

-

Screen payments against historical payment data

Any payment data can be screened based on benchmarking it with historical payment patterns to pinpoint out-of-the-ordinary payments faster.

-

Risk scoring based on certain factors

In some cases, AI has been used to score payments by risk based on factors like locations, banks, sums, recipients, countries, previous behavior, and much more. This way, you can easily identify the payments with higher risk levels and make sure they’re safe.

-

Adaptive learning

The advantage of the learning capabilities of AI is that it can, over time, identify risks increasingly well. It allows new types of risks to be spotted that you previously may not have caught.

-

Suspicious account behavior

In a few cases, AI has been applied for account takeover detection. For example, if unusual payment behavior or account usage patterns occur, machine learning has the capability to recognize it and notify the right person or put a stop to it, limiting any further financial damage.

-

Invoice fraud detection

When integrated effectively, machine learning can analyze incoming invoices and identify out-of-the-ordinary, duplicate, mismatched amounts, or other indicators of fraud. With a large number of incoming invoices, this can help payable departments save time.

-

Cleaning master data

Master data is one of the biggest assets of companies, and AI can help maintain it to be in good health. For example, it can organize it by categorization, create links or connections between values, and clean up master data into more usable formats, to name a few. Better structured master data provides better insights and makes it easier to spot fraud.

-

Dealing with false positives

You can let AI check future payments against historical payment data and establish certain tolerance levels and sensitivity for false positive management. Since dealing with false positives can be a lot of work for accounting, treasury, or finance, it can help speed up the process.

-

Trends analysis

Suppose AI is connected to the internet or apps in real-time; it can deduce trends, market data, signals, and other external factors, providing insight into potential disruptions or risks at an early stage. There are various use cases for this. For example, it can help predict fraudulent attacks based on cybercrime trends, and it could even assist with considering the impact of fraud on cash flow in forecasts and help develop what-if scenario analyses.

-

AI as a middleware

AI is evolving rapidly, becoming more integrated with many apps and systems. In the future, it could be leveraged as a step-in-between systems for data checks, restructuring, reformatting, and other purposes to help speed up payment processes and minimize payment fraud.

-

Sanctions screening

AI is incredibly good at comparing data sets, which is exactly how sanctions screening works. Some payment technologies already offer sanctions screening, but AI has the potential to do so as well. This can be particularly helpful for teams that do not yet have a payment hub in place.

-

Giving instructions

Perhaps in the future, payment hubs and TMS technologies will offer instructional functionalities like you're already used to with ChatGPT, Google Bard, or Microsoft Copilot. Imagine all the questions you could ask based on all the data. Why did X payment not process? What is my exposure? How much do I have available on Y account? What caused the discrepancy between our budget and forecast?

Important additional considerations when using AI or ML

While AI offers unprecedented opportunities for innovation and efficiency, it also raises various considerations that demand careful attention. Some of the things that we suggest you should at least consider:

- Do you really want to share sensitive data with AI that store your data to strengthen their intelligence? Most companies and contracts with customers do not allow you to share sensitive data with third parties. With cyber-attacks on AI suppliers, there is always a risk that your data is leaked in case of a breach.

- Like with all data, the garbage in garbage out principle also counts for AI. If you provide AI with bad data, you will receive wrong interpretations, which can be very misleading when making decisions.

- The longer algorithms run, the more accurate they should become. So, if you keep flagging false positives, fraud, and other risks to AI, it will start identifying those better over time. So, try to be patient. Though AI can help ease the number of false positives, you can still expect quite some false positives at the start until algorithms have learnt to filter those out.

- If you become too dependent on AI and it does not catch a mistake, it can go unnoticed unless you remain cautious and always keep a human eye on things.

- Ensure that an accountable person in the team can be held responsible for checking data quality and the accuracy of AI-generated outcomes. There’s always a risk that AI is wrong and it is up to the people who use it to examine any analysis thoroughly.

- It is best to start small, and slowly scale technologies like AI before rolling it out all at once. Even if it's rolled out fully, for example to all entities, it still means that entities must comply with their data input. Expect a lot of work cleaning up the data and getting buy-in from all stakeholders. All stakeholders must also clearly understand the benefits and use cases, so communication about such projects is vital.

- Sandbox environments can be a great way to test out the application of AI or ML. They provide a safe environment to play around with data without damaging any critical company data while still simulating the real impact that the technologies have.

Are AI and ML the future of payment fraud?

Until now, the true use of AI and ML has been limited, but it's expected to develop rapidly, and companies, banks, and financial technologies will likely incorporate new ways to leverage the technologies for fraud detection in the future. Recently, Eurofinance hosted a webinar where some of the biggest companies explained how they leverage AI in treasury, finance, and accounting. It is definitely worth a watch if you are interested in how AI will shape the future beyond payment fraud.

.png?width=980&height=200&name=payment%20process%20control%20-%20banner%20(1).png)

.png?width=980&height=500&name=payment%20process%20control%20-%20main%20banner%20(1).png)